FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

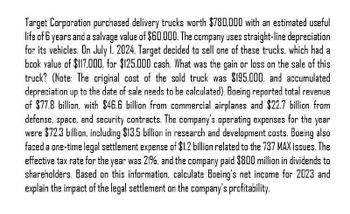

Transcribed Image Text:Target Corporation purchased delivery trucks worth $780,000 with an estimated useful

life of 6 years and a salvage value of $60.000. The company uses straight-line depreciation

for its vehicles. On July 1, 2024. Target decided to sell one of these trucks, which had a

book value of $117,000, for $125,000 cash. What was the gain or loss on the sale of this

truck? (Note: The original cost of the sold truck was $195.000, and accumulated

depreciation up to the date of sale needs to be calculated). Boeing reported total revenue

of $77.8 billion, with $46.6 billion from commercial airplanes and $22.7 billion from

defense, space.

and security contracts. The company's operating expenses for the year

were $72.3 billion, including $13.5 billion in research and development costs. Boeing also

faced a one-time legal settlement expense of $1.2 billion related to the 737 MAX issues. The

effective tax rate for the year was 21%. and the company paid $800 million in dividends to

shareholders. Based on this information, calculate Boeing's net income for 2023 and

explain the impact of the legal settlement on the company's profitability.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please give me answerarrow_forwardVaughn Manufacturing purchased a new machine on May 1, 2012 for $566400. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $20400. The company has recorded monthly depreciation using the straight-line method. On March 1, 2021, the machine was sold for $81600. What should be the loss recognized from the sale of the machine? $2500. $20400. $22900. $0.arrow_forwardOn January 1, 2016, Rexford Company purchased a drilling machine for $11,500. The machines has an estimated useful life of 4 years and a salvage value of $200. Given this information, if Rexford uses double-declining-balance method of depreciation, and sells the machine on December 31, 2017, for $3,000 cash. Then how much will be gain or loss on disposal of this asset? $ 2,750 loss $ 1,800 loss $1,562 gain $ 125 gainarrow_forward

- Babcock Company purchased a piece of machinery for $30,000 on January 1, 2022, and has been depreciating the machine using the sum-of-the-years'-digits method based on a five-year estimated useful life and no salvage value. On January 1, 2024, Babcock decided to switch to the straight-line method of depreciation. The salvage value is still zero and the estimated useful life is changed to a total of six years from the date of purchase. Ignore income taxes. Required: 1. Prepare the appropriate journal entry, if any, to record the accounting change. 2. Prepare the journal entry to record depreciation for 2024. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entry, if any, to record the accounting change. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 Record the accounting change.arrow_forwardBlossom Company purchased a delivery truck for $48,000 on July 1, 2025. The truck has an expected salvage value of $8,000, and is expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 15,000 in 2025 and 12,000 in 2026. Blossom uses the straight-line method of depreciation. (a) Your answer is partially correct. Compute depreciation expense for 2025 and 2026. Depreciation Expense $ 2025 $ 2026 5,000arrow_forwardMarsh Corporation purchased a machine on July 1, 2012, for $1,250,000. The machine was estimated to have a useful life of 10 years with an estimated salvage value of $70,000. During 2015, it became apparent that the machine would become uneconomical after December 31, 2019, and that the machine's salvage value is now $0. Accumulated depreciation on this machine as of December 31, 2014, was $295,000. What should be the charge for depreciation in 2015 under generally accepted accounting principles? O $177,000 O $191,000 O $205,000 O $238,750arrow_forward

- Bonita Industries purchased a new machine on May 1, 2012 for $561600. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $30000. The company has recorded monthly depreciation using the straight-line method. On March 1, 2021, the machine was sold for $67800. What should be the loss recognized from the sale of the machine?arrow_forwardOn February 1, 2006, Mason Company purchased a building for $359,000. The building was assigned a useful life of forty years and a salvage value of $11,000. XYZ Company uses the straight-line depreciation method to calculate depreciation on its long-term assets. The building was sold for $121,000 cash on August 1, 2029. Calculate the amount of the loss recorded on the sale. Do not enter your answer with a minus sign in front of your number.arrow_forwardCrouch Company purchased a new machine on May 1, 1998 for $176,000. At thetime of acquisition, the machine was estimated to have a useful life of ten yearsand an estimated salvage value of $8,000. The company has recorded monthlydepreciation using the straight-line method. On March 1, 2007, the machine wassold for $24,000. What should be the loss recognized from the sale of themachine? a. $0.b. $3,600.c. $8,000.d. $11,600.arrow_forward

- Jeter Company purchased a new machine on May 1, 1998 for $176,000. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $8,000. The company has recorded monthly depreciation using the straight-line method. On March 1, 2007, the machine was sold for $24,000. What should be the loss recognized from the sale of the machine? $-0- O $3,600 $8,000 $11,600arrow_forwardSheridan Company purchased an electric wax melter on April 30, 2025, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase. List price of new melter Cash paid Cost of old melter (5-year life, $800 salvage value) Accumulated depreciation-old melter (straight-line) Secondhand fair value of old melter $18,000 11,400 12,800 7,200 5,900 Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance. Sheridan's fiscal year ends on December 31, and depreciation has been recorded through December 31, 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)arrow_forwardCheyenne Corp. purchased a delivery truck for $42,000 on January 1, 2022. The truck has an expected salvage value of $9,000, and is expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 15,600 in 2022 and 10,000 in 2023. Compute depreciation expense for 2022 and 2023 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education