ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Incorrect

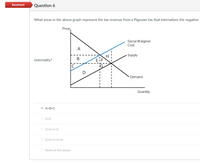

Question 6

What areas in the above graph represent the tax revenue from a Pigovian tax that internalizes the negative

Price,

Social Marginal

Cost

A

Supply

externality?

EIF

Demand

Quantity

A+B+C

O D+E

O D+E+F+G

O D+E+F+G+H

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of the following will most likely lead to the smallest deadweight loss (all else equal)? Select one: A. A payroll tax of $10 B. A mandated benefit that costs $15 and employees value at $4 C. A payroll tax of $7 D. A subsidy of $13 E. A mandated benefit that costs $9 and employees value at $3 O O O Oarrow_forwardWhat is Producer Surplus at a price of $5? Price 12 10 8 6 42 Quantity Demanded 1 2 WN 3 456 Quantity Supplied 6 5 4 3 2 1arrow_forwardTable 2: Market for Skis P 0 4 8 12 16 Qd Qs 15 0 12 9 6 3 20 0 6 12 12 16 20 2. Consider Table 2. a. What is the equilibrium price and quantity? b. What is the CS, PS, and TS? C. If there is a $3 tax, what is the equilibrium price buyers pay, the price sellers receive, and the quantity?arrow_forward

- If there is a $3 tax, what is the equilibrium price buyers pay, the price sellers receive, and the quantity? If there is a $3 tax, what is the CS, PS, tax revenue, TS, and deadweight loss? Include graph!arrow_forwarduncements us es $10 Materials $7 -Hill $5 49 sources 20 30 D Q If this market has a tax of $5 per unit imposed on it, what is the Deadweight Loss? O $7 O $25 O $30 O $100 IT * zoomarrow_forwardSuppose the graph shows the market for wheat. The equilibrium price is $25. To support incomes of farmers, the government imposes a price floor of $35. What is the cost of the program borne by the government? 50 45 40 35 30 25 20 15 10 5 Price - 100 200 300 400 500 600 700 800 Quantity Multiple Choice O O $14.000 $12.000 $21,000 $15,000arrow_forward

- i will 10 upvotes do fast .arrow_forwardThe graph shown portrays a subsidy to buyers. After the subsidy is in place, the post-subsidy price paid by buyers is post-subsidy price received by sellers is _________ the difference between these two figures is the amount of_ P 46 40 30 24 A $30; $46; the subsidy (B) $24; $40; government revenue C$24; $40; the subsidy (D) $40; $24; the subsidy E₁ 100 E2 150 S -D2 D. and thearrow_forward37 $50 Supply $40 t of $30 E $20 F Price $10 Ceiling Demand $0 40 80 120 160 200 Quantity In the market shown in the diagram above, the government has imposed a Price Ceiling at $10. Assuming the original equilibrium at point E was socially optimal, the Deadweight Loss from the Price Ceiling would be Select one: а. $800 b. $200 c. $100 d. $400 Pricearrow_forward

- Refer to the figure. Price (dollars) 10 9 8 7 6 4 B 2 1 Market for Artichokes 50 100 D 150 S 200 Quantity (pounds of artichokes) 250 Tools DL e Suppose the local farmers' market sets a minimum price of $6 per pound that farmers can charge for artichokes. The supply and demand for artichokes is described in the graph above. Using the graph, show the resulting deadweight loss from the new minimum price, and then determine the amount of the deadweight loss as a result of the pricing policy. Instructions. Use the tool provided "DL to illustrate this area on the graph. Ceadweight lose: $arrow_forwardpart C and D i need it in word not handwritten solutionarrow_forwardFigure 1. The graph depicts the market for plastic containers. Price 16- 14- 12- 10 8- 6 200 500 650 Social Cost Private Cost Demand Quantity Refer to Figure 1. In order to reach the social optimum, the government could O offer a subsidy of $8 per unit on the production of plastic containers. O impose a tax of $8 per unit on the production of plastic containers. O offer a subsidy of $4 per unit on the production of plastic containers. O impose a tax of $4 per unit on the production of plastic containers.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education