FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

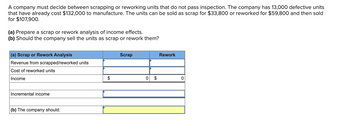

Transcribed Image Text:A company must decide between scrapping or reworking units that do not pass inspection. The company has 13,000 defective units

that have already cost $132,000 to manufacture. The units can be sold as scrap for $33,800 or reworked for $59,800 and then sold

for $107,900.

(a) Prepare a scrap or rework analysis of income effects.

(b) Should the company sell the units as scrap or rework them?

(a) Scrap or Rework Analysis

Revenue from scrapped/reworked units

Cost of reworked units

Income

Incremental income

(b) The company should:

Scrap

0

Rework

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Legendary Motors has 7,000 defective autos on hand, which cost $12, 880,000 to manufacture. Legendary can either sell these defective autos as scrap for $8,000 per auto, or spend an additional $18, 320, 000 on repairs and then sell them for $12,000 per unit. What is the net advantage to repair the autos compared to selling them for scrap? Group of answer choices $84,000,000 $18, 320, 000 $9, 680,000 $56,000,000arrow_forwardHelp mearrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Answer the following questions. 1. 2. A company has an inventory of 1,050 assorted parts for a line of missiles that has been discontinued. The inventory cost is $73,000. The parts can be either (a) remachined at total additional costs of $25,500 and then sold for $32,500 or (b) sold as scrap for $2,500. Which action is more profitable? Show your calculations. A truck, costing $104,500 and uninsured, is wrecked its first day in use. It can be either (a) disposed of for $16,000 cash and replaced with a similar truck costing $106,000 or (b) rebuilt for $82,000, and thus be brand-new as far as operating characteristics and looks are concemed. Which action is less costly? Show your calculations 1. A company has an inventory of 1,050 assorted parts for a line of missiles that has been discontinued. The inventory cost is $73,000. The parts can be either (a) remachined at total additional costs of $25,500 and then sold for $32,500 or (b) sold as scrap for $2,500. Which action is more…arrow_forward-S Garcia Company has 10,500 units of its product that were produced at a cost of $157,500. The units were damaged in a rainstorm. Garcia can sell the units as scrap for $21,000, or it can rework the units at a cost of $39,500 and then sell them for $52,000. (a) Prepare a scrap or rework analysis of income effects. (b) Should Garcia sell the units as scrap or rework them and then sell them? (a) Scrap or Rework Analysis Revenue from scrapped/reworked units Cost of reworked units Income Incremental income (b) The company should: Scrap Reworkarrow_forwardAnswer the following questions. A company has an inventory of 1,350 assorted parts for a line of missiles that has been discontinued. The inventory cost is $76,000. The parts can be either (a) remachined at total additional costs of $27,500 and then sold for $33,000 or (b) sold as scrap for $4,000. Which action is more profitable? Show your calculations. A truck, costing $101,500 and uninsured, is wrecked its first day in use. It can be either (a) disposed of for $15,500 cash and replaced with a similar truck costing $102,000 or (b) rebuilt for $82,000, and thus be brand-new as far as operating characteristics and looks are concerned. Which action is less costly? Show your calculations. 1. 2. 1. A company has an inventory of 1,350 assorted parts for a line of missiles that has been discontinued. The inventory cost is $76,000. The parts can be either (a) remachined t total additional costs of $27,500 and then sold for $33,000 or (b) sold as scrap for $4,000. Which action is more…arrow_forward

- Garrow_forwardSheridan Corporation manufactures several types of accessories. For the year, the gloves and mittens line had sales of $480,000. variable expenses of $363,000, and fixed expenses of $144,000. Therefore, the gloves and mittens line had a net loss of $27,000. If Sheridan eliminates the line, $36,000 of fixed costs will remain. Prepare an analysis showing whether the company should eliminate the gloves and mittens line. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45))arrow_forwardVelstrom Ltd is considering outsourcing one of its products rather than producing it in its factory. The business allocates part of the total rental charge of the factory, based on floor area, on the section responsible for making the product. The section bears a charge of £20,000 per year. If the section were closed, the floor space released would be used for warehousing and, as a result, the business would give up the tenancy of an existing warehouse for which it is paying £25,000 a year. SO what is the answerarrow_forward

- Marigold Corp. is unsure of whether to sell its product assembled or unassembled. The unit cost of the unassembled product is $27 and Marigold would sell it for $60. The cost to assemble the product is estimated at $13 per unit and the company believes the market would support a price of $64 on the assembled unit. What decision should Marigold make and why? Sell before assembly because the company will be better off by $9 per unit. Sell before assembly because the company will be better off by $4 per unit. Process further because the company will be better off by $18 per unit. Process further because the company will be better off by $20 per unit.arrow_forwardSubject: acountingarrow_forwardJohn has received a special order for 100 units of its product at a special price of $2,100. The product normally sells for $2,800 and has the following manufacturing costs: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit cost Per unit $ 840 420 560 700 $2,52 0 Assume that John has sufficient capacity to fill the order without harming normal production and sales. If John accepts the order, what effect will the order have on the company's short-term profit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education