FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

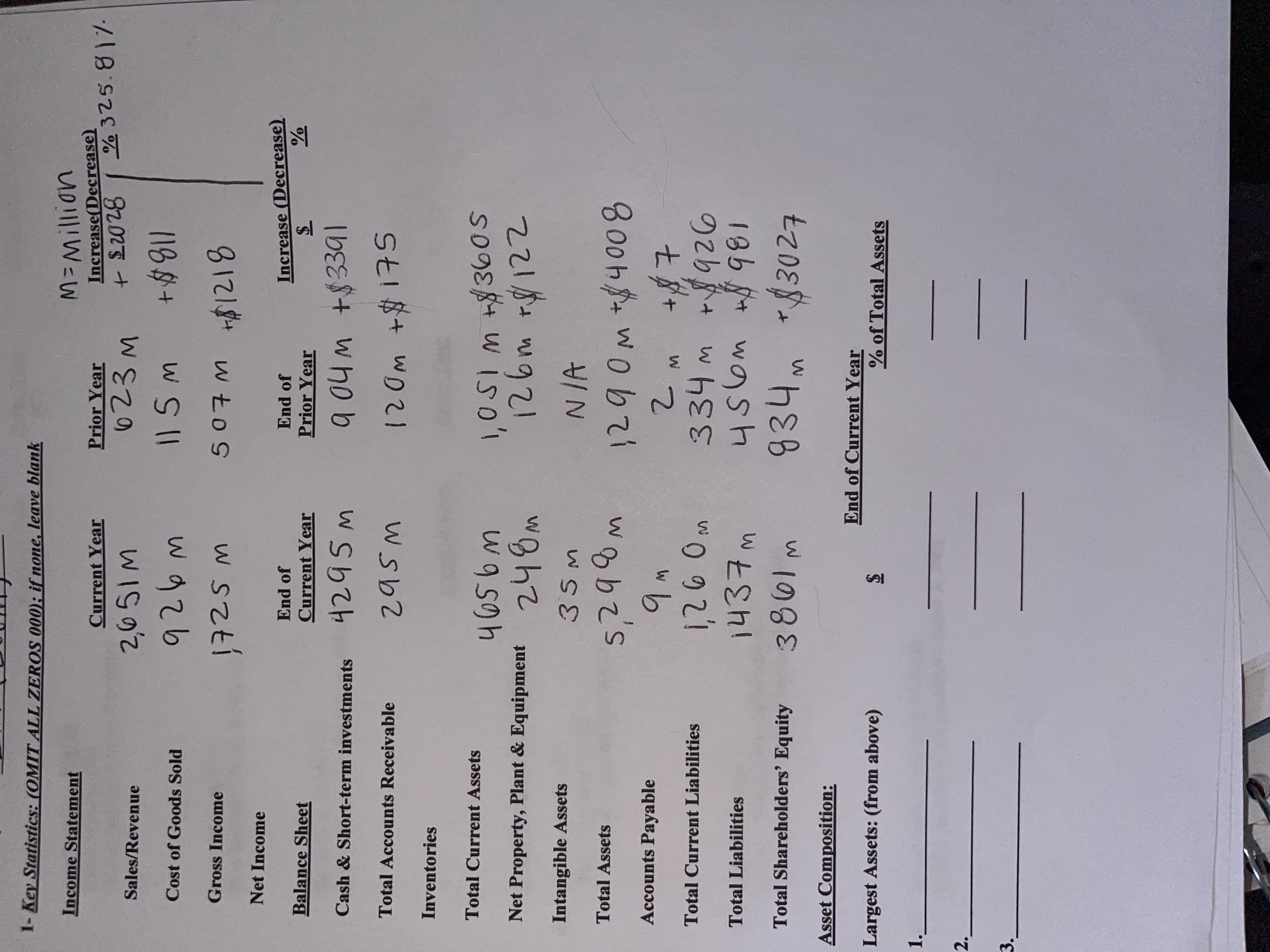

Based on the information in the image, calculate the percentage increase for each row and list the 3 largest assets, including the dollar ($) amount and percentage (%) increase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question: Determine the missing amount from each of the expanded accounting equation below: Assets Liabilities Capital (Beg. Bal) Owner's Equity Drawings Profit/Loss 97,600 85,400 48,800 ? (24,400) Explain Please.arrow_forwardselect the item that best completes each of the decriptions below A(n)____ is a record of increases and decreases in a spefic asset, liability, equity, revenues, or expenses items. A(n)____ is a resource owned or controlled by a company A common stock and dividendes are examples of___ accounts A(n)____ is a obilgations to transfer assets to others ___ are people and organziations that are entitlied to recieve payments from a companyarrow_forward1. How often should income statements be prepared? 2. Which is more important a. Statement of financial position (balance sheet) or b. Statement of results of operation (income statement)? 3. Explain the following: a. Balance sheet for a specific date (for example, December 31, 20X1) b. Income statement is for a period of time (for example: For the Year Ended December 31, 20X1) 4. What are the advantages of multistep income statement over a single-step income statement? 5. Relate accounts in the income statement with those in the balance sheet. Discuss how the income statement accounts affect balance sheet accounts.arrow_forward

- Common categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, Long-Term Liabilities, and Equity. For each of the following items, identify the balance sheet category where the item typically would best appear. If an item does not appear on the balance, indicate that instead. Account Title 1. Notes receivable (due in 2 years) 2. Trademarks 3. Cash 4. Patents 5. Interest receivable 6. Machinery 7. Prepaid rent (2 months of Rent) 8. Equipment 9. Repairs expense 10. Land Classification Account Title 11. Depreciation expense Building 12. Office equipment 13. Prepaid Insurance (expires in 5 months) 14. Buildings 15. Bonds payable (due in 10 years) 16. Trucks 17. Mortgages payable (due in 6 years) 18. Automobiles 19. Notes payable (due in 3 years) 20. Utilities expense Classificationarrow_forwardThe following lettered items represent a classification scheme for a balance sheet, and the numbered items represent data found on balance sheets. In the blank next to each account, write the letter indicating to which category it belongs. А. Current assets В. Investments C. Property, plant, and equipment D. Intangible assets Е. Current liabilities F. Long-term liabilities G. Stockholders' equity Н. Not on the balance sheetarrow_forwardCommon categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, Long-Term Liabilities, and Equity. For each of the following items, identify the balance sheet category where the item typically would best appear. If an item does not appear on the balance sheet, indicate that instead. Account Title 1. Long-term investment in stock 2. Depreciation expense-Building 3. Prepaid rent (2 months of rent) 4. Interest receivable 5. Taxes payable (due in 5 weeks) 6. Automobiles 7. Notes payable (due in 3 years) 8. Accounts payable 9. Cash 10. Common stock Classification Account Title 11. Unearned services revenue 12. Accumulated depreciation-Trucks 13. Prepaid insurance (expires in 5 months) 14. Buildings 15. Store supplies 16. Office equipment 17. Land (used in operations) 18. Repairs expense 19. Office supplies 20. Current portion of long-term note payable Classificationarrow_forward

- What is the total liabilities, please break down.arrow_forwardThe Income Summary is always closed into the Capital account by the amount of: Select one: Revenue minus expenses Total assets minus total liabilities plus owner’s equity The Net Income from the previous year’s closed accounts Liabilities minus Capital plus drawingsarrow_forwardPlease categorize allarrow_forward

- The current balance sheet of J.J. Arvesen Company contains the following major sections: A. Current assets B. Long-term investments C. Property, plant, and equipment D. Intangible assets E. Other assets F. Current liabilities G. Long-term liabilities H. Contributed capital I. Retained earnings J. Accumulated other comprehensive income The following is a list of accounts. Using the letters A through J, indicate in which section of the balance sheet each account would most likely be classified. If an account does not belong under one of the sections listed, select "Not under any of the choices" from the classification drop down box. For all accounts, indicate if the account is a contra account or an account that would normally be deducted on the balance sheet by selecting "yes" from the second drop down box, otherwise select "no". Contra or Account Classification Deducted (Yes/No) 1. Patents (net) 2. Income taxes payable 3. Notes receivable (due in 5 months) 4. Unearned rent 5. Discount…arrow_forwardHarrigan Service Company, Inc., was incorporated by lan Harrigan and five other managers. The following activities occurred during the year: 1. Received $71,400 cash from the managers; each was issued 1,190 shares. 2. Purchased equipment for use in the business at a cost of $50,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months). 3. Signed an agreement with a cleaning service to pay it $690 per week for cleaning the corporate offices, beginning next week. 4. Ian Harrigan borrowed $19,500 for personal use from a local bank, signing a one-year note.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education