Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

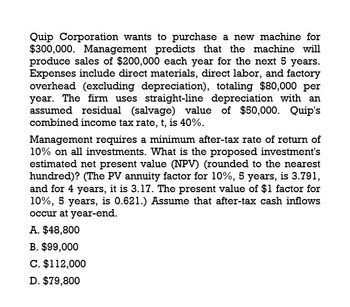

Transcribed Image Text:Quip Corporation wants to purchase a new machine for

$300,000. Management predicts that the machine will

produce sales of $200,000 each year for the next 5 years.

Expenses include direct materials, direct labor, and factory

overhead (excluding depreciation), totaling $80,000 per

year. The firm uses straight-line depreciation with an

assumed residual (salvage) value of $50,000. Quip's

combined income tax rate, t, is 40%.

Management requires a minimum after-tax rate of return of

10% on all investments. What is the proposed investment's

estimated net present value (NPV) (rounded to the nearest

hundred)? (The PV annuity factor for 10%, 5 years, is 3.791,

and for 4 years, it is 3.17. The present value of $1 factor for

10%, 5 years, is 0.621.) Assume that after-tax cash inflows

occur at year-end.

A. $48,800

B. $99,000

C. $112,000

D. $79,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forwardDauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forwardFilkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?arrow_forward

- After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide whether to go ahead and develop the deposit. The most cost-effective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend 900,000 for new mining equipment and pay 165,000 for its installation. The mined gold will net the firm an estimated 350,000 each year for the 5-year life of the vein. CTCs cost of capital is 14%. For the purposes of this problem, assume that the cash inflows occur at the end of the year. a. What are the projects NPV and IRR? b. Should this project be undertaken if environmental impacts were not a consideration? c. How should environmental effects be considered when evaluating this or any other project? How might these concepts affect the decision in part b?arrow_forwardUtica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forwardPique Corporation plans to purchase a new machine for $300,000. Management estimates that with the machine cash flows from sales will increase by $160,000 each year for the next 5 years. Expenses to generate the additional sales include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $70,000 per year. The firm uses straight-line depreciation with no terminal disposal value for all depreciable assets. The new machine has an expected salvage value of zero at the end of the project. Pique's combined income tax rate is 20%. Management requires a minimum after-tax rate of return of 8% on all investments.a. Calculate the Net Present Value (NPV) for this project.arrow_forward

- Hammer Corporation wants to purchase a new machine for $303,000. Management predicts that the machine will produce sales of $216,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The firm uses straight-line depreciation with an assumed residual (salvage) value of $50,000. Hammer's combined income tax rate, t, is 50%. What is the estimated accounting (book) rate of return (ARR) for the proposed investment, based on average investment? (Round answer to nearest whole number/percentage.)arrow_forwardHammer Corporation wants to purchase a new machine for $284,000. Management predicts that the machine will produce sales of $187,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $78,000 per year. The firm uses straight-line depreciation with an assumed residual (salvage) value of $50,000. Hammer's combined income tax rate, t, is 20%. Management requires a minimum after-tax rate of return of 10% on all investments. What is the estimated net present value (NPV) of the proposed investment (rounded to the nearest hundred dollars)? (The PV annuity factor for 10%, 5 years, is 3.791 and for 4 years it is 3.17. The present value $1 factor for 10%, 5 years, is 0.621.) Assume that after-tax cash inflows occur at year-end. Multiple Choice $82,100. $113,100. $132,300. $145,300. $103,300.arrow_forwardLakeside Inc. is considering replacing old production equipment with state-of-the-art technology that will allow production cost savings of $10,000 per month. The new equipment will have a five-year life and cost $420,000, with an estimated salvage value of $33,000. Lakeside's cost of capital is 7%. Lakeside Inc. uses a straight-line depreciation method. Required: Calculate the payback period and the accounting rate of return for the new production equipment. (Round your answers to 2 decimal places.) Payback period Accounting rate of return years %arrow_forward

- Hammer Corporation wants to purchase a new machine for $387,000. Management predicts that the machine will produce sales of $216,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $73,000 per year. The firm uses straight-line depreciation with an assumed residual (salvage) value of $50,000. Hammer's combined income tax rate, t, is 40%. Management requires a minimum after-tax rate of return of 10% on all investments. What is the approximate internal rate of return (IRR) of the proposed investment? (Note: To answer this question, students should use Table 2 from Appendix C, Chapter 12.) Assume that all cash flows occur at year-end.arrow_forwardB2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $384,000 with a 10-year life and no salvage value. It will be depreciated on a straight-line basis. The company expects to sell 153,600 units of the equipment’s product each year. The expected annual income related to this equipment follows. Sales $ 240,000 Costs Materials, labor, and overhead (except depreciation on new equipment) 84,000 Depreciation on new equipment 38,400 Selling and administrative expenses 24,000 Total costs and expenses 146,400 Pretax income 93,600 Income taxes (40%) 37,440 Net income $ 56,160 If at least an 9% return on this investment must be earned, compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)arrow_forwardB2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $376,000 with a 8-year life and no salvage value. It will be depreciated on a straight-line basis. The company expects to sell 150,400 units of the equipment's product each year. The expected annual income related to this equipment follows. Sales Costs Materials, labor, and overhead (except depreciation on new equipment) Depreciation on new equipment Selling and administrative expenses Total costs and expenses Pretax income Income taxes (30%) Net income If at least an 9% return on this investment must be earned, compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Chart Values are Based on: Select Chart Net present value n = j= Amount % X PV Factor = Present Value $ $ 235,000 82,000 47,000 23,500 152,500 82,500 24,750 $ 57,750 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning