FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

If you give me wrong answer, I will give you unhelpful rate.

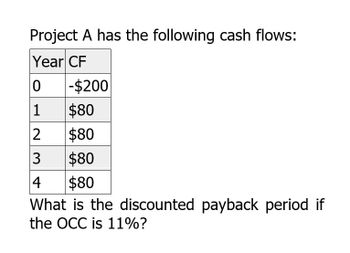

Transcribed Image Text:Project A has the following cash flows:

Year CF

0 -$200

1

$80

2

$80

3

$80

4 $80

What is the discounted payback period if

the OCC is 11%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Nonearrow_forwardThere is a project with the following cash flows : Year Cash Flow 0 −$ 23,350 1 6,300 2 7,400 3 8,450 4 7,350 5 5,900 What is the payback period?arrow_forwardConsider cash flows Year 0: -6900 Y1: 1700 Y2: 2900 Y3: 2900 Y4: 3500 What is the profitability index for this project if the return is 10%arrow_forward

- McCann Co. has identified an investment project with the following cash flows. Year Cash Flow 1 $800 2 1,030 3 1,340 4 1,110 a If the discount rate is 10 percent, what is the present value of these cash flows? b What is the present value at 18 and 28 percent?arrow_forwardWhat is Project A's Modified Internal Rate of Return with a WACC of 7.75%? YEAR 0 1 2 3 4 CASH FLOWS Project A -$1050 675 650 Project B -$1050 360 360 360 360arrow_forwardes A project has the following cash flows: Year Cash Flow 0 -$ 17,200 1 7,900 2 9,200 3 7,700 a. What is the NPV at a discount rate of zero percent? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the NPV at a discount rate of 12 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the NPV at a discount rate of 22 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is the NPV at a discount rate of 28 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. NPV b. NPV c. NPV d. NPVarrow_forward

- A project has the following cash flows. What is the payback period? Year Cash Flow 0 −$10,000 1 1,800 2 3,600 3 5,000 4 6,000arrow_forwardThe following table gives the cash flows for Project A and Project B: Year Project A Project B 0 -3000 -4000 1 1000 1500 2 1000 1800 3 2500 2000 If the discount rate is 15%, which project should we invest in? Project A Project Barrow_forwardSpecter Co. has identified an investment project with the following cash flows. What is the present value of these cash flows if the discount rate is 18%? Year Cash Flow $795 S945 $1,325 | S1,860 1 2 3 4 $2450.28 $3118.22 $2250.18 $3314.59arrow_forward

- the project's net cash flow is listed as follows. Please calculate its simple payback period and discounted payback period (i=10%). End of 2 3 4 1 5 Year $12 $11 $10 $10 $9, ,00 ,00 ,00 Net -$4 Cash 2,00 ,00 00 Flowarrow_forwardA project yields the following set of cash flows. What is the internal rate of return of this project? Assume the required rate of return is 5%. оо O Year Cash Flows ($) 0 -9,250 12 1 1,500 2 1,300 3 2,500 4 2,600 567 2,600 2,600 2,600 a. 13.58% b. 14.80% C. 10.92% d. 12.29% e. 8.58%arrow_forwardFernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.75% Year 0 1 2 3 Cash flows - $800 $510 $510 $510 a. 2.18 years b. 1.10 years c. 2.82 years d. 1.82 years e. 1.18 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education