Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Please provide this question solution accounting

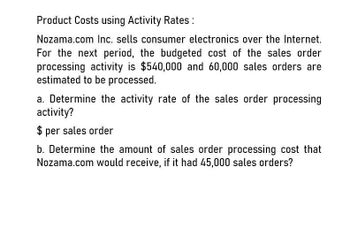

Transcribed Image Text:Product Costs using Activity Rates:

Nozama.com Inc. sells consumer electronics over the Internet.

For the next period, the budgeted cost of the sales order

processing activity is $540,000 and 60,000 sales orders are

estimated to be processed.

a. Determine the activity rate of the sales order processing

activity?

$ per sales order

b. Determine the amount of sales order processing cost that

Nozama.com would receive, if it had 45,000 sales orders?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Corazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forwardSales Needed to Earn Target Income Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Variable cost is 35% of the sales price; contribution margin is 65% of the sales price. Total fixed cost equals 78,000 (includes fixed factory overhead and fixed selling and administrative expense). Required: 1. Calculate the sales revenue that Chillmax must make to earn operating income of 81,900 by using the point in sales equation. 2. Check your answer by preparing a contribution margin income statement based on the sales dollars calculated in Requirement 1.arrow_forwardRefer to Cornerstone Exercise 3.4 for data on Dohini Manufacturing Companys purchasing cost and number of purchase orders. The controller for Dohini Manufacturing ran regression on the data, and the coefficients shown by the regression program are: Required: 1. Construct the cost formula for the purchasing activity showing the fixed cost and the variable rate. 2. If Dohini Manufacturing Company estimates that next month will have 430 purchase orders, what is the total estimated purchasing cost for that month? (Round your answer to the nearest dollar.) 3. What if Dohini Manufacturing wants to estimate purchasing cost for the coming year and expects 5,340 purchase orders? What will estimated total purchasing cost be? (Round your answer to the nearest dollar.) What is the total fixed purchasing cost? Why doesnt it equal the fixed cost calculated in Requirement 1?arrow_forward

- Product costing and decision analysis for a service company Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly 170,000 miles during a month. The following costs are budgeted for a month: Blue Star management wishes to assign these costs to individual flights in order to gauge the profitability of its service offerings. The following activity bases were identified with the budgeted costs: The size of the companys ground operation in each city is determined by the size of the workforce. The following monthly data are available from corporate records for each terminal operation: Three recent representative flights have been selected for the profitability study. Their characteristics are as follows: Instructions Determine the fuel, crew, and depreciation cost per mile flown. Determine the cost per arrival or departure by terminal city. Use the information in (1) and (2) to construct a profitability report for the three flights. Each flight has a single arrival and departure to its origin and destination city pairs.arrow_forwardUsing Regression to Calculate Fixed Cost, Calculate the Variable Rate, Construct a Cost Formula, and Determine Budgeted Cost Refer to the information for Pizza Vesuvio on the previous page. Coefficients shown by a regression program for Pizza Vesuvios data are: Required: Use the results of regression to make the following calculations: 1. Calculate the fixed cost of labor and the variable rate per employee hour. 2. Construct the cost formula for total labor cost. 3. Calculate the budgeted cost for next month, assuming that 675 employee hours are budgeted. (Note: Round answers to the nearest dollar.) Use the following information for Brief Exercises 3-17 through 3-20: Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected:arrow_forwardTotal cost method of product pricing Based on the data presented in Exercise 17, assume that Smart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. A. Determine the total costs and the total cost amount per unit for the production and sale of 10,000 cellular phones. B. Determine the total cost markup percentage (rounded to two decimal places) for cellular phones. C. Determine the selling price of cellular phones. (Round markup to the nearest dollar.)arrow_forward

