Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

ROA

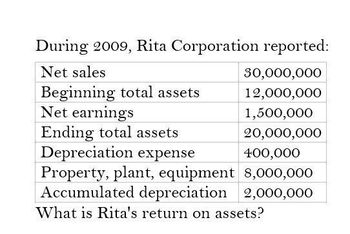

Transcribed Image Text:During 2009, Rita Corporation reported:

Net sales

30,000,000

Beginning total assets

12,000,000

Net earnings

1,500,000

Ending total assets

20,000,000

400,000

Depreciation expense

Property, plant, equipment 8,000,000

Accumulated depreciation 2,000,000

What is Rita's return on assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Target in 2017 reported net income of $2,934 billion, net sales of $71,879 billion, and average total assets of $38,215 billion. What is Target’s asset turnover? What is Target’s return on assets?arrow_forwardUse the following selected 2016 balance sheet and income statement information for Home Garden Supply Co. (in millions) to compute asset turnover (AT) to the nearest hundredth of a percent. Net income Gross profit on sales Average total assets Sales Tax rate on operating profit $69,960 $700,400 $360,600 $1,356,504 35% Question 24 options: A) 3.76 B) 5.17 C) 0.27 D) 17.30arrow_forwardNeed answer the questionarrow_forward

- What is the Return on Equity? Total Asset Turnover = .245 Net Income = $400,000 Equity Multiplier = 1.20 Net Sales = $1,300,000arrow_forwardH6. BDU Company has net income of $500,000 and average assets of $2,000,000 for the current year. If its asset turnover is 1.25 times, what is its profit margin? Show proper step by step calculationarrow_forwardPlease help me with show all calculation thankuarrow_forward

- In its 2014 annual report, Campbell Soup Company reports beginning- of-the-year total assets of $8,113 million, end-of-the-year total assets of $8,323 million, total sales of $8,268 million, and net income of $807 million. a. Compute Campbell ?s asset turnover. b. Compute Campbell ?s profit margin on the sale. c. Compute Campbell?s return on an asset using (1) asset turnover and profit margin and (2) net income. (1) Assets turnover and profit margin (2) Net income Return on assets % %arrow_forwardWhat was select's 2005 percentage return on assets?arrow_forwardUse the following information to answer the next question. Total Asset = $40 million Basic earning power (BEP) ratio is 20% Times-interest-earned (TIE) Principal payments = 4 million ratio is 6.55 $1.35 million; $0.37 million What is the company's EBIT? The company's interest expense? $3.33 million; $0.83 million $8.0 million; $0.62 million Depreciation = $1.0 million. $7.5 million; $0.75 million Lease payments = 0.6 million $8.0 million; $1.22 millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning