FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

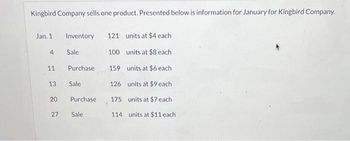

Transcribed Image Text:Kingbird Company sells one product. Presented below is information for January for Kingbird Company.

Jan. 1

4

11

13

20

27

Inventory 121 units at $4 each

100 units at $8 each

159 units at $6 each

126

units at $9 each

175 units at $7 each

114 units at $11 each

Sale

Purchase

Sale

Purchase

Sale

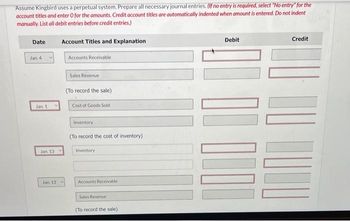

Transcribed Image Text:Assume Kingbird uses a perpetual system. Prepare all necessary journal entries. (If no entry is required, select "No entry" for the

account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent

manually. List all debit entries before credit entries.)

Date

Jan. 4

Jan 1

Jan 13.

Jan 13

Account Titles and Explanation

Accounts Receivable

Sales Revenue

(To record the sale)

Cost of Goods Sold

Inventory

(To record the cost of inventory),

Inventory

Accounts Receivable

Sales Revenue

(To record the sale)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please calculate LIFO perpetual system and Average cost, perpetual systemFerris Company began January with 6,000 units of its principal product. The cost of each unit is $8. Merchandise transactions for the month of January are as follows: "Includea purchase price and cost of freight. 8,000 units were on hand at the end of the month. Please show work. Directions are at the top to find LIFO, perpetual system and Average cost, perpetual system. Units Unit Cost Purchased Sold Balancearrow_forwardShadee Corporation expects to sell 630 sun shades in May and 320 in June. Each shade sells for $162. Shadee's beginning and ending finished goods inventories for May are 60 and 50 shades, respectively. Ending finished goods inventory for June will be 55 shades. Each shade requires a total of $60.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 130 in direct materials inventory on May 1, 80 poles in inventory on May 31, and 110 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $15 per hour. Additionally, Shadee's fixed manufacturing overhead is $10,000 per month, and variable manufacturing overhead is $10 per unit produced. Use the information and solutions presented to complete the requirements. Required: 1. Determine Shadee's budgeted manufacturing cost per shade. (Note: Assume that fixed overhead per unit is $18.) 2. Prepare Shadee's budgeted cost of goods…arrow_forwardThe trailer company exspects to sell 9000 for $155 each for a total of $1,395,000 in January and 4500 units for $225 each for a total of $1,012,500 in February. The company exspects the cost of goods sold to average 70% of sales revenue, and the company exspects to sell 4700 units in march for $290 each. Trailer's target ending inventory is $9000 plus 50% of next months cost of goods sold. Prepare Trailer's inventory, purchases, and cost of goods sold budget for January and February. Trailer Company Inventory, Purchases, and Cost of Goods Sold Budget Two months Ended January 31 and February 28 January february cost of goods sold Plus: Desired ending merchandise inventory Total merchandise inventory required Less: Beginning merchandise inventory Budgeted purchasesarrow_forward

- Yorkley Corporation plans to sell 41,000 units of its single product in March. The company has 2,800 units in its March 1 finished-goods inventory and anticipates having 2,400 completed units in inventory on March 31. On the basis of this information, how many units does Yorkley plan to produce during March?arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.]Shadee Corp. expects to sell 650 sun visors in May and 420 in June. Each visor sells for $17. Shadee’s beginning and ending finished goods inventories for May are 85 and 55 units, respectively. Ending finished goods inventory for June will be 55 units. Each visor requires a total of $4.00 in direct materials that includes an adjustable closure that the company purchases from a supplier at a cost of $1.50 each. Shadee wants to have 27 closures on hand on May 1, 21 closures on May 31, and 23 closures on June 30 and variable manufacturing overhead is $1.25 per unit produced. Suppose that each visor takes 0.50 direct labor hours to produce and Shadee pays its workers $7 per hour. Required:1. Determine Shadee’s budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $1.50.) (Round your answer to 2 decimal places.)arrow_forward[The following information applies to the questions displayedbelow.]Shadee Corp. expects to sell 630 sun visors in May and 410 inJune. Each visor sells for $24. Shadee’s beginning and endingfinished goods inventories for May are 75 and 45 units,respectively. Ending finished goods inventory for June will be 60units.!Each visor requires a total of $4.00 in direct materials that includes an adjustableclosure that the company purchases from a supplier at a cost of $1.50 each. Shadeewants to have 31 closures on hand on May 1, 23 closures on May 31, and 20 closureson June 30 and variable manufacturing overhead is $1.75 per unit produced.Suppose that each visor takes 0.80 direct labor hours to produce and Shadee paysits workers $8 per hour.Additional information:Selling costs are expected to be 8 percent of sales.Fixed administrative expenses per month total $1,300.Required:Complete Shadee's budgeted income statement for the months of May and June.(Note: Assume that fixed overhead per unit is…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education