FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Help

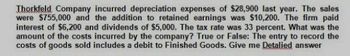

Transcribed Image Text:Thorkfeld Company incurred depreciation expenses of $28,900 last year. The sales

were $755,000 and the addition to retained earnings was $10,200. The firm paid

interest of $6,200 and dividends of $5,000. The tax rate was 33 percent. What was the

amount of the costs incurred by the company? True or False: The entry to record the

costs of goods sold includes a debit to Finished Goods. Give me Detalied answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the past year, Momsen Limited had sales of $47362, interest expense of $4166, cost of goods sold of $17,359, selling and administrative expense of $12,146, and depreciation of $6,995. If the tax rate was 21 percent, what was the company's net income? Multiple Choice O $5,132 $6,496 $11,550 $4,547 $2.444arrow_forwardThe company recorded a net loss of P175,000 for the year just ended. Total operating expenses was P3,792,000, cost of sales was P1,822,300 and sales discount was P89,890. How much is the gross sales that the company generated during the year?arrow_forwardHelp me please urgentarrow_forward

- Nonearrow_forwardRogue Industries reported the following items for the current year: Sales = $3,000,000; Cost of Goods Sold = $1,500,000; Depreciation Expense = $170,000; Administrative Expenses = $150,000; Interest Expense = $30,000; Marketing Expenses = $80,000; and Taxes = $300,000. Rogue's gross profit is equal to Select one: a. 1,070,000 b. $1,100,000 c. $1,500,000 d. $770,000arrow_forwardDuring the year, the Senbet Discount Tire Company had gross sales of $1.09 million. The company's cost of goods sold and selling expenses were $578,000 and $231,000, respectively. The company also had notes payable of $700,000. These notes carried an interest rate of 6 percent. Depreciation was $108,000. The tax rate was 23 percent. a. What was the company's net income? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What was the company's operating cash flow? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) a. Net income b. Operating cash flowarrow_forward

- During the year, the Senbet Discount Tire Company had gross sales of $538,900. The company's cost of goods sold and selling expenses were $178,400 and $104,200, respectively. The company also had debt of $484,000, which carried an interest rate of 6 percent. Depreciation was $62,100. The tax rate was 24 percent. a. What was the company's net income? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What was the company’s operating cash flow? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)arrow_forwardDuring the year, Belyk Paving Co. had sales of $2,600,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,535,000, $465,000, and $520,000, respectively. In addition, the company had an interest expense of $245,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carryforward provisions.) (Enter your answer as directed, but do not round intermediate calculations.) Required: (a) What is Belyk's net income? (Negative amount should be indicated by a minus sign.) Net income (b) What is Belyk's operating cash flow? Operating cash flow Aarrow_forwardDuring the year, the Senbet Discount Tire Company had gross sales of $1.23 million. The company’s cost of goods sold and selling expenses were $592,000 and $245,000, respectively. The company also had notes payable of $840,000. These notes carried an interest rate of 4 percent. Depreciation was $122,000. The tax rate was 22 percent. a. What was the company’s net income? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.) b. What was the company’s operating cash flow? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education