FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

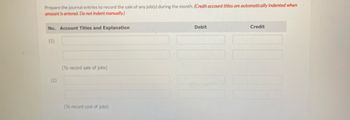

Transcribed Image Text:**Journal Entry Preparation Guide**

To accurately record financial transactions for job sales during the month, filling out journal entries correctly is essential. Follow the steps below to ensure precision and compliance with accounting standards.

1. **Sales Entry:**

- **Account Titles and Explanation:**

- Fill in the appropriate accounts to reflect the sale of a job.

- **Debit and Credit Columns:**

- Input the respective amounts to maintain a balanced entry.

- **Note:** Credit account titles will automatically be indented when the amount is entered.

*(1) This entry records the sale of jobs.*

2. **Cost of Jobs Entry:**

- **Account Titles and Explanation:**

- Select accounts that account for the cost associated with producing or delivering jobs.

- **Debit and Credit Columns:**

- Enter the amounts for costs, ensuring the entry balances.

*(2) This entry records the cost of jobs.*

By carefully documenting each transaction, you will maintain accurate financial records that provide valuable insights into the company's economic events.

Transcribed Image Text:**Lott Company Production and Cost Analysis**

Lott Company employs a job order cost system and calculates overhead applied to production based on direct labor costs. As of January 1, 2020, Job 50 was the exclusive job in process. Costs incurred prior to this date were as follows: direct materials costing $23,200, direct labor of $13,920, and manufacturing overhead totaling $18,560. By this date, Job 49 was already completed at a cost of $104,400 and was part of the finished goods inventory. The Raw Materials Inventory account held a balance of $17,400.

**January Production Activity:**

During January, Lott Company initiated production on Jobs 51 and 52. Jobs 49 and 50 were completed and sold on account during the month for $141,520 and $183,280, respectively. Additional events during the month included:

1. Purchased additional raw materials costing $104,400 on account.

2. Incurred factory labor costs amounting to $81,200, which included $18,560 for employer payroll taxes.

3. Manufacturing overhead costs were incurred as follows:

- Indirect materials: $19,720

- Indirect labor: $23,200

- Depreciation expense on equipment: $13,920

- Other manufacturing overhead costs on account: $18,560

4. Direct materials and direct labor were assigned to jobs as outlined below:

| Job No. | Direct Materials | Direct Labor |

|---------|------------------|--------------|

| 50 | $11,600 | $5,800 |

| 51 | $45,240 | $29,000 |

| 52 | $34,800 | $23,200 |

This detailed breakdown assists in understanding the allocation and flow of costs within Lott Company’s production for that period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Company sells one product. Presented below is information for January for Blue Company. Jan. 1 11 Jan. 4 4 13 20 27 Jan. 4 Date Jan. 11 Jan. 13 Jan. 13 Blue uses the FIFO cost flow assumption. All purchases and sales are on account. Jan. 20 Assume Blue uses a perpetual system. Prepare all necessary journal entries. (If no entry is required, select "No entry for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Jan. 27 Jan. 27 V V Inventory > Sale V Purchase Sale Purchase Sale Accounts Receivable Account Titles and Explanation Sales Revenue (To record the sale) Cost of Goods Sold Inventory Purchases (To record the cost of inventory) Accounts Payable Accounts Receivable Sales Revenue (To record the sale) Cost of Goods Sold Inventory 164 units at $6 each 132 units at $9 each 169 units at $6 each 106 units at $10 each Purchases 122 units at $4…arrow_forwardPlease Introduction and explanation show work please without plagiarism please strictly no plagiarism pleasearrow_forwardBb.77.arrow_forward

- Please do not give solution in image format ?arrow_forwardQuestion 3, Part 2. Please answer in same format as questionarrow_forwardView transaction list Journal entry worksheet 1 2 3 4 5 6 > Wages of $11,000 are earned by workers but not paid as of December 31. Note: Enter debits before credits. Transaction General Journal Debit Credit а. Record entry Clear entry View general journalarrow_forward

- Do not provide hand written solution.arrow_forwardInstructions: Please show work and detailed explanations on how you got your answer. 1. Journalize the above transactions for Bramble Supply Co. Omit cost of goods sold entries. (Round interest revenue to 0 demcial places, e.g. 591. List all debit entries before credit entries. Record journal entries in the order presented in the probelm. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Use 360 days for calculation. 2. Record the collection of the Takham notes at its maturity in 2023. 3. Assume Takham dishonors its note at its maturity in 2023. Bramble expects to eventually collect the note. Record the dishonr of the Takham note. 3. Assume Takham dishonors its note at its maturity in 2023; Bramble does not expect to collect the note. Record the dishonor of the Takham note.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education