EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Hello tutor give correct solution

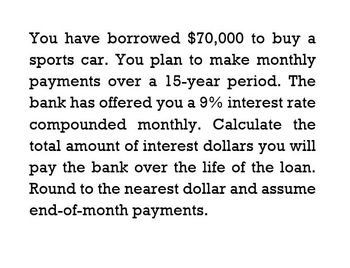

Transcribed Image Text:You have borrowed $70,000 to buy a

sports car. You plan to make monthly

payments over a 15-year period. The

bank has offered you a 9% interest rate

compounded monthly. Calculate the

total amount of interest dollars you will

pay the bank over the life of the loan.

Round to the nearest dollar and assume

end-of-month payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate $4,200 over the next 6 years when the interest rate is 8%, how much do you need to deposit in the account? B. If you place $8,700 in a savings account, how much will you have at the end of 12 years with an interest rate of 8%? C. You invest $2,000 per year, at the end of the year, for 20 years at 10% interest. How much will you have at the end of 20 years? D. You win the lottery and can either receive $500,000 as a lump sum or $60,000 per year for 20 years. Assuming you can earn 3% interest, which do you recommend and why?arrow_forwardIf Bergen Air Systems takes out a $100,000 loan, with eight equal principal payments due over the next eight years, how much will be accounted for as a current portion of a noncurrent note payable each year?arrow_forwardYou have borrowed $10,000 from a bank at the interest rate of 1% per month. Yourmonthly payment is $554.15. Find the time required to repay the loan.arrow_forward

- You plan to borrow $10,000 from the bank. For a four-year loan, the bank requires annual end-of-year payments of $3,223.73. What is the annual interest rate on this loan?arrow_forwardNeed helparrow_forwardTimothy Lawrence plans to borrow $5,000 and to repay it in 36 monthly installments. This loan is being made at an annual add-on interest rate of 11.5 percent. Calculate the finance charge on this loan, assuming that the only component of the finance charge is interest. Round the answer to the nearest cent. $ Use your finding in part (a) to calculate the monthly payment on the loan. Round the answer to the nearest cent. $ per month Using a financial calculator, determine the APR on this loan. Round the answer to 2 decimal places. %arrow_forward

- Can you please solve this question?arrow_forwardYou have credit card debt of $30,000 that has an APR (monthly compounding) of 18%. Each month you pay the minimum monthly payment. You are required to pay only the outstanding interest. You have received an offer in the mail for an otherwise identical credit card with an APR of 10%. After considering all your alternatives, you decide to switch cards, roll over the outstanding balance on the old card into the new card, and borrow additional money as well. How much can you borrow today on the new card without changing the minimum monthly payment you will be required to pay? (Note: Be careful not to round any intermediate steps less than six decimal places.) You can borrow $ on the new card without changing the minimum monthly payment you will be required to pay. (Round to the nearest dollar.)arrow_forwardYou plan to use a 15 year mortgage obtained from a local bank to purchase a house worth $124,000.00. The mortgage rate offered to you is 7.75%. You will make a down payment of 20% of the purchase price. a. Calculate your monthly payments on this mortgage. List in a spreadsheet the cash flow the bank expects to receive from you. Submit the spreadsheet with your answers. b. Calculate the amount of interest and principal for the 60th payment. Show your work. c. Calculate the amount of interest and principal to be paid on the 180th payment. Show your work. d. What is the amount of interest paid over the life of this mortgage?arrow_forward

- your credit card has a balance of $3000 in an annual interest rate of 17% with no further purchase charge to the card and the balance being paid off over five years. The monthly payment is $75 and the total interest paid is $1500. You can get a bank loan at 9.5% with a term of six years complete parts, a and B below. A. How much will you pay each month? How does this compare with the credit card payment each month? A. the monthly payment for the bank loan are approximately $__ This is $__ more than a monthly credit card payments. B. The monthly payments are the bank loan are approximately $__ This is $__ less than the monthly credit card payments. B.How much total interest will you pay? How does this compare with the total credit-card interest? A. The total interest paid over 3 years for the bank loan is approximately$__. This is $__ more than the total credit-card interest. B. The total interest paid over 3 years for the bank loan is approximately $__. This is $__ less than the…arrow_forwardWestern Bank offers you a $10,000, 6-year term loan at 7 percent annual interest. What is the amount of your annual loan payment?arrow_forwardUsing the simple interest method, find the monthly payments on a $2,000 installment loan if the funds are borrowed for 30 months at an annual interest rate of 7%. You can use financial calculator, Excel. Round the answer to the nearest cent. Round the answer to the nearest cent. $ per month How much interest will be paid during the first year of this loan? Round your intermediate computations and final answers to the nearest cent. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College