FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Joseph & Jordan, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $159 per hour for its

professional services; it costs the firm $84 per hour to cover the cost of its staff. To cover its MOH costs, the partners have always

applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 8,400 direct labor

hours and $158,760 of MOH costs.

In the current year, the firm's professional staff worked on three key client projects: All Ways, Inc., for 2,900 hours; My Way, Inc., for

2,400 hours; and High Way, Inc., for 4,600 hours. These clients were billed for this work by the end of the year.

Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $129,000 this year.

Actual MOH costs for the year totaled $139,000.

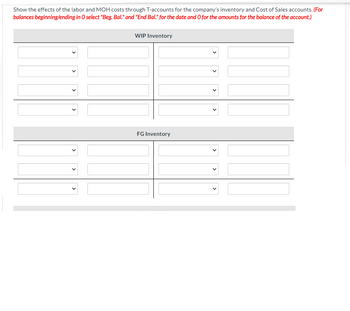

Transcribed Image Text:Show the effects of the labor and MOH costs through T-accounts for the company's inventory and Cost of Sales accounts. (For

balances beginning/ending in O select "Beg. Bal." and "End Bal." for the date and O for the amounts for the balance of the account.)

WIP Inventory

FG Inventory

✓

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Determine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75%.)

Gross margin percentage

Profit margin percentage

35.28

%

%

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Determine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75%.)

Gross margin percentage

Profit margin percentage

35.28

%

%

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company 10, a local road building contractor, had budgeted indirect costs for 2023 of $600,000. Budgeted labour hours for the year were 12,500 costing $260,000 and budgeted machine hours were 14,000. The company marks-up the total cost of each job by 40% to determine selling price. The company has just completed a road repair for the local council. The direct costs were as follows: Materials: $32,100 Labour: 305 hours Machining: 75 hours What is the total selling price of this job assuming the company allocates overheads on: A labour hour basis? A machine hour basis? (1) (ii) A B C D (1) Labour hour basis $53,084 $74,318 $65,436 $20,496 (ii)Machine hour basis $41,659 $58,323 $49,441 $4,521arrow_forwardRutland Business Services (RBS) provides miscellaneous consulting and services to local businesses. In August, RBS worked for three clients. It worked 270 hours for Selden Contracting, 170 hours for Moenhart Insurance, and 230 hours for Englewood Medical Center. RBS bills clients at $545 an hour; its labor costs are $140 an hour. A total of 750 hours were worked in August with 80 hours not billable to clients. Overhead costs of $71,250 were incurred and were assigned to clients on the basis of direct labor-hours. Because 80 hours were not billable, some overhead was not assigned to jobs. RBS had $60,000 in marketing and administrative costs. All transactions were on account. Required:What are the revenue and cost per client? Prepare an income statement for August.arrow_forwardhelp mearrow_forward

- The service department at Major Motors sold $48,000 in service last month. They had direct costs of $16,500 to pay their technicians. They were not given credit for any parts sales or expenses because that was the responsibility of their separate parts department. They were, however, allocated $29,250 in fixed expenses. What is the gross profit Major Motors earned last month?arrow_forwardLongyearbyen Co. incurs $1,050,000 of overhead costs each year in its three main departments, machining ($600,000), inspections ($300,000) and packing ($150,000). The machining department works 4,000 hours per year, there are 600 inspections per year, and the packing department packs 1,000 orders per year. In the past a traditional overhead allocation system was used using direct labor hours. They are considering switching to an activity based costs allocation of overhead. Information about Longyearbyen's two products is as follows: Product Beer 3,000 MHs Machine Hours Inspections Product Coal 1,000 MHs Orders Packed 100 Inspections 350 orders packed 1,700 DLHS 500 Inspections 650 orders packed Direct Labor Hours 1,800 DLHS Under an activity based costing allocation, Beer will be allocated $ more than under the old traditional system?arrow_forwardKorvanis Corporation operates a Medical Services Department for its employees. Charges to the company's operating departments for the variable costs of the Medical Services Department are based on the actual number of employees in each department. Charges for the fixed costs of the Medical Services Department are based on the long-run average number of employees in each operating department. Variable Medical Services Department costs are budgeted at $57 per employee. Fixed Medical Services Department costs are budgeted at $639,300 per year. Actual Medical Services Department costs for the most recent year were $105,800 for variable costs and $645,000 for fixed costs. Data concerning employees in the three operating departments follow: Budgeted number of employees Cutting 604 Milling 293 Assembly 918 Actual number of employees for the most recent year 504 393 Long-run average number of employees 1,050 700 818 1,750 Required: 1. Determine the Medical Services Department charges for the…arrow_forward

- The Hudson Block Company has a trucking department that delivers stones to two plants. The budgeted costs for the trucking department are $340,000 per year in fixed costs and $0.30 per ton variable cost. Last year, 70,000 tons of crushed stone were budgeted to be delivered to the West Plant and 100,000 tons of crushed stone to the East Plant. During the year, the trucking department actually delivered 75,000 tons of crushed stone to the West Plant and 90,000 tons to the East Plant. Its actual costs for the year were $65,000 variable and $350,000 fixed. The company allocates fixed and variable costs separately. The level of budgeted fixed costs is determined by the peak-period requirements. The West Plant requires 40% of the peak-period capacity and the East Plant requires 60%. 10. The amount of fixed trucking department cost that should be allocated to the West Plant at the end of the year for performance evaluation purposes is: a.$160,000. b.$204,000. c.$140,000. d.$136,000 e.$158,500…arrow_forwardMaira Corporation has set various goals and the management is taking various appropriate actions to ensure the company achieves these goals. One of the actions is to reduce operational costs, which exceeds budgeted amount. Which of the following functions best describes this process? A. Decision-making B. Planning C. Directing operational activities D. Controlling 2. HOC Company's costs for the month of June 2021 were as follows: direct materials, RM25,000; direct labor, RM32,500; selling, RM16,000; administrative, RM15,500; and manufacturing overhead, RM44,400. The beginning work in process inventory was RM17,000 and the ending work in process inventory was RM7,000. What was the cost of goods manufactured for the month? (a) RM105,000 (b) RM31,500 (c) RM133,400 (d) RM111,900 3. Chery Company manufactures and sells washing machines. In order to make assembly of the machines faster and easier, some of the metal parts in the machines are coated with grease. How should the cost of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education