FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

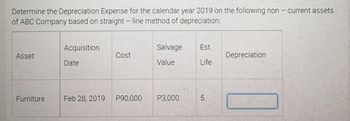

Transcribed Image Text:Determine the Depreciation Expense for the calendar year 2019 on the following non - current assets

of ABC Company based on straight line method of depreciation:

Acquisition

Salvage

Est.

Asset

Cost

Depreciation

Date

Value

Life

Furniture

Feb 28, 2019

P90,000

P3,000

LO

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company purchases a $10,000 piece of equipment with a $1,000 salvage value and estimated life of 5 years on October 1, 2019. What is the company’s depreciation expense for 2019 if they use the straight-line method of depreciation? Group of answer choices $2,000 $450 $1,800 $0arrow_forwardI need to know how to calculate the gain on the equipment sold in part C The balance sheets of HiROE Inc. showed the following at December 31, 2020 and 2019: December 31, 2020 December 31, 2019 Equipment, less accumulated depreciation of $212,625 at December 31, 2020, and $151,875 at December 31, 2019. $ 273,375 $ 334,125 Required: If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amount of the depreciation expense for 2020? Assume the same facts as in part a, and assume that the estimated useful life of the equipment to HiROE Inc., is eight years and that there is no estimated salvage value. Determine: What the original cost of the equipment was. What depreciation method is apparently being used. When the equipment was acquired. Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model and record the journal…arrow_forwardSh9arrow_forward

- Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following data are used for equipment purchased on January 1, 2020. Cost and residual value Estimated service life: Acquisition cost $26,250 Years 5 Residual value $1,050 Service hours 21,000 Productive output (units) 50,400 e. Double-declining-balance method: Compute the depreciation amount for each year. 2020 2021 2022 2023 2024 Answer Answer Answer Answer Answerarrow_forwardOn January 1, 2019, Vaughn Inc. purchased equipment for $ 44900. The company is depreciating the equipment at the rate of $ 710 per month. At January 31, 2020, the balance in Accumulated Depreciation is O $9230. O $35670. O $710. O $8520.arrow_forwardThe balance sheets of HIROE Inc. showed the following at December 31, 2020 and 2019: December 31, 2020 December 31, 2019 Equipment, less accumulated depreciation of $212,625 at December 31, 2020, and $151,875 at December 31, 2019. $273,375 $334,125 Required: a. If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amount of the depreciation expense for 2020? b. Assume the same facts as in part a, and assume that the estimated useful life of the equipment to HİROE Inc., is eight years and that there is no estimated salvage value. Determine: 1. What the original cost of the equipment was. 2. What depreciation method is apparently being used. 3. When the equipment was acquired. c. Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model and record the journal entry for the sale of the machine to calculate the gain or loss on the sale of one…arrow_forward

- n The T-accounts for Equipment and the related Accumulated Depreciation-Equipment for Oriole Company at the end of 2022 are shown here. Equipment Beg. bal. 75,600 Disposals 21,800 Acquisitions 45,500 End. bal. 99,300 Accumulated Depreciation-Equipment Disposals 5,000 Beg. bal. 44,700 Depr. exp. 11,500 End. bal. 51,200 In addition, Oriole Company's income statement reported a loss on the disposal of plant assets of $4,000. What amount was reported on the statement of cash flows as "cash flow from sale of equipment"? (Show an amount that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash flow from sale of equipment eTextbook and Media $arrow_forwardComputing Partial Period Depreciation under Multiple Depreciation Methods Compute depreciation expense for 2021 for each asset #1, #2, #3, and #4. Note: Do not round until your final answer. Round your final answer to the nearest whole dollar. Acquisition Acquisition Useful Salvage 2021 Depreciation Value Asset Date Depreciation Method Cost Life Expense #1 Jan. 1, 2020 Straight-line $4,000 4 years $200 $ 950 v #2 Aug. 30, 2020 Double-declining-balance 5,800 8 years 400 $ 1,125 x #3 Feb. 1, 2021 Sum-of-the-years'-digits 7,200 4 years 320 $ 1,147 x #4 Jul. 31, 2021 Straight-line 13,520 8 years 0 $arrow_forwardFollowing are the details related to fixed assets of Jackson company as at December 31, 2022: Date of Residual Purchase January 1, 2020 $15,000 April 1, 2015 1,000 Asset Machinery Delivery Van September 30, 2018 Furniture 500 December 31, 2012 Building 25,000 Required: Estimated Useful Life 30 Years 12 Years 8 Years 40 Years Cost $ 550,000 45,000 72,000 1,250,000 Value 1. Calculate the annual depreciation for each of the fixed assets given above. 2. Determine the book value of each fixed asset as on December 31, 2022.arrow_forward

- PLEASE provide Solutionsarrow_forwardPlease avoid solutions image based thanxarrow_forwardDepreciation calculation methods Gandolfi Construction Co. purchased a CAT 336DL earth mover at a cost of $1,000,000 in January 2019. The company's estimated useful life of this heavy equipment is 8 years, and the estimated salvage value is $200,000. Required: a. Using straight-line depreciation, calculate the depreciation expense to be recognized for 2019, the first year of the equipment's life, and calculate the equipment's net book value at December 31, 2021, after the third year of the equipment's life. b. Using declining-balance depreciation at twice the straight-line rate, calculate the depreciation expense to be recognized for 2021, the third year of the equipment's life.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education