FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

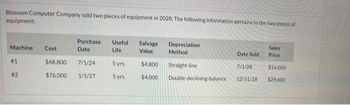

Transcribed Image Text:Blossom Computer Company sold two pieces of equipment in 2028. The following information pertains to the two pieces of

equipment:

Machine

#1

#2

Cost

$68,800

$76,000

Purchase Useful Salvage

Date

Life

Value

7/1/24

1/1/27

5 yrs.

5 yrs.

$4,800

$4,000

Depreciation

Method

Straight-line

Date Sold

7/1/28

Double-declining-balance 12/31/281

Sales

Price

$16,000

$29,600

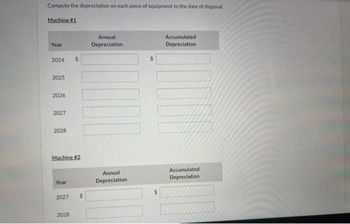

Transcribed Image Text:Compute the depreciation on each piece of equipment to the date of disposal.

Machine #1

Year

2024

2025

2026

2027

2028

Machine #2

Year

$

2027 $

2028

Annual

Depreciation

Annual

Depreciation

$

$

Accumulated

Depreciation

Accumulated

Depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dogarrow_forwardSparrow_forwardC E F H |Historical cost Estimated useful life 2$ 270,000 6 years Salvage value Estimated useful hours $ 24,000 12,000 hours Estimated hours per year: 3,100 2019 1,100 2020 1,200 2021 2,800 2022 2,600 2023 1,200 2024 Required 1 Complete the depreciation schedule using the Double Declining Balance Method. Adventure Park, Corp Depreciation Schedule - Double Declining Balance Depreciation Expense Ending Book Balance Beginning Year Book Balance Rate # of Years 2019 2020 2021 2022 2023 2024 HINT: the last year of depreciation expense will be a plug in order not to depreciate below the salvage value. Your ending book balance should be the $24,000 salvage value. 2 Analyze the effect of depreciation on the 2020 financial statements. Page 1 Assets = Liabilities + Equity Revenues Expenses = Net Income 3 Record depreciation expense for 2020. General Journal DR CRarrow_forward

- QS 10-6 (Algo) Double-declining-balance method LO P1 A building is acquired on January 1 at a cost of $870,000 with an estimated useful life of eight years, and salvage value of $78,300. Compute depreciation expense for the first three years using the double-declining-balance method. Note: Round your answers to the nearest dollar. Annual Period First Year Second Year Third Year Depreciation for the Period Depreciation Rate(%) Beginning of Period Book Value Depreciation Expense End of Period Accumulated Depreciation Book Valuearrow_forwardRequired information Problem 8-6A Disposal of plant assets LO C1, P1, P2 Onslow Co. purchased a used machine for $240,000 cash on January 2. On January 3, Onslow paid $8,000 to wire electricity to the machine and an additional $1,600 to secure it in place. The machine will be used for six years and have a $28,800 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- MODULE 5 8-7 DISPOSAL OF ASSET Please read the problem below and provide the correct answer along with an explanation of the answer. Thank you! Dump It is selling a machine that no longer is large enough for the production requirements. Dump It has had the machien for 3 years and has depreicated it using the straightline method. Original cost had been $98,000 and salvage was estimated at $6000. The machine has a life of 8 years. a) Journalize the sale of the imagine $70,000 b) Journalize teh sale of the machine for $50,000arrow_forwardinitial book value $ n residual value $ years years 1 $ 2 $ 3 $ 4 $ 5 $ 6 $ 7 $ 8 $ 9 $ 10 $ 11 $ 12 $ annual depreciation cumulative depreciation BV 1 $ 2 $ 3 $ 4 $ 5 $ 6 $ 7 $ 8 $ 3,000,000 9 $ 10 $ 12 11 $ 12 $ 16.67% annual depreciation cumulative depreciation BV 500,000.00 $ 416,666.67 $ 347,222.22 $ 289,351.85 $ 241,126.54 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 2,750,000 500,000 $ 2,500,000 750,000 $ 2,250,000 1,000,000 $ 2,000,000 1,250,000 $ 1,750,000 1,500,000 1,250,000 1,000,000 750,000 500,000 250,000 1,500,000 $ 1,750,000 $ 2,000,000 $ 2,250,000 $ 2,500,000 $ 2,750,000 $ 3,000,000 $ 200,938.79 $ 167,448.99 $ 139,540.82 $ 116,284.02 $ 96,903.35 $ 80,752.79 $ 67,293.99 $ - 500,000.00 $2,500,000.00 916,666.67 $2,083,333.33 1,263,888.89 $1,736,111.11 1,553,240.74 $1,446,759.26 1,794,367.28 $ 1,205,632.72 1,995,306.07 $1,004,693.93 2,162,755.06 $ 837,244.94 2,302,295.88 $ 697,704.12…arrow_forwardEXERCISE/TUTORIAL12. 1 A 2 Rubicon Limited purchased machinery on 1 January 20.1 at a cost of R70 000. It has an expected useful life of ten (10) years with no residual value. REQUIRED 1. Calculate the Depreciation on machinery for 20.1 and 20.2 if: a. The straight-line method is used. b. The diminishing amount method is used (rate 20%). c. Sum-of-the-years-digit method is used. 2. Discuss the effect of a change in the method of depreciation from the straight- line method in 20.1 to the diminishing amount method in 20.2.arrow_forward

- QUESTION 7 Equipment costing $70,000 with a salvage value of $14,000 and an estimated life of eight years has been depreciated using the straight-line method for two years. Assuming a revised estimated total life of five years and no change in the salvage value, the depreciation expense for year three would be $14,000. $11,200. $ 8,400. $18,667.arrow_forwardchapter 9 question 5 fill in all the blanks that need to be filledarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education