FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:For the year ended December 31, 2022, Oriole Electrical Repair Company reports the following summary payroll data.

Gross earnings:

Administrative salaries

Electricians' wages

Total

Deductions:

FICA taxes

Federal income taxes withheld

State income taxes withheld (3%)

United Fund contributions payable

Health insurance premiums

Total

$204,000

376,000

$580,000

$39,224

165,000

17,400

27,982

18,500

$268,106

Oriole's payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.6% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $497,000, and

gross earnings subject to unemployment taxes total $145,000. No employee exceeds the $132,900 limit related to FICA taxes.

(a) Prepare a summary journal entry at December 31 for the full year's payroll.

(b)

Journalize the adjusting entry at December 31 to record the employer's payroll taxes.

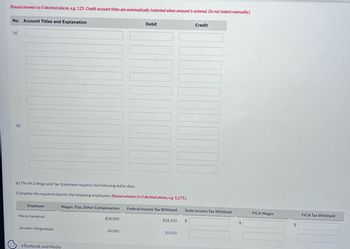

Transcribed Image Text:(Round answers to 0 decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

No. Account Titles and Explanation

(a)

&

(b)

(c) The W-2 Wage and Tax Statement requires the following dollar data.

Complete the required data for the following employees. (Round answers to O decimal places, e.g. 5,275.)

Employee

Maria Sandoval

Jennifer Mingenback

Wages, Tips, Other Compensation

eTextbook and Media

$58,000

Debit

28,000

Federal Income Tax Withheld

$28,420

10,920

Credit

State Income Tax Withheld

$

$

FICA Wages

$

FICA Tax Withheld

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The payroll register of Patel Engineering Co. indicates $1,440 of social security withheld and $360 of Medicare tax withheld on total salaries of $24,000 for the period. Federal withholding for the period totaled $4,320. Provide the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. The payroll register of Patel Engineering Co. indicates $1,350 of social security withheld and $337.50 of Medicare tax withheld on total salaries of $22,500 for the period. Earnings of $6,300 are subject to state and federal unemployment compensation taxes at the federal rate of 0.6% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places.arrow_forwardAssume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 9.1). Note: Do not round intermediate calculations and round your final answers to the nearest cent. Employee Pat Brown Marital status S Gross pay $ 1,900 FIT Social Security FICA Medicare Net payarrow_forwardA7 please help......arrow_forward

- The payroll register of Castilla Heritage Co indicates $2,790 of social security withheld and $697.50 of Medicare tax withheld on total salaries of $46,500 for the period. Earnings of $13,000 are subject to state and federal unemployment gompensation taxes at the federal rate of 0.8% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places.arrow_forwardBMX Company has one employee. FICA Social Security taxes are withheld in the amount of $316.20. FICA Medicare taxes are withheld in the amount of $73.95. Federal unemployment taxes are $30.60 and State unemployment taxes are $275.40 for this pay period. Medical Insurance of $242.25 is withheld as requested by the employee and federal income taxes are $607.05. Use this information to record below the journal entry for the employer's payroll tax expense for this first pay period of the year in January. Note: Round your answers to 2 decimal places. View transaction list View journal entry worksheet No 1 Date January 31 General Journal Payroll taxes expense FICA-Social security taxes payable FICA-Medicare taxes payable Federal unemployment taxes payable State unemployment taxes payable Debit 696.15 Credit 316.20 73.95 30.60 275.40arrow_forwardFor the first week of 2022, Coby Co. pays wages of $6,000 and withholds $1,000 for federal income taxes and $400 for state income taxes. The combined FICA and Medicare tax rate is 7.65%. The FUTA rate is 0.8% and the SUTA rate is 5.4% Record the payroll. Record the payroll tax.arrow_forward

- 14. On March 21st Jamukha recorded salaries owed to employees and payroll taxes. Employee's gross salaries were $8,300. FICA tax was withheld at a rate of 7.65%. Federal income taxes (FIT) of $1,500 were withheld, and state income taxes (SIT) of $600 were withheld. The federal unemployment tax (FUTA) rate was 1%, and the state unemployment tax (SUTA) rate was 3.25% No cash has been paid yet, so record all the amounts due in the appropriate payable accounts.arrow_forwardUse (a) the percentage method and (b) the wage - bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. As we go to press, the federal income tax rates for 2024 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2023 federal income tax tables for Manual Systems with Forms W-4 From 2020 or Later with Standard Withholding and 2023 FICA rates have been used.Amount to Be withheldarrow_forwardAssume that the MUST Co. pays a weekly payroll. Using the portion of the Wage Bracket Withholding Table given, what would be the amount of federal income tax to withhold for this pay period for a single employee whose gross earning is $2,250 and who counted 2 withholding allowance? Table for Percentage Method of Withholding WEEKLY Payroll Period SINGLE person(including head of household)-- Assume the deduction for each withholding allowance is $75. If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is $0 Not over $43. . . ver--- But not over-- of excess over-- $43 --$222 | $ 0.00 plus 10% ---$43 $222 ---$767 $17.90 plus 15% --$222 $767 --$1,796| $99.65 plus 25% ---$767 $1,796 --$3,700 $356.90 plus 28% ---$1,796 $3,700 ---87,992 | $890.12 plus 33% --S3,700 $7,992 ---$8,025 | $2,306.38 plus 35% ---$7,992 $8,025 $2,317.93 plus 39.6% ---$8,025 $356.90 $442.02 $484.02 $630.00arrow_forward

- can you help with C & D? thanks :)arrow_forwardQ) Find the federal withholding tax using the wage bracket method for each of the following employees. Kerry Cook: 1 withholding allowance, single, $2165.17 monthly earnings Mary Jackson: 2 withholding allowances, married, $639.80 weekly earnings Julie Pendleton: 0 withholding allowances, single, $1843.19 monthly earnings L. Sanchez: 3 withholding allowances, married, $521.10 weekly earnings B. Maynard: 4 withholding allowance, married, $2484.97 monthly earningsarrow_forwardYou [The following information applies to the questions displayed below.] The following summary data for the payroll period ended December 27, 2021, are available for Cayman Coating Company: Gross pay $ 100,000 FICA tax withholdings ?question mark Income tax withholdings 15,150 Group hospitalization insurance 1,580 Employee contributions to pension plan ?question mark Total deductions 26,673 Net pay ?question mark Additional information: For employees, FICA tax rates for 2021 were 7.65% on the first $142,800 of each employee’s annual earnings. However, no employees had accumulated earnings for the year in excess of the $142,800 limit. For employers, FICA tax rates for 2021 were also 7.65% on the first $142,800 of each employee’s annual earnings. The federal and state unemployment compensation tax rates are 0.6% and 5.4%, respectively. These rates are levied against the employer for the first $7,000 of each employee’s annual earnings. Only $15,700 of the gross…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education