FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need all 11 required, please and thank you ! very important

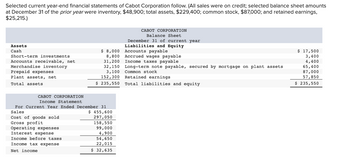

Transcribed Image Text:**Selected Current Year-End Financial Statements of Cabot Corporation**

The following is an overview of Cabot Corporation's financial statements for the current year ending December 31. All sales were made on credit.

### Balance Sheet

**Cabot Corporation**

*Balance Sheet*

*December 31 of current year*

| **Assets** | **Liabilities and Equity** |

|-------------------------------|---------------------------------------------------------------|

| Cash | $8,000 | Accounts payable | $17,500 |

| Short-term investments | $8,800 | Accrued wages payable | $3,400 |

| Accounts receivable, net | $31,200 | Income taxes payable | $4,400 |

| Merchandise inventory | $32,150 | Long-term note payable, secured by mortgage on plant assets | $65,400 |

| Prepaid expenses | $3,100 | Common stock | $87,000 |

| Plant assets, net | $152,300 | Retained earnings | $57,850 |

| **Total assets** | **$235,550** | **Total liabilities and equity** | **$235,550** |

### Income Statement

**Cabot Corporation**

*Income Statement*

*For Current Year Ended December 31*

| **Description** | **Amount** |

|-------------------------|-------------|

| Sales | $455,600 |

| Cost of goods sold | $297,050 |

| Gross profit | $158,550 |

| Operating expenses | $99,000 |

| Interest expense | $4,900 |

| Income before taxes | $54,650 |

| Income tax expense | $22,015 |

| **Net income** | **$32,635** |

### Additional Context

- **Prior Year Information**: As of December 31 of the previous year, selected balance sheet figures included:

- **Inventory**: $48,900

- **Total assets**: $229,400

- **Common stock**: $87,000

- **Retained earnings**: $25,215

These financial statements provide a snapshot of Cabot Corporation's financial health, reflecting asset management, liabilities, equity, and profitability for the specified period.

![**Educational Website Content: Financial Ratio Analysis**

**Required:**

Compute the following:

1. Current ratio

2. Acid-test ratio

3. Days' sales uncollected

4. Inventory turnover

5. Days' sales in inventory

6. Debt-to-equity ratio

7. Times interest earned

8. Profit margin ratio

9. Total asset turnover

10. Return on total assets

11. Return on equity

**Note:** Do not round intermediate calculations.

---

**Instructions:**

Complete these calculations by entering your answers in the tabs below.

Tabs available: Req 1 and 2, Req 3, Req 4, Req 5, Req 6, Req 7, Req 8, Req 9, Req 10, Req 11

---

### Compute the Current Ratio and Acid-Test Ratio

**(1) Current Ratio**

- **Numerator:**

- Current Assets / Current Liabilities

- **Denominator:**

- Equals the Current Ratio

- The result will be formatted as "Current Ratio = X to 1"

---

**(2) Acid-Test Ratio**

- **Numerator:**

- (Current Assets - Inventory) / Current Liabilities

- **Denominator:**

- Equals the Acid-Test Ratio

- The result will be formatted as "Acid-Test Ratio = X to 1"

---

Use the navigation buttons to move between calculation tabs:

[Req 1 and 2] [Req 3]

**Explanation:**

This section provides a structured method for calculating both the current and acid-test ratios, which are key measures of a company's liquidity. These ratios can help assess a company's ability to meet its short-term obligations.](https://content.bartleby.com/qna-images/question/f2bfa172-bfc6-4a2e-9589-90b7bd2d30c6/1c401701-0919-42bc-bead-9de35892e1dd/q4q4j3n_thumbnail.png)

Transcribed Image Text:**Educational Website Content: Financial Ratio Analysis**

**Required:**

Compute the following:

1. Current ratio

2. Acid-test ratio

3. Days' sales uncollected

4. Inventory turnover

5. Days' sales in inventory

6. Debt-to-equity ratio

7. Times interest earned

8. Profit margin ratio

9. Total asset turnover

10. Return on total assets

11. Return on equity

**Note:** Do not round intermediate calculations.

---

**Instructions:**

Complete these calculations by entering your answers in the tabs below.

Tabs available: Req 1 and 2, Req 3, Req 4, Req 5, Req 6, Req 7, Req 8, Req 9, Req 10, Req 11

---

### Compute the Current Ratio and Acid-Test Ratio

**(1) Current Ratio**

- **Numerator:**

- Current Assets / Current Liabilities

- **Denominator:**

- Equals the Current Ratio

- The result will be formatted as "Current Ratio = X to 1"

---

**(2) Acid-Test Ratio**

- **Numerator:**

- (Current Assets - Inventory) / Current Liabilities

- **Denominator:**

- Equals the Acid-Test Ratio

- The result will be formatted as "Acid-Test Ratio = X to 1"

---

Use the navigation buttons to move between calculation tabs:

[Req 1 and 2] [Req 3]

**Explanation:**

This section provides a structured method for calculating both the current and acid-test ratios, which are key measures of a company's liquidity. These ratios can help assess a company's ability to meet its short-term obligations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education