- Variable Cost Ratio, Contribution Margin Ratio Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Unit variable cost is 21 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is 30,000 and fixed selling and administrative expense is 48,000. Required: 1. Calculate the variable cost ratio. 2. Calculate the contribution margin ratio. 3. Prepare a contribution margin income statement based on the budgeted figures for next year. In a column next to the income statement, show the percentages based on sales for sales, total variable cost, and total contribution margin.arrow_forwardIdentifying Fixed, Variable, Mixed, and Step Costs Consider each of the following independent situations: a. A computer service agreement in which a company pays 150 per month and 15 per hour of technical time b. Fuel cost of the companys fleet of motor vehicles c. The cost of beer for a bar d. The cost of computer printers and copiers at your college e. Rent for a dental office f. The salary of a receptionist in a law firm g. The wages of counter help in a fast-food restaurant h. The salaries of dental hygienists in a three-dentist office. One hygienist can take care of 120 cleanings per month. i. Electricity cost which includes a 15 per month billing charge and an additional amount depending on the number of kilowatt-hours used Required: 1. For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost. (Hint: First, consider what the driver or output measure is. If additional assumptions are necessary to support your cost type decision, be sure to write them down.) Example: Raw materials used in productionVariable cost 2. CONCEPTUAL CONNECTION Change your assumption(s) for each situation so that the cost type changes to a different cost type. List the new cost type and the changed assumption(s) that gave rise to it. Example: Raw materials used in production. Changed assumptionthe materials are difficult to obtain, and a years worth must be contracted for in advance. Now, this is a fixed cost. (This is the case with diamond sales by DeBeers Inc. to its sightholders. See the following website for information: www.keyguide.net/sightholders/.)arrow_forwardCustomers as a Cost Object Morrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, medium balances, and high balances. The activities associated with the three different customer categories and their associated annual costs are as follows: Additional data concerning the usage of the activities by the various customers are also provided: Required: (Note: Round answers to two decimal places.) 1. Calculate a cost per account per year by dividing the total cost of processing and maintaining checking accounts by the total number of accounts. What is the average fee per month that the bank should charge to cover the costs incurred because of checking accounts? 2. Calculate a cost per account by customer category by using activity rates. 3. Currently, the bank offers free checking to all of its customers. The interest revenues average 90 per account; however, the interest revenues earned per account by category are 80, 100, and 165 for the low-, medium-, and high-balance accounts, respectively. Calculate the average profit per account (average revenue minus average cost from Requirement 1). Then calculate the profit per account by using the revenue per customer type and the unit cost per customer type calculated in Requirement 2. 4. CONCEPTUAL CONNECTION After the analysis in Requirement 3, a vice president recommended eliminating the free checking feature for low-balance customers. The bank president expressed reluctance to do so, arguing that the low-balance customers more than made up for the loss through cross-sales. He presented a survey that showed that 50% of the customers would switch banks if a checking fee were imposed. Explain how you could verify the presidents argument by using ABC.arrow_forward

- Friendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complete the application) and number of applications. The bank controller has accumulated the following data for the setup activity: Required: 1. Estimate a regression equation with application hours as the activity driver and the only independent variable. If the bank forecasts 2,600 application hours for the next month, what will be the budgeted application cost? 2. Estimate a regression equation with number of applications as the activity driver and the only independent variable. If the bank forecasts 80 applications for the next month, what will be the budgeted application cost? 3. Which of the two regression equations do you think does a better job of predicting application costs? Explain. 4. Run a multiple regression to determine the cost equation using both activity drivers. What are the budgeted application costs for 2,600 application hours and 80 applications?arrow_forwardProduct cost method of product costing Smart Stream Inc. uses the product cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 10,000 cell phones are as follows: Smart Stream desires a profit equal to a 30% return on invested assets of 1,200,000. A. Determine the amount of desired profit from the production and sale of 10,000 cell phones. B. Determine the product cost per unit for the production of 10,000 cell phones. C. Determine the product cost markup percentage for cell phones. D. Determine the selling price of cell phones.arrow_forwardNeed help with this accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,