ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

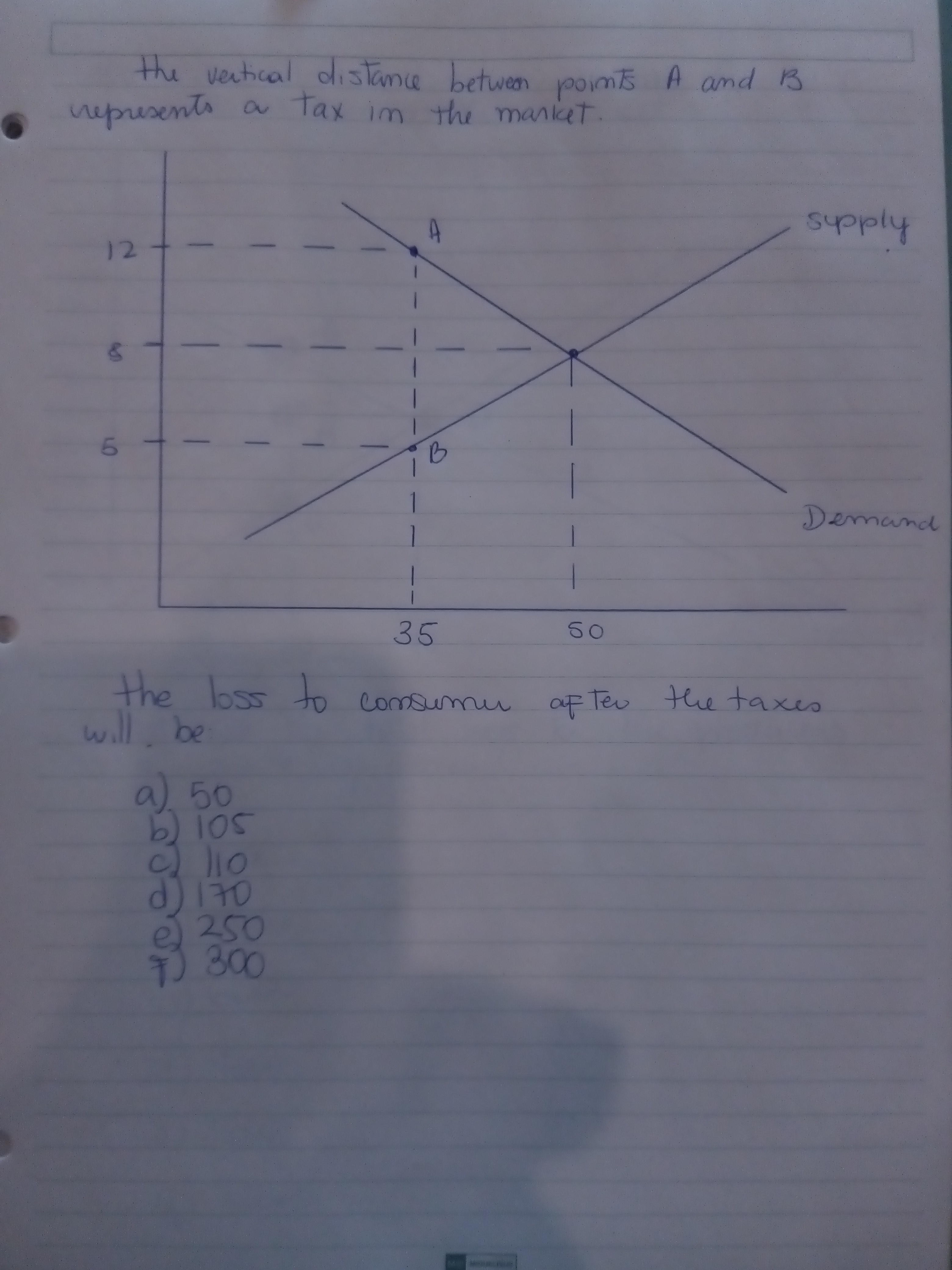

Transcribed Image Text:the vertical distamce betwen pom A amd B

nepresents a tax im the manket.

supply

12

1

Demand

35

50

the

loss comsumu

to

aF Teu the taxes

will. be

a) 50

b) 1os

d)170

e) 250

300

1O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Urgently needarrow_forwardInstructions: Type in the amount of a tax, and click Supply or Demand to choose whether the tax is imposed on sellers or on buyers. Then move the Demand or Supply sliders to change the elasticities of supply and demand Set the tool to illustrate an $8 tax imposed on the buyers. Adjust the elasticity demand so that the vertical intercept is $80. Adjust the supply elasticity so that the vertical intercept of the supply curve is $40. Answer the following questions: a. What is the price paid with this $8 tax? $[ (answer to two decimal places) D. How does the new price change as you move the supply slider towards "less elastic?" the after price talis c. What changes if you impose the tax on sellers instead of on buyers? supply shifts instead of demandarrow_forwardard My courses My Media 30 t of s page pter 17 Figure 8-5 Price Pa P₁ P₂ 0 B D F Tax G 8₂ C O a. F O b. A OC. A+B+C O d. D+E E H 9₁₂ D Jump to... Quantity Refer to Figure 8-5. Which area represents producer surplus after the tax is levied on the consumer? Time left 0:49:47 NEXT PAGE ?arrow_forward

- Typed asap Its urgent please I need helparrow_forwardewenseal Figure 4-9 S2 $1.40 S, 1.20 1.00 D 90 100 Quantity (billions of gallons) Refer to Figure 4-9. The market for gasoline was initially in equilibrium at point b and a $.40 excise tax is illustrated. What does the triangular area abc represent? O the revenue the government derives from the tax the tax paid by consumers the tax paid by producers the deadweight loss (or excess burden) created by the tax Pricearrow_forwarddon't use chatgpt answer and i need correct answer proper explanation step by step and i will 10 upvotes.arrow_forward

- Need soon ECONOMICSarrow_forward2. Suppose the price.elasticity of demand for commödity M is less than one. When a tax is imposed on commodity Mproduetion, it changes the price, quantity, and consumer speņding in which of the following ways? - Price Quantity Spending Irierease Decrease Decreàse. Therease Ancrease a. Increase- b. -Deerease Decrease Decrease Decrease - Decrease Iacreasearrow_forwardFigure 6-9 Price $20 N NAS8ON 00 18 16 14 12 10 6 4 2 0 O $6. O $4. 10 20 30 40 50 60 70 80 90 $10. $2. S Datter Tax Refer to Figure 6-9. The amount of the tax per unit is D Quantityarrow_forward

- Solve 16 onlysarrow_forwardUse the following table to answer the question about taxes, where P = Price buyers pay, P, Price sellers receive, and Qe equilibrium quantity. hand written plz Table No Tax With Tax $14 $15.00 $14 $13.00 4200 3700 How much is the tax and how much revenue is generated from the tax? Hint: Use the data to draw the graphs and find the slopes. O&$1:53,700 b. 52:57.400 9c $2,51,000 Od $1,5500arrow_forward4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education