FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

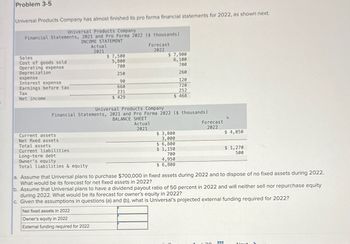

Transcribed Image Text:Problem 3-5

Universal Products Company has almost finished its pro forma financial statements for 2022, as shown next.

Universal Products Company

Financial Statements, 2021 and Pro Forma 2022 ($ thousands)

INCOME STATEMENT

Sales

Cost of goods sold

Operating expense

Depreciation

expense

Interest expense

Earnings before tax

Tax

Net income

Actual

2021

Current assets

Net fixed assets

Total assets

Current liabilities

Long-term debt

Owner's equity

Total liabilities & equity

$ 7,500

5,800

700

250

90

660

231

$ 429

Forecast

2022

$ 7,900

6,100

700

260

120

720

252

$ 468

Universal Products Company

Financial Statements, 2021 and Pro Forma 2022 ($ thousands)

BALANCE SHEET

Actual

2021

$ 3,800

3,000

$ 6,800

$ 1,150

700

4,950

$ 6,800

Forecast

2022

$ 4,050

$ 1,270

500

a. Assume that Universal plans to purchase $700,000 in fixed assets during 2022 and to dispose of no fixed assets during 2022.

What would be its forecast for net fixed assets in 2022?

20

b. Assume that Universal plans to have a dividend payout ratio of 50 percent in 2022 and will neither sell nor repurchase equity

during 2022. What would be its forecast for owner's equity in 2022?

c. Given the assumptions in questions (a) and (b), what is Universal's projected external funding required for 2022?

Net fixed assets in 2022

Owner's equity in 2022

External funding required for 2022

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- which of the following is not a COVID-19 tax relief provision available to a self-employed taxpayers?arrow_forwardWhich of the following statements is incorrect? O A. If MOH is overallocated to a job that has been sold, and the company calculates sales price by marking up job costs, the job will likely be underpriced. O B. The formula to arrive at the POHR is total budgeted manufacturing overhead divided by total estimated allocation base. O C. To calculate the increase to WIP for allocated MOH costs, the POHR is multiplied by the actual amount of the allocation based used by the cost object. D. "Number of units" is typically not an appropriate allocation base for MOH because the company's products do not consume equal overhead resources. If the over/underallocated MOH is fairly large and the majority of the units have not been sold, the balance in MOH should be prorated between WIP, FG, and COGS. O E.arrow_forwardIncome Statement: The income statement of Taco Bell company is given for the years 2020 & 2019. 2020 2019 General and administrative expenses 25,000 24,000 Interest expense 1,200 1,500 Net sales $124,000 S138,000 Selling expenses 11,880 12,720 Income taxes $1,109.5 1,883 108 000 95,000 COGS 450 600 Gain on Sale of land l2020 andarrow_forward

- Here are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2019 Sales $ 5,000 Cost 3,900 Net income $ 1,100 BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $ 7,500 $ 12,100 Debt $ 833 $ 1,000 Equity 6,667 11,100 Total $ 7,500 $ 12,100 Total $ 7,500 $ 12,100 a. If sales increase by 10% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? b. What will be the value of this balancing item?arrow_forwardHere are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2022 Sales $ 5,000 Cost 3,900 Net income $ 1,100 BALANCE SHEET, YEAR-END 2021 2022 2021 2022 Assets $ 7,500 $ 12,100 Debt $ 833 $ 1,000 Equity 6,667 11,100 Total $ 7,500 $ 12,100 Total $ 7,500 $ 12,100 If sales increase by 10% in 2023 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? What will be the value of this balancing item?arrow_forwardYear ended December 31, 2023 2022 2021 Revenues $4,578,041 $3,864,324 $3,003,610 Costs and expenses: Cost of goods sold $2,227,189 $2,089,089 $2,005,691 Selling and administrative 922,261 836,212 664,061 Interest 29,744 32,966 30,472 Other expenses (income) 1,475 2,141 (43) Total costs and expenses $3,180,669 $2,960,408 $2,700,181 Income before income taxes $1,397,372 $903,916 $303,429 Income taxes 229,500 192,600 174,700 Net income $1,167,872 $711,316 $128,729 Venus IndustriesConsolidated Balance Sheets (in thousands) December 31, ASSETS 2023 2022 Current assets: Cash and equivalents $291,284 $260,050 Accounts receivable, less allowance for doubtful accounts of $19,447 and $20,046 826,977 616,064 Inventories 592,986 512,917 Deferred income taxes 26,378 28,355 Prepaid expenses 40,663 32,977 Total current assets $1,778,288 $1,450,363 Property, plant, and equipment $571,032 $497,795 Less accumulated depreciation (193,037)…arrow_forward

- Compute NET Profit margin ratioarrow_forwardCosts per Equivalent Unit and Production Costs The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $52,800 of direct materials. ACCOUNT Work in Process-Forging Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Nov. 1 Bal., 5,500 units, 70% completed 60,885 30 Direct materials, 50,000 units 465,000 525,885 30 Direct labor 46,910 572,795 30 Factory overhead 64,784 637,579 30 Goods finished, 2 units 30 Bal., 4,400 units, 80% completed Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers (a-c) to the nearest dollar. a. Cost of beginning work in process inventory completed in November. b. Cost of units transferred to the next department during November. c. Cost…arrow_forwardPlease helparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education