Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

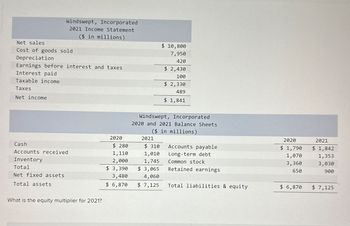

Transcribed Image Text:Net sales

Windswept, Incorporated

2021 Income Statement

Cost of goods sold

Depreciation

($ in millions)

Earnings before interest and taxes

Interest paid

Taxable income

Taxes

Net income

$ 10,800

7,950

420

$ 2,430

100

$ 2,330

489

$ 1,841

Windswept, Incorporated

2020 and 2021 Balance Sheets

($ in millions)

2020

2021

2020

Cash

$ 280

$ 310

Accounts payable

$ 1,790

2021

$ 1,842

Accounts received

1,110

1,010

Long-term debt

Inventory

2,000

1,745

Common stock

1,070

3,360

1,353

3,030

Total

$ 3,390

$ 3,065

Retained earnings

650

900

Net fixed assets

3,480

4,060

Total assets

$ 6,870

$ 7,125

Total liabilities & equity

$ 6,870

$ 7,125

What is the equity multiplier for 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- net income? Find net incomearrow_forwardUsing the financial data for Key Wahl Industries Sales Net Profit After Tax Total Assets Total Liabilities O.50 02 O.75 $4,500,000 What is the debt ratio? O.075 $337,5000 $6,750,000 $ 3,375,000arrow_forwardLife-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00…arrow_forward

- jjarrow_forwardSales Revenues Cost of goods sold Fixed costs 48 16 Selling, general, and administrative expenses 22 Depreciation EBIT |laxes| 19 pastor Profit illa ESINOPATI 7 *** Tax rate Dividends paid ASSETS Current Assets Lish Accounts receivable Inventories Total current assets Cross Fixed assets Accumulated depreciation Net Fixed assets Intangible assets TOTAL ASSETS 40% $10 Partial Balance Sheet 12 31 2019 $4 6 LIABILITIES Current Liabilities Accruals Accounts payable 5 Total current liabilities Long-term debt Total Liabilities 70 OWNERS EQUITY 10 Retained earnings Common stock 0 total owner's equity |IOTAL LIABILITES & OWNERS SQUITY These are surtulative reliános szarnings haut textsenck strapl, calkat nainsi sum ASSETS LIABILITIES Total current assets Gros Fned assets Accumulated depreciation Intangbleaxeets Meninis prade Toral current liabilities 105 Toral liabilities OWNERS EQ Larrow_forwardSales Revenue Less: Cost of Goods Sold Gross Profits Less: Operating Expenses Operating Profits Less: Interest Expense Net Profits Before Taxes Less: Taxes (40%) Net Profits After Taxes Assets Cash Income Statement Pulp, Paper and Paperboard, Inc. For the Year Ended December 31, 2019 Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and stockholders' equity Current liabilities Balance Sheet Pulp, Paper and Paperboard, Inc. December 31, 2019 Accounts payable Notes payable Accruals Total current liabilities Long-term debts Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Calculate the following: NP, GP $2,080,976 1,701,000 $ 379,976 273,846 $ 106,130 19,296 S 86,834 34,810 S 52,024 Current Ratio - Quick Ratio Receivable days - Payable days $ 95,000 237,000 243.000 $ 575,000 500,000 75.000 $ 425,000…arrow_forward

- Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 450,600 298,350 152,250 99,300 4,500 Cost of goods sold Gross profit Operating expenses Interest expense. Income before taxes Income tax expense Net income $ 10,000 Accounts payable Accrued wages payable 9,200 31,400 Income taxes payable 30,150 Long-term note payable, secured by mortgage on plant assets 3,050 Common stock 152,300 Retained earnings $ 236,100 Total liabilities and equity CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity 48,450 19,518 $ 28,932 $ 17,500 3,800 4,700 69,400 88,000 52,700 $ 236,100 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total…arrow_forwardPresented below are selected ledger accounts of Skysong Corporation as of December 31, 2025. Cash Administrative expenses Selling expenses Net sales Cost of goods sold Cash dividends declared (2025) Cash dividends paid (2025) Discontinued operations (loss before income taxes) Depreciation expense, not recorded in 2024 Retained earnings, December 31, 2024 Effective tax rate = 20% (a) Compute net income for 2025. Net income $ 60 $124,000 247,000 198,000 1,364,000 521,000 54,000 39,200 101,000 75,000 228.000arrow_forwardNet sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Target Corporation Income Statement Data for Year $65,357 45,583 15,101 707 (94) 1,384 $ 2,488 $18,424 26,109 Balance Sheet Data (End of Year) $44,533 $11,327 17,859 15,347 Walmart Inc. $44,533 $408,214 304,657 79,607 10,512 2,065 (411) 7,139 $ 14,335 $48,331 122,375 $170,706 $55,561 44,089 71,056 $170,706 Beginning-of-Year Balances $44,106 13,712 $163,429 65,682 55,390arrow_forward

- Crane Ltd. reported the following for the fiscal year 2021: Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Gain on sale of land Profit before income tax Income tax expense Profit Additional information: 1. 2. CRANE LTD. Income Statement Year Ended September 30, 2021 3. 4. 5. 6. $ 109,000 34,000 (44,000) $583,000 338,000 245,000 99,000 146,000 36,500 $109,500 Accounts receivable decreased by $16,300 during the year. Inventory increased by $7,800 during the year. Prepaid expenses decreased by $5,800 during the year. Accounts payable to suppliers increased by $11,300 during the year. Accrued expenses payable increased by $5,300 during the year. Income tax payable decreased by $7,100 during the year.arrow_forwardSales Depreciation COGS Interest Cash Accts Receivables Notes Payable L ong-term debt Net fixed assets Accounts Payable Inventory Dividend payout Tax rate 2020 21. What is the ROE for 2021? $5,300 $5,900 750 850 2400 180 200 200 800 1500 3000 250 700 2021 2900 196 500 22. What is the Inventory period in 2021? 400 550 1950 3500 400 900 30% 35% 30% 20. What is the cash flow from operating activities?arrow_forwardNet Sales COGS Depreciation EBIT Interest Taxable Income Taxes Net Income 2019 Income Statement Dividends Additions to Retained Earnings 147 647.74 3,456 1,895 235 1,326 320 1,006 211.26 794.74arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education