ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

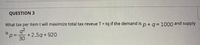

Transcribed Image Text:QUESTION 3

What tax per item t will maximize total tax reveue T = tq if the demand is p+q3D1000 and supply

92

+2.5q+920

30

is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- PRICE 21096 11 8 3 2 1 E Supply Demand H 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 QUANTITY Refer to Figure 8-2. The amount of tax revenue received by the government is a) $10. b) $1. c) sarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward(a) The supply and demand equations for a good are p-2q = 1 and p+ 2q = 9, respectively. Find the equilibrium price and quantity. A percentage [of the price] tax of 100r% is imposed. Find the new equilibrium price and quantity. What fraction of the tax paid has been passed onto the consumer? (b) If an asset is purchased at some initial time t = 0 for $200 and sold at some time t > 0 in the future, the value of the sale is given by P(t) = (2t² + 14t+200)e-¹/10, dollars. Find the stationary points of P(t) and determine their nature. Should the asset be purchased and, if so, when is the best time to sell it? [Hint: The fact that e> 2.7 may be useful.]arrow_forward

- Figure 18-1 Price per unit P P₂ P₁ B F GE H Q₁ 9 0₂ S+ Sales tax S Demand Refer to Figure 18-1. Area F+G represents Quantity O the excess burden of the sales tax. O the portion of sales tax revenue borne by consumers. O sales tax revenue collected by the government. O the portion of sales tax revenue borne by producers.arrow_forwardShould a per unit tax become more efficient or less efficient as we consider longer time horizons? Why?arrow_forwardQuestion 2: Imposing a single-stage tax Assume that there are 1000 importers and manufacturers, 2,000 wholesalers, and 10,000 retailers. Each manufacturer (importer) has sales of $30,000,000 which is sold equally across wholesalers, and wholesalers put a 20% markup on the price before selling to retailers Then the goods are resold equally to 10,000 retailers and the retailers impose a 25% markup on it. Suppose the government needs to raise 4.5 billion with a single- stage sales tax, a. What would be the rate of tax the government needs to impose on the sales of importers and manufacturers to achieve the revenue target. b. What would be the rate of tax the government needs to impose on the sales of wholesalers to achieve the revenue target?arrow_forward

- With respect to the sources of state tax revenue, the corporate income tax generates approximately twice the revenue as state sales and use taxes. O True O Falsearrow_forward1) The demand function for a product is shown by the equation P = 15 – Q and the Supply function P = 3 + 0.5Q. the product is subject to a tax of IDR.3/unit a. Determine the amount and price of the balance before and after tax. b. determine the amount and the balance price if the government provides a subsidy of IDR.2/unit c. how much tax is borne by producers and consumers d. how much of a subsidy is enjoyed by consumers e. How much does the government get for taxes and the amount of subsidies issued by the government?arrow_forwardConsider an ad-valorem tax on a good X. The Demand for good X is constant elasticity with elasticity -2. The Supply for good Y is constant elasticity with elasticity 3. What is the incidence of the tax? Provide a fraction that shows the ratio of the tax burden that falls on the supply side relative to the demand side: 3/2 2/3 none of these (2+3)/2 (2+3)/3arrow_forward

- Question 44 Please refer to the description of a tax on a market, represented by the graphic .. The amount of deadweight loss as a result of the tax is represented by the area(s) Check all that apply. F C. E.arrow_forwardExcise tax is not applied to: Excise tax is not applied to: None of the answer choices are correct. Wine Distilled spirits Beer Doughnutsarrow_forward(Figure: Determining Tax Burdens) Based on the graph, the original market price is $4. The graph depicts a tax of with a corresponding deadweight loss of Price ($) 98765432 T X D 0 50 100 150 200 250 300 350 400 450 500 550 600 Quantity $6; $3 $3; $150 $6; 50 units $3; $75arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education