Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Need help

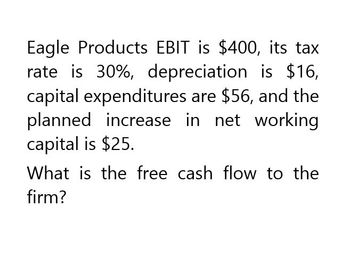

Transcribed Image Text:Eagle Products EBIT is $400, its tax

rate is 30%, depreciation is $16,

capital expenditures are $56, and the

planned increase in net working

capital is $25.

What is the free cash flow to the

firm?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your pro forma income statement shows sales of $982,000, cost of goods sold as $482,000, depreciation expense of $104,000, and taxes of $99,000 due to a tax rate of 25%. What are your pro forma earnings? What is your pro forma free cash flow? The pro forma free cash will be $___? (round to the nearest dollar)arrow_forwardWhat is the basic earning power?arrow_forwardDaniel's Market has sales of $36,000, costs of $28,000, depreciation expense of $3,000, and interest expense of $1,500. If the tax rate is 30 percent, what is the operating cash flow, OCF?arrow_forward

- A firm has sales of $4,790, costs of $2,590, interest paid of $174, and depreciation of $483. The tax rate is 21 percent. What is the cash coverage ratio? Multiple Choice 12.64 times 7.01 times 9.78 times 9.87 times 16.77 timesarrow_forwardBenson, Inc., has sales of $44830, costs of $14,370, depreciatior and interest expense of $2,390. The tax rate if 23 percent. What is the operating cash flow, or OCF?arrow_forwardBronze, Inc has sales of $58,200, costs of $25,300, depreciation expense of $3,100, and interest expense of $4,400. If the tax rate is 21 percent, what is the operating cash flow?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning