FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

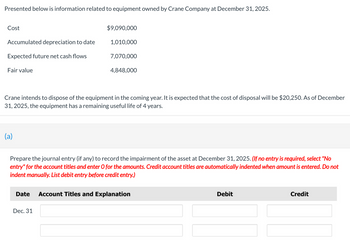

Transcribed Image Text:Presented below is information related to equipment owned by Crane Company at December 31, 2025.

Cost

Accumulated depreciation to date

Expected future net cash flows

Fair value

(a)

$9,090,000

1,010,000

Crane intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $20,250. As of December

31, 2025, the equipment has a remaining useful life of 4 years.

7,070,000

4,848,000

Dec. 31

Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2025. (If no entry is required, select "No

entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not

indent manually. List debit entry before credit entry.)

Date Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute for the TOTAL amount of Accumulated depreciation for the company's PPEarrow_forwardMa1. d) In accordance with IAS 36: Impairment of Assets, an entity shall assess at the end of each reporting period whether there is any indication that an asset may be impaired. If any of such indications exist, the entity shall estimate the recoverable amount of the asset. However, some assets would require mandatory testing for impairment. Required: Outline assets that require mandatory testing for impairment in accordance with IAS 36: Impairment of Assets.arrow_forwardBlossom Computer Company sold two pieces of equipment in 2028. The following information pertains to the two pieces of equipment: Machine #1 #2 Cost $68,800 $76,000 Purchase Useful Salvage Date Life Value 7/1/24 1/1/27 5 yrs. 5 yrs. $4,800 $4,000 Depreciation Method Straight-line Date Sold 7/1/28 Double-declining-balance 12/31/281 Sales Price $16,000 $29,600arrow_forward

- After first recording any impairment losses on plant and equipment and the patent. Required: 1. Compute the book value of the plant and equipment and patent at the end of 2024. 2. When should the plant and equipment and the patent be tested for impairment? 3. When should goodwill be tested for impairment? 4. Determine the amount of any impairment loss to be recorded, if any, for the three assets. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the book value of the plant and equipment and patent at the end of 2024. Note: Enter your answers in millions rounded to 1 decimal place. For example, $5,500,000 should be entered as $5.5. Plant and equipment Book Value million Patent millionarrow_forwardssarrow_forwardwhy was 3/12 used for the double declining method for equipment when the asset was acquired on Oct 2, 2021 and their financial year ended on Sept 30, 2022?arrow_forward

- What is the journal entry Declan's Designs recorded to recognize 2022 deprecation expense? Question 5 options: Dr. Accumulated Depreciation $3,000 Cr. Depreciation Expense $3,000 Dr. Depreciation Expense $2,000 Cr. Accumulated Depreciation $2,000 Dr. Depreciation Expense $3,000 Cr. Accumulated Depreciation $3,000 Dr. Depreciation Expense $1,000 Cr. Accumulated Depreciation $1,000arrow_forwardssarrow_forwardSubject :- Accountimgarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education