College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

On January 1 20x1 , the kane manufacturing company purchased

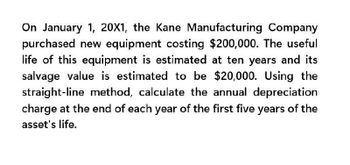

Transcribed Image Text:On January 1, 20X1, the Kane Manufacturing Company

purchased new equipment costing $200,000. The useful

life of this equipment is estimated at ten years and its

salvage value is estimated to be $20,000. Using the

straight-line method, calculate the annual depreciation

charge at the end of each year of the first five years of the

asset's life.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.arrow_forwardColquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forwardMontello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forward

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forwardReferring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forwardMontezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $4,000. Determine the depreciation expense for the final three years of the assets life, and create the journal entry for year four.arrow_forward

- Urquhart Global purchases a building to house its administrative offices for $500,000. The best estimate of the salvage value at the time of purchase was $45,000, and it is expected to be used for forty years. Urquhart uses the straight-line depreciation method for all buildings. After ten years of recording depreciation, Urquhart determines that the building will be useful for a total of fifty years instead of forty. Calculate annual depreciation expense for the first ten years. Determine the depreciation expense for the final forty years of the assets life, and create the journal entry for year eleven.arrow_forwardAkron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.arrow_forwardMontezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and is expected to be driven for ten years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After five years of recording depreciation, Montezuma determines that the delivery truck will be useful for another five years (ten years in total, as originally expected) and that the salvage value will increase to $10,000. Determine the depreciation expense for the final five years of the assets life, and create the journal entry for years 6–10 (the entry will be the same for each of the five years).arrow_forward

- For each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a seventeen-year remaining legal life was purchased for $850,000. The patent will be usable for another six years. B. A patent was acquired on a new tablet. The cost of the patent itself was only $12,000, but the market value of the patent is $150,000. The company expects to be able to use this patent for all twenty years of its life.arrow_forwardDuring the current year, Arkells Inc. made the following expenditures relating to plant machinery. Renovated seven machines for $250,000 to improve efficiency in production of their remaining useful life of eight years Low-cost repairs throughout the year totaled $79,000 Replaced a broken gear on a machine for $6,000 A. What amount should be expensed during the period? B. What amount should be capitalized during the period?arrow_forwardUtica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning