Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with this general accounting question not use

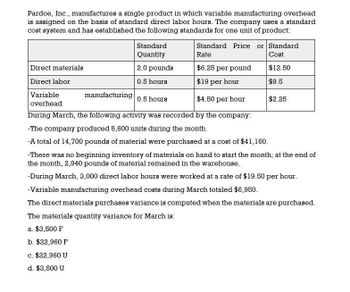

Transcribed Image Text:Pardoe, Inc., manufactures a single product in which variable manufacturing overhead

is assigned on the basis of standard direct labor hours. The company uses a standard

cost system and has established the following standards for one unit of product:

Standard

Quantity

Standard Price or Standard

Rate

Cost

Direct materials

2.0 pounds

$6.25 per pound

$12.50

Direct labor

0.5 hours

$19 per hour

$9.5

Variable

manufacturing

0.5 hours

$4.50 per hour

$2.25

overhead

During March, the following activity was recorded by the company:

-The company produced 5,600 units during the month.

-A total of 14,700 pounds of material were purchased at a cost of $41,160.

-There was no beginning inventory of materials on hand to start the month; at the end of

the month, 2,940 pounds of material remained in the warehouse.

-During March, 3,000 direct labor hours were worked at a rate of $19.50 per hour.

-Variable manufacturing overhead costs during March totaled $6,950.

The direct materials purchases variance is computed when the materials are purchased.

The materials quantity variance for March is:

a. $3,500 F

b. $22,960 F

c. $22,960 U

d. $3,500 U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Medical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Overhead costs are assigned to each product based on __________________. A. the proportion of that products use of the cost driver B. a predetermined overhead rate for a single cost driver C. price of the product D. machine hours per productarrow_forwardPrimera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forwardRoberts Company produces two weed eaters: basic and advanced. The company has four activities: machining, engineering, receiving, and inspection. Information on these activities and their drivers is given below. Overhead costs: Required: 1. Calculate the four activity rates. 2. Calculate the unit costs using activity rates. Also, calculate the overhead cost per unit. 3. What if consumption ratios instead of activity rates were used to assign costs instead of activity rates? Show the cost assignment for the inspection activity.arrow_forward

- Adam Inc.s records for May include the following information: A. What are Adams standard labor hours for the units made? B. What is Adams total standard labor cost for the units made?arrow_forwardThe following data appeared in the accounting records of Craig Manufacturing Inc., which uses the weighted average cost method: Case 1All materials are added at the beginning of the process, and labor and factory overhead are added evenly throughout the process. Case 2One-half of the materials are added at the start of the manufacturing process, and the balance of the materials is added when the units are one-half completed. Labor and factory overhead are applied evenly during the process. Make the following computations for each case: a. Unit cost of materials, labor, and factory overhead for the month b. Cost of the units finished and transferred during the month c. Cost of the units in process at the end of the montharrow_forwardActivity-based and department rate product costing and product cost distortions Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Instructions Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is 315,000 and 540,000 for the Cutting and Finishing departments, respectively. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Determine the total and per-unit cost assigned to each product under activity-based costing. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods.arrow_forward

- Freeman Furnishings has summarized its data as shown: Compute the cost of goods manufactured, assuming that the overhead is allocated based on direct labor hoursarrow_forwardMulliner Company showed the following information for the year: Required: 1. Calculate the standard direct labor hours for actual production. 2. Calculate the applied variable overhead. 3. Calculate the total variable overhead variance.arrow_forwardPuvo, Inc., manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product: Standard Quantity Standard Priceor Rate Standard Cost Direct materials 2.5 pounds $ 3.50 per pound $ 8.75 Direct labor 0.6 hours $ 8.00 per hour $ 4.80 Variable manufacturing overhead 0.6 hours $ 1.75 per hour $ 1.05 During March, the following activity was recorded by the company: The company produced 3,400 units during the month. A total of 12,000 pounds of material were purchased at a cost of $33,600. There was no beginning inventory of materials on hand to start the month; at the end of the month, 2,400 pounds of material remained in the warehouse. During March, 2,240 direct labor-hours were worked at a rate of $8.50 per hour. Variable manufacturing overhead costs during March totaled $2,552. The direct…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning