Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide correct answer accounting question

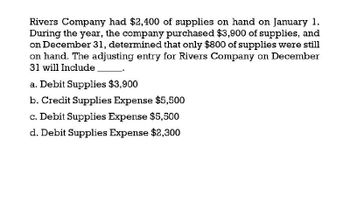

Transcribed Image Text:Rivers Company had $2,400 of supplies on hand on January 1.

During the year, the company purchased $3,900 of supplies, and

on December 31, determined that only $800 of supplies were still

on hand. The adjusting entry for Rivers Company on December

31 will Include

a. Debit Supplies $3,900

b. Credit Supplies Expense $5,500

c. Debit Supplies Expense $5,500

d. Debit Supplies Expense $2,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardplease note every entry should have narration , explanation , calculation answer in text form show full working for each entry and partsarrow_forward

- On January 1, 2022, Sunland Company had Accounts Receivable of $54,800 and Allowance for Doubtful Accounts of $3,800. Sunland Company prepares financial statements annually. During the year, the following selected transactions occurred: Jan. 5 Sold $4,700 of merchandise to Rian Company, terms n/30. Feb. 2 Accepted a $4,700, 4-month, 9% promissory note from Rian Company for balance due. 12 Sold $10,140 of merchandise to Cato Company and accepted Cato’s $10,140, 2-month, 10% note for the balance due. 26 Sold $5,300 of merchandise to Malcolm Co., terms n/10. Apr. 5 Accepted a $5,300, 3-month, 8% note from Malcolm Co. for balance due. 12 Collected Cato Company note in full. June 2 Collected Rian Company note in full. 15 Sold $1,800 of merchandise to Gerri Inc. and accepted a $1,800, 6-month, 11% note for the amount due. Journalize the transactions. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is…arrow_forwardOn January 1, 2022, Harvee Company had Accounts Receivable of $54,200 and Allowance for Doubtful Accounts of $3,700. Harvee Company prepares financial statements annually. During the year, the following selected transactions occurred: Jan. 5 Sold $4,000 of merchandise to Rian Company, terms n/30. Feb. 2 Accepted a $4,000, 4-month, 9% promissory note from Rian Company for balance due. 12 Sold $12,000 of merchandise to Cato Company and accepted Cato’s $12,000, 2-month, 10% note for the balance due. 26 Sold $5,200 of merchandise to Malcolm Co., terms n/10. Apr. 5 Accepted a $5,200, 3-month, 8% note from Malcolm Co. for balance due. 12 Collected Cato Company note in full. June 2 Collected Rian Company note in full. 15 Sold $2,000 of merchandise to Gerri Inc. and accepted a $2,000, 6-month, 12% note for the amount due. - Journalize the transactions (Omit cost of good sold entries)arrow_forwardOn January 1, 2022, Nash's Trading Post, LLC had Accounts Receivable of $57,300 and Allowance for Doubtful Accounts of $3,500. Nash's Trading Post, LLC prepares financial statements annually. During the year, the following selected transactions occurred: Sold $4,500 of merchandise to Rian Company, terms n/30. Accepted a $4,500, 4-month, 10% promissory note from Rian Company for balance due. Sold $14,400 of merchandise to Cato Company and accepted Cato's $14,400, 2-month, 10% note for the balance due. Sold $5,700 of merchandise to Malcolm Co., terms n/10. Accepted a $5,700, 3-month, 8% note from Malcolm Co. for balance due. Jan. 5 Feb. 2 12 26 Apr. 5 12 Collected Cato Company note in full. June 2 Collected Rian Company note in full. 15 Sold $2,100 of merchandise to Gerri Inc. and accepted a $2,100, 6-month, 11% note for the amount due.arrow_forward

- ook ht rint rences In its first year of operations, Cloudbox has credit sales of $230,000. Its year-end balance in accounts receivable is $13,000, and the company estimates that $3,000 of its accounts receivable is uncollectible. a. Prepare the year-end adjusting entry to estimate bad debts expense. b. Prepare the current assets section of Cloudbox's classified balance sheet assuming Inventory is $29,500, Cash is $21,500, and Prepaid Rent is $3,750. Note: The company reports Accounts receivable, net on the balance sheet. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the year-end adjusting entry to estimate bad debts expense. View transaction list Journal entry worksheet 1 Record the year-end adjusting entry to estimate bad debts expense. Note: Enter debits before credits. Date December 31 General Journal Bad debts expense 8 Allowance for doubtful accounts Debit Creditarrow_forwardAt the end of the prior year, Durney's Outdoor Outfitters reported the following information. Accounts Receivable, December 31, prior year Accounts Receivable (Gross) (A) $ 48,283 Allowance for Doubtful Accounts (XA) 8,474 Accounts Receivable (Net) (A) $ 39,809 During the current year, sales on account were $306,673, collections on account were $290,750, write-offs of bad debts were $7,059, and the bad debt expense adjustment was $4,775. Required: 1-a. Complete the Accounts Receivable and Allowance for Doubtful Accounts T-accounts to determine the balance sheet values. 1-b. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the income statement for the current year. 1-c. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the balance sheet for the current year.arrow_forwardprepare these entries for Sarah's plant services. prepare general journal entries for the needed balance dy adjustments for the year ending 30/6/21: A stocktake of the inventory on hand was completed on 30/6/21. The value of the stocktake was $17,000. The inventory asset account as at 30/6/21 before adjustments was $18.000 The allowance for Doubtful debts should be 5% of the balance of Accounts Receivable. The accounts receivable balance at 30/6/21 is $76,120 and the balance of the Allowance for Doubtful Debts was $3,450arrow_forward

- On January 1, 2022, Kingbird, Inc. had Accounts Receivable of $49,900 and Allowance for Doubtful Accounts of $3,500. Kingbird, Inc. prepares financial statements annually. During the year, the following selected transactions occurred: Jan. 5 Sold $3,450 of merchandise to Rian Company, terms n/30. Feb. 2 Accepted a $3,450, 4-month, 8% promissory note from Rian Company for balance due. 12 Sold $11,800 of merchandise to Cato Company and accepted Cato’s $11,800, 2-month, 9% note for the balance due. 26 Sold $5,300 of merchandise to Malcolm Co., terms n/10. Apr. 5 Accepted a $5,300, 3-month, 8% note from Malcolm Co. for balance due. 12 Collected Cato Company note in full. June 2 Collected Rian Company note in full. 15 Sold $2,200 of merchandise to Gerri Inc. and accepted a $2,200, 6-month, 11% note for the amount due. Journalize the transactions. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is…arrow_forwardIn its first year of operations, Cloudbox has credit sales of $200,000. Its year-end balance in accounts receivable is $10,000, and the company estimates that $1,500 of its accounts receivable is uncollectible.a. Prepare the year-end adjusting entry to estimate bad debts expense.b. Prepare the current assets section of Cloudbox’s classified balance sheet assuming Inventory is $22,000, Cash is $14,000, and Prepaid Rent is $3,000. Note: The company reports Accounts receivable, net on the balance sheet.arrow_forwardIn its first year of operations, Cloudbox has credit sales of $200,000. Its year-end balance in accounts receivable is $10,000, and the company estimates that $1,500 of its accounts receivable is uncollectible. a. Prepare the year-end adjusting entry to estimate bad debts expense. b. Prepare the current assets section of Cloudbox's classified balance sheet assuming Inventory is $22,000, Cash is $14,000, and Prepaid Rent is $3,000. Note: The company reports Accounts receivable, net on the balance sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub