FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

B2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $384,000 with a 10-year life and no salvage value. It will be

| Sales | $ | 240,000 | |

| Costs | |||

| Materials, labor, and |

84,000 | ||

| Depreciation on new equipment | 38,400 | ||

| Selling and administrative expenses | 24,000 | ||

| Total costs and expenses | 146,400 | ||

| Pretax income | 93,600 | ||

| Income taxes (40%) | 37,440 | ||

| Net income | $ | 56,160 | |

If at least an 9%

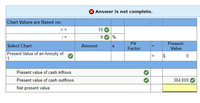

Transcribed Image Text:O Answer is not complete.

Chart Values are Based on:

n =

10

i =

%

PV

Factor

Present

Value

Select Chart

Amount

Present Value of an Annuity of

1

Present value of cash inflows

Present value of cash outflows

384,000

Net present value

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calligraphy Pens is deciding when to replace its old machine. The machine's current salvage value is $3,050,000. Its current book value is $1,800,000. If not sold, the old machine will require maintenance costs of $710,000 at the end of the year for the next five years. Depreciation on the old machine is $360,000 per year. At the end of five years, it will have a salvage value of $155,000 and a book value of $0. A replacement machine costs $4,650,000 now and requires maintenance costs of $380,000 at the end of each year during its economic life of five years. At the end of the five years, the new machine will have a salvage value of $745,000. It will be fully depreciated by the straight-line method. In five years, a replacement machine will cost $3,650,000. The company will need to purchase this machine regardless of what choice it makes today. The corporate tax rate is 25 percent and the appropriate discount rate is 7 percent. The company is assumed to earn sufficient revenues to…arrow_forwardA project has to sell a machine that is obsolete. The market department finds a buyer who is willing to pay $100, 000 for the machine. The machine was purchased 4 years ago for $1.1 million. The accounting department notes that the depreciation method for this machine is straight line, and the machine will be depreciated to zero over a five year time period after purchase. What is the machine's after - tax salvage value? Tax rate is 21%. Question 1 options: $1, 635.24 $2, 314.05 $142,000.00 - $2,784.62$289.26arrow_forwardYour company is considering the purchase of a new 623K Wheel Tractor-Scraper. Use the following information to calculate the hourly owning costs, hourly operating costs, and total owning and operating costs. - Delivered price (with tires): $420,000 - Cost of Tires: $30,000 and their life is determined by the average operation in zone B. - Salvage value is zero - the equipment is new and it is anticipated to be used for 5 years, until end of its service life. - Anticipated operating hours per year: 2,000 hrs/yr - Simple interest rate for purchase loan: 12% - Annual cost of Insurance: $5,500 (See optional method) - Property tax rate: 2% - Fuel use will be average value in medium range - Cost of fuel: $3.10 per gallon - Hourly Maintenance Cost: $5.00 per hour - Repair cost: $11.00 per hour - Operator cost (with fringes): $75 per hour - No undercarriage or special wear items costs…arrow_forward

- Wildhorse Inc. wants to purchase a new machine for $38,790, excluding $1,500 of installation costs. The old machine was purchased 5 years ago and had an expected economic life of 10 years with no salvage value. The old machine has a book value of $2,200, and Wildhorse Inc. expects to sell it for that amount. The new machine will decrease operating costs by $9,000 each year of its economic life. The straight-line depreciation method will be used for the new machine for a 6-year period with no salvage value. Click here to view PV table. (a) Determine the cash payback period. (Round cash payback period to 2 decimal places, e.g. 10.53.) Cash payback period (b) years Determine the approximate internal rate of return. (Round answer to O decimal places, e.g. 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Internal rate of return %arrow_forwardThe management of Jasper Equipment Company is planning to purchase a new milling machine that will cost $160,000 installed. The old milling machine has been fully depreciated but can be sold for $15,000. The new machine will be depreciated on a straight-line basis over its 10-year economic life to an estimated salvage value of $10,000. If this milling machine will save Jasper $20,000 a year in production expenses, what are the annual net cash flows associated with the purchase of this machine? Assume a marginal tax rate of 40 percent. a. $15,000 b. $27,000 c. $21,000 d. $18,000arrow_forwardSalsa Co. is contemplating the replacement of an old machine with a new one. The following information has been gathered: Old Machine New Machine Price $300,000 $600,000 Accumulated Depreciation 89,300 Remaining useful life 10 years Useful life 10 years Annual operating costs $240,000 $180,600 If the old machine is replaced, it can be sold for $24,000. How much is the sunk cost?arrow_forward

