FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need part 1, 2a, 2b, 2c please

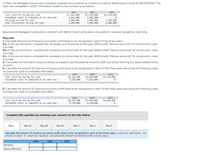

1. Calculate the amount of revenue and gross

2-a. In the journal below, complete the necessary

2-b. In the journal below, complete the necessary journal entries for the year 2022 (credit "Various accounts" for construction costs incurred).

2-c. In the journal below, complete the necessary journal entries for the year 2023 (credit "Various accounts" for construction costs incurred).

Transcribed Image Text:**Westgate Construction Company Contract Overview**

In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows:

**Contract Financial Details:**

- **2021:**

- Cost incurred during the year: $2,184,000

- Estimated costs to complete as of year-end: $5,616,000

- Billings during the year: $1,800,000

- Cash collections during the year: $1,680,000

- **2022:**

- Cost incurred during the year: $3,510,000

- Estimated costs to complete as of year-end: $2,106,000

- Billings during the year: $3,600,000

- Cash collections during the year: $3,960,000

- **2023:**

- Cost incurred during the year: $2,316,000

- Estimated costs to complete as of year-end: $0

- Billings during the year: $4,386,000

- Cash collections during the year: $5,000,000

Assume that Westgate Construction’s contract with Santa Clara County does not qualify for revenue recognition over time.

**Required Tasks:**

1. **Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years.**

2. **Journal Entries:**

- Complete the necessary journal entries for the year 2021.

- Complete the necessary journal entries for the year 2022.

- Complete the necessary journal entries for the year 2023.

3. **Prepare a Partial Balance Sheet:**

- Complete the required information for the years 2021 and 2022 showing any items related to the contract.

4. **Revenue and Gross Profit Calculation:**

- Calculate the revenue and gross profit (loss) to be recognized in each of the three years based on incurred costs and costs to complete information.

**Costs Details for Calculation:**

- **2021:**

- Cost incurred during the year: $2,520,000

- Estimated costs to complete as of year-end: $5,720,000

- **2022:**

- Cost incurred during the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate other expense income: Income Statement May 31, 2021 May 31, 2020 May 31, 2019 REVENUE $ 83,959 $ 69,217 $ 69,693 OPERATING EXPENSES: Salaries and employee benefits 30,173 25,031 24,776 Purchased transportation 21,674 17,466 16,654 Rentals and landing fees 4,155 3,712 3,360 Depreciation and amortization 3,793 3,615 3,353 Fuel 2,882 3,156 3,889 Maintenance and repairs 3,328 2,893 2,834 Business realignment costs 116 320 Goodwill and other asset impairment charges 435 Other 11,981 10,492 10,041 OPERATING EXPENSES 78,102 66,800 65,227 OPERATING INCOME 5,857 2,417 4,466 OTHER (EXPENSE) INCOME: Interest expense (793) (672) (588) Interest income 52 55 59 Other retirement plans income (expense) 1,983 (122) (3,251) Loss on debt extinguishment (393) Other, net (32) (9) (31) OTHER (EXPENSE) INCOME 817 (748) (3,811) INCOME BEFORE INCOME TAXES 6,674 1,669 655 PROVISION FOR INCOME TAXES 1,443 383 115 NET INCOME $…arrow_forwardattached in ssthx 316 16 17 4 717 1 5arrow_forwardplease answer and explain with work and steps thanksarrow_forward

- please dont give handwritten answer thank youarrow_forwardWhat hould i do the property taxes were levied in the amount of $905,000. All of the taxes are expected to be collected before February 2021. Note: Enter debits before credits. Transaction General Journal Debit Credit 03 .arrow_forwardsarrow_forward

- pare.3arrow_forwardDo parts a to d Accounting for Income Taxes Yoda Company is in the process of accounting for its income taxes for the year ended December 31, 2020. The following information came from Yoda's accounting and taxation records: Accounting income before income taxes for 2020 $ 98,967 Depreciation expense for property, plant, and equipment for 2020 $ 222,227 Capital cost allowance to be claimed on Yoda's 2020 income tax return $ 244,450 Book value of property, plant, and equipment at December 31, 2019 $ 1,399,268 Undepreciated capital cost of property, plant, and equipment at December 31, 2019 $ 1,203,370 Assume that there were no additions or disposals of property, plant, and equipment during 2020. In 2020, Yoda began offering a 1-year warranty on all merchandise sold. Following are details pertaining to this warranty: Warranty expense for 2020 for accounting purposes $ 38,860…arrow_forward5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. Cost incurred during the year Estimated costs to complete as of year-end Req 1 Complete this question by entering your answers in the tabs below. Req 2A Revenue Gross profit (loss) $ $ Req 2B 2024 0 $ 0 $ Req 2C 2025 2024 $ 2,530,000 5,730,000 0 $ 0 Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years using the above information. Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sken. Req 3 2026 2025 $ 3,865,000 4,230,000 10,000,000 Req 4 2026 $ 4,095,000 Req 5 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education