FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

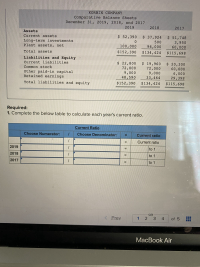

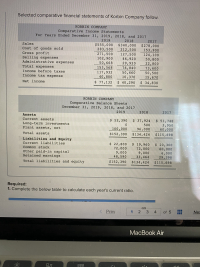

Transcribed Image Text:Required:

1. Complete the below table to calculate each year's current ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate Swifty's gross profit percentage and percentage markup on cost for each fiscal year. (Round answers to 2 decimal places, eg. 52.75.) Percentage gross profit Percentage markup on cost Fiscal 2023 35.74 % 3.43 % Fiscal 2022 36.13 % 5.67 %arrow_forwardUsing the attached financial statements attached, ratios need to be calculated for all boxes that are greyed out. Please provide details of how these ratios are calculated.arrow_forwardQuestion 51: In the vertical analysis of an income statement, what is the base (100%) figure? Answer: A. Total expenses B. Total revenues C. Total assets D. Net incomearrow_forward

- Hello, could you explain to me what is a decimal place when calculating financial ratios. thank you.arrow_forwardIn step 3, how did you arrive at 125,000 for the adjustment?arrow_forwardeBook Inventory $5,000 $4,900 65,000 29,000 230,000 froze Income Statement Pietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietro predicts that 54,100 units will be produced, with the following total costs: Direct materials Direct labor Variable overhead Fixed overhead Next year, Pietro expects to purchase $120,500 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows: Direct materials nirxas. F en pizzes Work-in-Process Inventory $14,000 $16,000 Beginning Ending Next year, Pietro expects to produce 54,100 units and sell 53,400 units at a price of $18.00 each. Beginning inventory of finished goods is $42,500, and ending inventory of finished goods is expected to be $34,000. Total selling expense is projected at $27,000, and total administrative expense is projected at $108,000. Required: erat. Contin no Ing. 1. Prepare an income statement in good form. Round the percent to four decimal places before…arrow_forward

- Very important please be correct thank you need all 11 requiredarrow_forwardOne item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 17 % = 10 % x (a) (b) = 28 % x 0.75 18 % = (c) x 1.5 10 % = 20 % x (d) (e) = 15 % x 1.2 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank (b) fill in the blank % (c) fill in the blank % (d) fill in the blank (e) fill in the blank %arrow_forwardUsing the following selected items from the comparative balance sheet of Oriole Products.Determine the horizontal analysis. (Round percentages to 2 decimal places, e.g. 12.21%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) ORIOLEPRODUCTSComparative Balance SheetDecember 31 2014 2013 Horizontal analysis Amount Percentage Amount Percentage Current assets $110,880 enter percentages % $128,216 enter percentages % Long-term assets 174,240 enter percentages % 117,304 enter percentages % Total assets 3,168,000 enter percentages % 2,728,000 enter percentages % Determine the vertical analysis. (Round percentages to 1 decimal place, e.g. 12.2%.) ORIOLEPRODUCTSComparative Balance SheetDecember 31 2014 2013 Vertical analysis Amount Percentage Amount Percentage Current assets $110,880…arrow_forward

- Determine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75%.) Gross margin percentage Profit margin percentage 35.28 % %arrow_forwardIdentify any favorable and unfavorable trends in the following income statements by preparing a vertical analysis. (Round percentages to two decimal places.) Year 2 Year 1 Revenues $394,000 $212,500 Operating expenses: Wages expense $ 79,000 $ 65,000 Rent expense 19,000 18,000 Utilities expense 21,000 14,200 Interest expense 7,500 7,800 Total operating expenses $126,500 $105,000 Net income $267,500 $107,500arrow_forwardNeed the answers in that formats thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education