FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

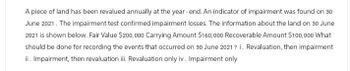

Transcribed Image Text:A piece of land has been revalued annually at the year-end. An indicator of impairment was found on 30

June 2021. The impairment test confirmed impairment losses. The information about the land on 30 June

2021 is shown below. Fair Value $200,000 Carrying Amount $160,000 Recoverable Amount $100,000 What

should be done for recording the events that occurred on 30 June 2021? i. Revaluation, then impairment

ii. Impairment, then revaluation iii. Revaluation only iv. Impairment only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Conceptual Question Identify whether or not each of the following items should be capitalized as intangible assets from the following list. Explain your reason with relevant accounting standard. Capitalised Not capitalized Employment costs of staff conducting research activiities Cost of constructing a working model of a new product License purchased to permit production and sale of a product for ten yearsarrow_forwardIf no legal, regulatory, contractual, cempetative, economic, or other factors limit the life of an intangible asset's assigned value is allocated to expense over which of the following? A. Equally over 20 years. B. Equally over 40 years. C. Equally over 20 years with an annual impairment review. D. No amortization, but annually reviewed for impairment and adjusted accordingly. E. No amortization over an indefinite period of time.arrow_forwardSage Hill Inc. owns equipment that cost $594,000 and has accumulated depreciation of $154,000. The expected future net cash flows from the use of the asset are expected to be $392,000. The fair value of the equipment is $339,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward

- Gadubhaiarrow_forwardParesarrow_forwardWhich of the following will cause a difference in book depreciation and federal depreciation? Choosing to depreciate a class of property using straight-line on the federal return and straight-line on the books. Depreciating property with a useful life of less than one year. Electing to take a Section 179 deduction on eligible property. Placing property in service mid-year.arrow_forward

- What should be the carrying value of goodwill for reporting unit A at year - end? What should be the carrying value of goodwill for reporting unit D at year-end ? What impairment loss should reporting unit B report for the year?\table [[Reporting Unit, A, B, C, D Reporting Unit Carrying Value of reporting unit Goodwill included in carrying value Fair Value of net identifiable assets at year-end Fair Value of reporting unit at year-end G A $600,000 $60,000 $600,000 $590,000 B C $330,000 $520,000 $48,000 $40,000 $300,000 $500,000 $305,000 $585,000 D $380,000 $28,000 $375,000 $400,000arrow_forwardCrane Corporation uses straight-line depreciation, prepares adjusting entries annually, and has a December 31 year end. It purchased equipment on January 1, 2020, for $196,400. The equipment had an estimated useful life of five years and a residual value of $20,440. On December 31, 2021, the company tests for impairment and determines that the equipment's fair value is $95,600. (a) Your answer has been saved. See score details after the due date. Assuming annual depreciation has already been recorded at December 31, calculate the equipment's carrying amount at December 31, 2021, immediately after recording depreciation for the year. (b) Carrying amount $ 126016 Calculate the amount of the impairment loss, if any. Impairment loss $ Attempts: 1 of 1 used Warrow_forwardplease do not provide solution in image format thank you!arrow_forward

- On December 31, 20x1, Entity A determines that its building is impaired. The following information is gathered: Building Accumulated Depreciation Fair Value less Cost of Disposal 1,000,000 200,000 600,000 580,000 Value in Use How much is the impairment loss?arrow_forwardThe equipment has carrying amount of 140,000 and recoverable amount of $110,000 as at year end date. What is the impairment loss?arrow_forwardAfter first recording any impairment losses on plant and equipment and the patent. Required: 1. Compute the book value of the plant and equipment and patent at the end of 2024. 2. When should the plant and equipment and the patent be tested for impairment? 3. When should goodwill be tested for impairment? 4. Determine the amount of any impairment loss to be recorded, if any, for the three assets. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the book value of the plant and equipment and patent at the end of 2024. Note: Enter your answers in millions rounded to 1 decimal place. For example, $5,500,000 should be entered as $5.5. Plant and equipment Book Value million Patent millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education