FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

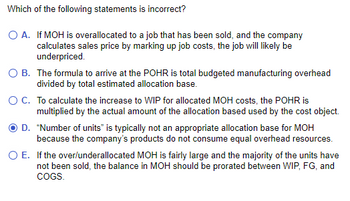

Transcribed Image Text:Which of the following statements is incorrect?

O A.

If MOH is overallocated to a job that has been sold, and the company

calculates sales price by marking up job costs, the job will likely be

underpriced.

O B. The formula to arrive at the POHR is total budgeted manufacturing overhead

divided by total estimated allocation base.

O C. To calculate the increase to WIP for allocated MOH costs, the POHR is

multiplied by the actual amount of the allocation based used by the cost object.

D. "Number of units" is typically not an appropriate allocation base for MOH

because the company's products do not consume equal overhead resources.

If the over/underallocated MOH is fairly large and the majority of the units have

not been sold, the balance in MOH should be prorated between WIP, FG, and

COGS.

O E.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I’ve received the solution to this problem, but the year 2 fixed manufacturing overhead deferred and the absorption costing loss were both wrong for year 2.arrow_forwardSelect and “X” in the column that corresponds to the cost classification for each of the following scenarios. Some items may fit in more than one column.arrow_forwardThese are tue/false questions. ____ 21. Differential revenue is the amount of increase or decrease in revenue expected from a particular course of action as compared with an alternative. ____ 22. Equivalent units of production are the number of units that could have been manufactured from start to finish during an accounting period. ____ 23. One of the differences in accounting for a process costing system compared to a job order system is that the amounts used to transfer goods from one department to the next comes from the cost of production report instead of job cost cards. ____ 24. The primary accounting tool for controlling and reporting for cost centers is a budget performance report. ____ 25. The dollars available from each unit of sales to cover fixed cost and profit is the unit variable cost.arrow_forward

- I - A decrease in production will ordinarily result in an increase in fixed production cost per unit. II - Factory rent is included in manufacturing overhead, but office rent is a period cost. a. True, True b. False, True c. True, False d. False, Falsearrow_forwardDogarrow_forwardI need the answer as soon as possiblearrow_forward

- Compute the product margins for B300 and T500 under the company's traditional costing system. Compute the product margins for B300 and T500 under the activity-based costing system. Prepare a quantitative comparison of the traditional and activity-based cost assignments.arrow_forwardKindly answer all questions: 1.) Cost behavior is considered linear whenever a straight line is a reasonable approximation for the relation between cost and activity. A. True B. False 2.) Which of the following is an example of a cost that is variable with respect to the number of units produced? A. rent on administrative office building B. rent on factory building C. Salaries of top marketing executives D. direct labor cost, where the direct labor force is adjusted to actual production of the period 3.) Fixed costs are constant in total amount over the relevant range of operations. A. True B. False 4.) The cost function derived by the simple least squares method: A. must be tested for minimum and maximum points. B. is parabolic. C. is linear. D. is curvilinear.arrow_forwardWhich of the following statements is true? In variable costing, fixed manufacturing overhead costs flows through the inventory accounts on the balance sheet before being recorded as sales revenue on the income statement. In variable costing, fixed manufacturing overhead costs flows through the inventory accounts on the balance sheet before being recorded as part of selling and administrative expenses on the income statement. In variable costing, fixed manufacturing overhead costs flows through the inventory accounts on the balance sheet before being recorded as part of cost of goods sold on the income statement. In variable costing, fixed manufacturing overhead costs are recorded as period expenses on the income statement as incurred.arrow_forward

- 20. An activity-based overhead rate is computed as follows: A) actual overhead divided by actual use of cost drivers B) estimated overhead divided by estimated use of cost drivers. C) estimated overhead divided by actual use of cost drivers. D) actual overhead divided by estimated use of cost drivers. woll (A (8 21. Companies that switch to Activity-Based Costing often find they have A) been overpricing some products. B) been sacrificing profitability by underpricing some products. C) All of the these answers are correct. D) possibly losing market share to competitors. GO0.09 ( D) Sob Testavl 22. Marathon Oil Company manufactures two products, Regular and Supreme. Marathon's overhead costs consist of machining, $3,000,000; and assembling, $1,500,000. Information on the two products is: Regular 10,000 10,000 90,000 How much Overhead is applied to Regular using traditional costing based on direct Supreme 15,000 30,000 160,000 Direct labor hours (D dan Machine hours Number of parts labor…arrow_forward1. What is a segment of an organization? Give a few examples of segments of Walmart Corporation. 2. What costs are assigned to a segment under the contribution approach? 3. Distinguish between a traceable fixed cost and a common fixed cost. 4. Explain how the contribution margin is different from the segment margin. 5. Why aren't common fixed costs allocated to segments under the contribution approach?arrow_forwardAll of the following are variable costs except for which of the following? Group of answer choices Production supervisor’s salary Sales commission based on number of sales units Direct material costs Direct labor costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education