- Cullumber Lumber, is considering purchasing a new wood saw that costs $40,000. The saw will generate revenues of $100,000 per year for five yearsThe cost of materials and labor needed to generate these revenues will total $60,000 per yearand other cash expenses will be $10,000 per year. The machine is expected to sell for $2.000 at the end of its fiveyear life and will be depreciated on a straight-line basis over five years to zeroCullumber's tax rate is 26 percentand its opportunity cost of capital is 14.20 percent. What is the project's NPV(Do not round intermediate calculationsRound final answer to decimal places, e.g. 5,275)arrow_forwardBSU Inc. wants to purchase a new machine for $29,300, excluding $1,500 of installation costs. The old machine was bought five years ago and had an expected economic life of 10 years without salvage value. This old machine now has a book value of $2,000, and BSU Inc. expects to sell it for that amount. The new machine would decrease operating costs by $7,000 each year of its economic life. The straight-line depreciation method would be used for the new machine, for a six-year period with no salvage value. Click here to view the factor table. (a) Determine the cash payback period. (Round cash payback period to 2 decimal places, e.g. 10.53.) Cash payback period (b) Determine the approximate internal rate of return. (Round answer to O decimal places, e.g. 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Internal rate of return (c) years The investment Assuming the company has a required rate of return of 10%, determine whether the new machine…arrow_forwardFactor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $491,000 cost with an expected four-year life and a $20,000 salvage value Additional annual information for this new product line follows PV of $. EX of St. PVA of Stand EVA of $ (Use appropriate factors) from the tables provided) Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation Machinery 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year 3. Compute net present value for this machine using a discount rate of 7% Complete this question by entering your answers in the tabs below. Required 1 Required 2 year 4 Required 3 Compute net present value for this machine using a discount rate of 7%. (Do not round intermediate calculations. Negative amounts should be entered with a minus sign.…arrow_forward

- Pique Corporation plans to purchase a new machine for $300,000. Management estimates that with the machine cash flows from sales will increase by $160,000 each year for the next 5 years. Expenses to generate the additional sales include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $70,000 per year. The firm uses straight-line depreciation with no terminal disposal value for all depreciable assets. The new machine has an expected salvage value of zero at the end of the project. Pique's combined income tax rate is 20%. Management requires a minimum after-tax rate of return of 8% on all investments.a. Calculate the Net Present Value (NPV) for this project.arrow_forwardThe Plastics Division of Minock Manufacturing currently earns $3.54 million and has divisional assets of $25 million. The division manager is considering the acquisition of a new asset that will add to profit. The investment has a cost of $5,466,000 and will have a yearly cash flow of $1,458,500. The asset will be depreciated using the straight-line method over a five-year life and is expected to have no salvage value. Divisional performance is measured using ROI with beginning-of-year net book values in the denominator. The company's cost of capital is 7 percent. Ignore taxes. The division manager learns that there is an option to lease the asset on a year-to-year lease for $1,162,000 per year. All depreciation and other tax benefits would accrue to the lessor. Required: a. What is the division's residual income before considering the project? b. What is the division's residual income if the asset is purchased? c. What is the division's residual income if the asset is leased? Note:…arrow_forwardBenson Enterprises is deciding when to replace its old machine. The machine’s current salvagevalue is $1.2 million. Its current book value is $1 million. If not sold, the old machine will requiremaintenance costs of $420,000 at the end of the year for the next five years. Depreciation on theold machine is $200,000 per year. At the end of five years, it will have a salvage value of $220,000.A replacement machine costs $3.5 million now and requires maintenance costs of $160,000 at theend of each year during its economic life of five years. At the end of five years, the new machinewill have a salvage value of $540,000. It will be fully depreciated using the three-year MACRSschedule. In five years a replacement machine will cost $4,000,000. Pilot will need to purchasethis machine regardless of what choice it makes today. The corporate tax is 35 percent and theappropriate discount rate is 10 percent. The company is assumed to earn sufficient revenues togenerate tax shields from…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education