ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

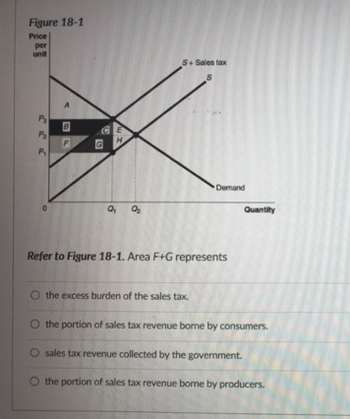

Transcribed Image Text:Figure 18-1

Price

per

unit

P

P₂

P₁

B

F

GE

H

Q₁

9

0₂

S+ Sales tax

S

Demand

Refer to Figure 18-1. Area F+G represents

Quantity

O the excess burden of the sales tax.

O the portion of sales tax revenue borne by consumers.

O sales tax revenue collected by the government.

O the portion of sales tax revenue borne by producers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 9) The following graph shows the effect of a per-ticket tax on plane tickets from Boston to Tampa. Use the graph to answer questions 5 to 10. $30 $20 $10 Price (P) of airline tickets (in dollars per ticket) How much of the per-ticket tax is paid by passengers? $40 230 200 190 2850 3000 Swith tax Sno tax D Figure 14 Image author created Quantity (Q) of airline tickets (thousands per day)arrow_forward7.7 pleaase explainarrow_forwardFigure 8-5 Price P3 P1 P₂ a. A C. B d. D F -Tax- G 92 C E P2 and Q2 o b. P2 and Q1 X P1 and Q1 P3 and Q2 H Refer to Figure 8-5. What is the price sellers receive after the tax and the quantity sold? 9₁₂ S Quantityarrow_forward

- Figure 4-15 Price (dollars per case) $32 27 22 20 0 Tax- 50 O $7. O $20. O $22. O $27. 90 Supply with tax Supply Quantity (thousands of cases) Figure 4-15 shows the market for beer. The government plans to impose a per-unit tax in this market. Refer to Figure 4-15. The price buyers pay after the tax isarrow_forwardFigure 8-8 Suppose the government imposes a $10 per unit tax on a good. Price 24 22- 20 18 Supply 16+ 14+ 12 F G 10+ H 6- 4- K M Demand 3 69 12 15 18 21 24 27 30 33 36 39 Quantity Refer to Figure 8-8. One effect of the tax is to O reduce producer surplus from $96 to $24. O create a deadweight loss of $72. O reduce consumer surplus from $180 to $72. All of the above are correct. 00 2.arrow_forwardUsing the supply and demand data for wheat below, what would happen if the government placed a $3 per bushel tax on wheat? Bushels demanded 45 50 56 61 67 Price per bushel $6 $5 $4 LA LA LA $3 $2 Bushels supplied 77 73 68 61 57 O the producer price would fall, the consumer price would rise, and the quantity sold would increase. The producer price would fall, the consumer price would rise, and the equilibrium quantity would fall O Both the consumer price and the producer price would rise the consumer price would rise by less than $3 while the producer price would fall by more than $3 O the equilibrium consumer price would rise by $3arrow_forward

- Price (dollars per hour) 7.00 6.60 6.00 5.60 5.00 0 1 2 3 4 5 6 7 8 Quantity (thousands of frisbees) Figure 6.3.1 OB) $5.60. S + tax Refer to Figure 6.3.1 showing the market for frisbees before and after a tax is imposed. On each frisbee, the sellers' burden of the tax is OA) $0.60. OC) $0.40. S OD) $6.60.arrow_forwardPlease give me answer with detail explanationarrow_forwarda. $7 b. $3 c. Between $5 and $7 d. Between $3 and $5 7 PRICE EL 3 60 100 fer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is posed? QUANTITYarrow_forward

- Question 3arrow_forwardPrice te ng 20 18 16 14 12 10 8 6 4 O -~ 2 8 10 Quantity What is the amount of producer surplus after the government imposes the excise tax on the market? C Multiple Choice ооо 4 $40 $32 $9 $7 6 12 14 S₂ 16 Sarrow_forward3 3 points The figure below shows the market for snowboards in the state of Colorado. The Colorado state legislature has imposed a sales of tax on each snowboard sold. Assume that the pre-tax price of a snowboard was $50. After the tax, consumers are paying $55 per snowboard while firms are receiving $40 per snowboard. DI Arse 1 The tax burden on households is $30 0000 O $5 $10 $15 $20 Sept O100arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education