FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

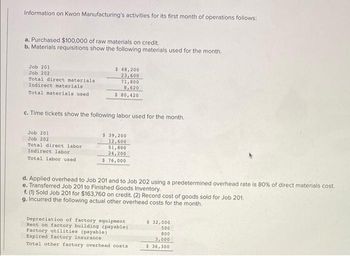

Transcribed Image Text:Information on Kwon Manufacturing's activities for its first month of operations follows:

a. Purchased $100,000 of raw materials on credit.

b. Materials requisitions show the following materials used for the month.

Job 201

Job 202

Total direct materials

Indirect materials

Total materials used.

Job 201

Job 202

Total direct labor

$ 48,200

23,600

c. Time tickets show the following labor used for the month.

Indirect labor

Total labor used

71,800

8,620

$ 80,420

$ 39,200

12,600

51,800

24,200

$ 76,000

d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost.

e. Transferred Job 201 to Finished Goods Inventory.

f. (1) Sold Job 201 for $163,760 on credit. (2) Record cost of goods sold for Job 201.

g. Incurred the following actual other overhead costs for the month.

Depreciation of factory equipment

Rent on factory building (payable)

Factory utilities (payable)

Expired factory insurance.

Total other factory overhead costs

$ 32,000

500

800

3,000

$ 36,300

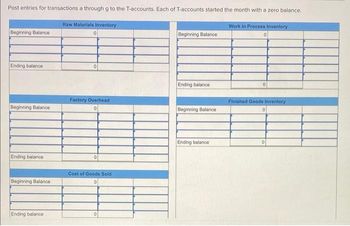

Transcribed Image Text:Post entries for transactions a through g to the T-accounts. Each of T-accounts started the month with a zero balance.

Beginning Balance

Ending balance

Beginning Balance

Ending balance

Beginning Balance

Ending balance

Raw Materials Inventory

0

Factory Overhead

0

Cost of Goods Sold

0

0

Beginning Balance

Ending balance

Beginning Balance

Ending balance

Work In Process Inventory

0

Finished Goods Inventory

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question: X Company began manufacturing operations on January 1. The following information is for the year: Direct materials purchased $5,260 Direct materials used Overhead $4,198 $24,991 As of December 31, all jobs were finished, but there were four jobs that were not sold, with costs totaling $1,358. Cost of goods sold for the year was $38,987. What was direct labor for the year?arrow_forwardJournal Entries, T-Accounts Lincoln Brothers Company makes jobs to customer order. During the month of May, the following occurred: a. Materials were purchased on account for $45,760. b. Materials totaling $40,880 were requisitioned for use in producing various jobs. c. Direct labor payroll for the month was $19,200 with an average wage of $12 per hour. d. Actual overhead of $8,860 was incurred and paid in cash. e. Manufacturing overhead is charged to production at the rate of $5.40 per direct labor hour. f. Completed jobs costing $59,000 were transferred to Finished Goods. g. Jobs costing $58,000 were sold on account for $ 73,850. Make the entry to record the revenue from the sale first, followed by the entry to record the cost of the jobs. Beginning balances as of May 1 were: Materials Inventory Work-in-Process Inventory Finished Goods Inventory Required: $1,300 3,400 2,640 1 more notification 1. Prepare the journal entries for the preceding events.arrow_forwardUsing the attached Prepare a schedule of cost of goods manufactured.arrow_forward

- Please answer this questionarrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Information on Kwon Manufacturing’s activities for its first month of operations follows: Purchased $100,100 of raw materials on credit. