ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Instructions: Adjust the sliders so that the vertical intercept of the supply curve is $10.00 and the vertical intercept is $83.00 for the

demand curve. Represent a $16.00 tax that is paid by sellers. Click the Tax Burden switch above the graph to show areas that

represent some of the effects on consumer and producer surplus.

Report all answers as positive values to two decimal places.

a) How much revenue does the government earn from this tax? $1

b) How much of the government's revenue would have been consumer surplus had there not been a tax? $

c) How much of the government's revenue would have been producer surplus had there not been a tax? $

Transcribed Image Text:ces

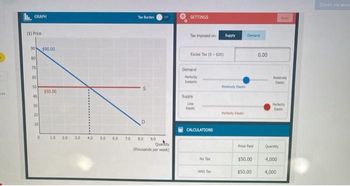

II. GRAPH

($) Price

90 $90.00

80

70

60

50

40

30

20

10

0

150.00

1.0 2.0

3.0

4.0

5.0 6.0

7.0

Tax Burden

S

8.0 9.0

off

Quantity

(thousands per week)

SETTINGS

Tax imposed on: Supply

Excise Tax (0-$20)

Demand

Perfectly

Inelastic

Supply

Lew

Elastic

CALCULATIONS

No Tax

With Tax

Perfectly fiestic

Demand

Price Paid

$50.00

$50.00

0.00

Relatively

Perfectly

Elastic

Quantity

4,000

4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 19 The original equilibrium of a market is at price $20 and quantity 20. If a tax of $10 is imposed and producers receive a net price of $18, how much (in dollars) is the tax burden on producers? 2arrow_forwardIf after a tax is imposed, the price paid by the buyer rises by $3 while the price received by the seller falls by $2, and the quantity of goods sold falls from 300 to 200 units, what is the amount of government revenue from this tax?arrow_forwardConsider the following supply and demand curves Price = 35-4*Q Price = 3*Q Suppose the government places a 7-dollar tax on producers. Doing so would generate _____ dollars of revenue. Suppose now instead of putting a 7-dollar tax on producers, the government put the 7-dollar tax on consumers. Doing so would generate _______ dollars of revenue. In this case, consumers would pay _____ percent of the tax. Give typed answer ASAP with proper step by step explanation. Will give upvote only for the correct answer . Thank you .arrow_forward

- If the demand for a product is inelastic but the supply is elastic, the ________ will bear the tax incidence. Question 43 options: a) the local government b) the producer c) the consumer d) the federal governmentarrow_forwardThe demand function D(p) = 200 - 4p and supply function is S(p)= 6p1. Find the equilibrium price and quantity2. If government collect $10 unit tax from each product, find the equilibrium demand and supplyprices.3. How much tax revenue is collected?4. What is the deadweight loss amount as a result of taxation?arrow_forwardIf the burden of a tax on sugary drinks is borne mostly by consumers, it must be the case that: a) The demand for sugary drinks is much less elastic than their supply. b) Both the demand for, and the supply of, sugary drinks is inelastic. c) Both the demand for, and the supply of, sugary drinks is elastic. d) The demand for sugary drinks is much more elastic than their supply.arrow_forward

- tax on buyersarrow_forwardQuestion 2: Imposing a single-stage tax Assume that there are 1000 importers and manufacturers, 2,000 wholesalers, and 10,000 retailers. Each manufacturer (importer) has sales of $30,000,000 which is sold equally across wholesalers, and wholesalers put a 20% markup on the price before selling to retailers Then the goods are resold equally to 10,000 retailers and the retailers impose a 25% markup on it. Suppose the government needs to raise 4.5 billion with a single- stage sales tax, a. What would be the rate of tax the government needs to impose on the sales of importers and manufacturers to achieve the revenue target. b. What would be the rate of tax the government needs to impose on the sales of wholesalers to achieve the revenue target?arrow_forwardTax exludes total surplus is 42017arrow_forward

- If the state government would like to increase tax revenue, please give three examples of products/commodities that the government should impose tax on so that they can collect the highest amount of tax revenue. Please explain your reasons clearly.arrow_forwardQ)Economics If the tax elasticity of supply is 0.16, by how much will the quantity supplied increase when the marginal tax rate decreases from 40 to 36 percent?arrow_forwardQuestion 4 24 22 20 18 Supply 16 14 12 10 4 Demand 369 12 15 18 21 24 27 30 33 36 QUANTITY Consider the market described by the graph above where the vertical distance between points A and B represents a tax in the market. The per-unit burden of the tax on sellers is $4 and the tax results in a loss of $72 in producer surplus. $8 and the tax results in a loss of $48 in producer surplus. $4 and the tax results in a loss of $16 in producer surplus. $8 and the tax results in a loss of $16 in producer surplus.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education