FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

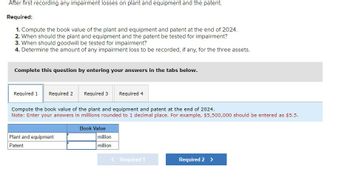

Transcribed Image Text:After first recording any impairment losses on plant and equipment and the patent.

Required:

1. Compute the book value of the plant and equipment and patent at the end of 2024.

2. When should the plant and equipment and the patent be tested for impairment?

3. When should goodwill be tested for impairment?

4. Determine the amount of any impairment loss to be recorded, if any, for the three assets.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Required 4

Compute the book value of the plant and equipment and patent at the end of 2024.

Note: Enter your answers in millions rounded to 1 decimal place. For example, $5,500,000 should be entered as $5.5.

Plant and equipment

Book Value

million

Patent

million

<Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On June 15, 2024, Perfect Furniture discarded equipment that had a cost of $8,000, a residual value of $0, and was fully depreciated. Journalize the disposal of the equipment. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Jun. 15 Accumulated Depreciation-Equipment Cash Depreciation Expense-Equipment Equipment Gain on Disposal Loss on Disposal Maintenance Expenses Debit Creditarrow_forwardPrepare a separate depreciation schedules for each machine. Prepare the schedule for all years, information permitting.arrow_forwardTo be included in property, plant, and equipment, an asset must have all of the following except a. the asset must have an expected life of a normal operating cycle. b. the asset must be held for use. c. the asset must be tangible in nature. d. the asset must have an expected life of more than one year.arrow_forward

- From the following information prepare adjusting entries in the general journal and enter them in the work sheet. Plant and equipmentto be depreciated are composed of the following: Assets Date Acquired cost estimatedusage or life salvage value depreciation method Building 7/1/2014 $306,000 25 years $20,000 sum-of-years' digits Truck #1 4/1/2014 28,000 60,000 miles 3,100 miles driven Truck #2 9/1/2015 33,000 60,000 miles 4,200 miles driven Lift Truck #1* 8/17/2011 7,900 10 years 900 straight-line Lift Truck #2 3/29/2015 4,500 10 years 500 straight-line Lift Truck #3 9/16/2016 5,000 10 years 500 straight-line Office Equipment 7/1/2016 32,800 7 years 2,000 straight-line Computer 12/19/2018 7,600 4 years 1,600 Double-decling *sold 12/31/18 Truck No. 1has been driven 45,000 miles prior to 1/1/18 and truck No. 2 has been driven 30,500 miles prior to 1/1/18. During 2018 truck No. 1 was driven 12000 miles and truck No. 2 was driven 16000 miles. Remember…arrow_forwardQ2-) An asset owned by Photon Environmental was book-depreciated by the straight-line method over a 5-yea period with book values of$296,000 and $224,000in years 2 and 3 , respectively. Determine(a)the salvage valueSused in the calculation and(b)the unadjusted basisB. Please type out the correct step by step answer with proper explanation of it within 30min .will give upvote only for the correct answer.thank youarrow_forwardItem 2: Entity B purchased equipment for $180,000 on January 1, 2024 with an estimated salvage value $30,000 and a five-year useful life. Compute the annual depreciation and then show what this asset looks like on the balance sheet at the end of the third year (prepare a partial classified balance sheet). Show your work.arrow_forward

- And c. Land and d. Factory building journal formalarrow_forwardWhich of the following will cause a difference in book depreciation and federal depreciation? Choosing to depreciate a class of property using straight-line on the federal return and straight-line on the books. Depreciating property with a useful life of less than one year. Electing to take a Section 179 deduction on eligible property. Placing property in service mid-year.arrow_forwardNot previously answered.arrow_forward

- Prepare the journal entry to record TWO of the following scenarios. Please be sure to identify which scenarios you have selected. (a) Discarding of Machine #1: Original cost, $25,000; accumulated depreciation, $20,000. (b) Sale of Machine #2: Original cost, $50,000; accumulated depreciation, $35,000; sold for $18,000 cash. (c) Sale of Machine #3: Original cost, $75,000; accumulated depreciation, $65,000; sold for $4,000 cash.arrow_forwardPete's Propellers Company showed the following information in its Property, Plant, and Equipment Subledger regarding Machine #5027. Machine 5027 Date of Depreciation purchane Jan. 12/10 Jan. 12/18 Rat. Cost $ 62,000 40,000 16,200 Component Single metal housing Methode Reaidual Ent.tife SL. $8,000 15 yra Motor DDB 6,000 10 yrs Blade Jan. 12/18 SL 1,400 s yrs $118,200 *SL = Straight-line; DDB = Double-declining-balance On January 7, 2020, the machine blade cracked and it was replaced with a new one costing $13,200 purchased for cash (the old blade was scrapped). The new blade had an estimated residual value of $2,000 and an estimated life of filve years and would continue to be depreciated using the straight-line method. During 2020, it was determined that the useful life on the metal housing should be Increased to a total of 18 years instead of 15 years and that the residual value should be increased to $10,000. Required: 1. Prepare the entry to record the purchase of the replacement…arrow_forwardSeveral expenditures are listed below. Indicate whether or not each expenditure would be included in the cost of acquisition for each item below. The answer box provides two options, Yes (if the expenditure would be included ) or No, (if the expenditure would not be included.) Cost testing materials and labor in testing a purchased machine Yes before use Compensation for injury to No construction worker Cost of overhaul to a used Yes machine purchased before initial use Cost of tearing down a building Yes on newly acquired land Repairs to a new machine Yes damaged while moving it into > > > > >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education