FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

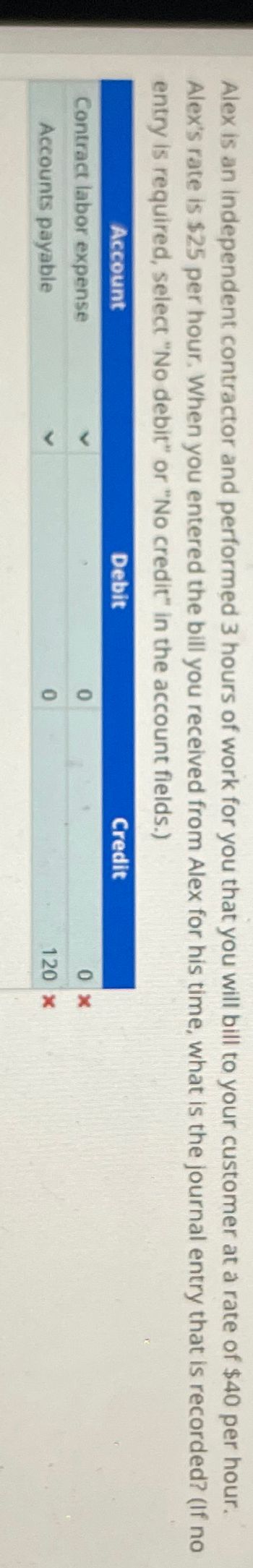

Transcribed Image Text:Alex is an independent contractor and performed 3 hours of work for you that you will bill to your customer at a rate of $40 per hour.

Alex's rate is $25 per hour. When you entered the bill you received from Alex for his time, what is the journal entry that is recorded? (If no

entry is required, select "No debit" or "No credit" in the account fields.)

Account

Contract labor expense

Accounts payable

Debit

0

0

Credit

0x

120 x

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- ssarrow_forwardCompleting the Payroll Register The Employee Payroll Register presents all the computations previously performed as it applies to this payroll period. Complete the following steps (if a field should be blank, leave it blank): Record the amount to be withheld for group insurance. Record the amount to be withheld for health insurance. Each worker is to be paid by check. Assign check numbers provided to the correct employee. Compute the net pay for each employee. Total the input columns. KIPLEY COMPANY, INC.Payroll RegisterFor Period Ending January 8, 20-- EARNINGS DEDUCTIONS NET PAY Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Grp. Ins. Health Ins. Ck. No. Amount Carson, F. $700.00 $43.40 $10.15 $48.00 $21.49 $0.42 $21.00 $20.00 Wilson, W. 897.04 55.62 13.01 68.00 27.54 0.54 26.91 50.00 Utley, H. 678.75 42.08 9.84 14.00 20.84 0.41 20.36 40.00 Fife, L. 877.10 54.38 12.72 33.00 26.93 0.53 26.31 50.00 Smith, L. 790.00 48.98 11.46 59.00…arrow_forwardDon't provide answers in image formatarrow_forward

- ces Gomez Corporation uses the allowance method to account for uncollectibles. On January 31, it wrote off an $1,800 account of a customer, C. Green. On March 9, it receives a $1,300 payment from Green. 1. Prepare the journal entry for January 31. 2. Prepare the journal entries for March 9; assume no additional money is expected from Green. View transaction list No 1 2 3 Date View journal entry worksheet January 31 March 09 March 09 General Journal Allowance for doubtful accounts Accounts receivable C. Green Accounts receivable-C. Green Allowance for doubtful accounts Cash Accounts receivable C. Green Debit 1,800 1,300 1,300 Credit 1,800 1,300 1,300arrow_forwardWhat is the FIT, SIT, and NET pay to complete the payroll chart?arrow_forwardCompleting a payroll register 1 € (30 min) Check Figure Net Pay $2,529.97 P10-2A. Nickels Company of Windsor has five salaried employees. Your task is to record the following information for the last week of March in a payroll register. Use the tables in the chapter appendices to determine deductions. Claim Code 3 1 1 Department Sales Sales Weekly Salary $950 620 980 650 Employee Jenny Quan Frank Sloan Alberta Nobel Office Jeremy Gold Office 4 Assume that each employee contributes $12 per week for union dues.arrow_forward

- ABC Co. holds job interviews this week and agrees to hire Juan at a weekly rate of $1,000 ($200/day for 5 workdays in a week) starting next Monday. How much in payroll expense does it recognize this week? Use accrual accounting rules to solve. O A. $1,000 B. It depends on how many days there are left in the week from the date Juan is hired. O C. No payroll expense is recorded. D. It depends on whether Juan was paid any amount at all this week.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardFollowing are some transactions and events of Business Solutions. February 26 The company paid cash to Lyn Addie for eight days' work at $120 per day. March 25 The company sold merchandise with a $2,100 cost for $3,300 on credit to Wildcat Services, invoice dated March 25. Required: 1. Assume that Lyn Addie is an unmarried employee. Her $960 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $96. Compute her net pay for the eight days' work paid on February 26. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). 4. Record the entries for the merchandise sold on March 25 if a 4% sales tax rate applies.…arrow_forward

- Alex is an independent contractor and performed 3 hours of work for you that you will bill to your customer at a rate of $40 per hour. Alex's rate is $25 per hour. When you entered the bill you received from Alex for his time, what is the journal entry that is recorded? (If no entry is required, select "No debit" or "No credit" in the account fields.) Account Contract labor expense Accounts payable Debit 0 0 Credit 0x 120 xarrow_forwardplease help me with thesearrow_forwardNN provided $1,000 of services on account to a customer which has not been recorded yet. The customer will not be billed for the services until July. I U ... Format REF DEBIT CREDIT DATE ACCOUNT TITLES AND EXPLANATION 民 A For the week ending June 30, NN's employees earned $15,000 in gross wages which will not be paid until July. NN is required to withhold the following amounts from the employees' payroll: $1200 in Employment Insurance; $800 for Canada Pension Plan; and $6,700 for income tax payable. No entries have been made yet to record the payroll. BIU - Format DATE ACCOUNT TITLES AND EXPLANATION REF DEBIT CREDIT On June 30, NN counted its supplies and determined that it had $250 still on hand. Format BIU ... DATE ACCOUNT TTTLES AND EXPLANATION REF DEBIT CREDIT By June 30, NN has earned $10,000 of the balance in the unearned revenue account. of B I U Format REF DEBIT CREDIT DATE ACCOUNT TITLES AND EXPLANATIONarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education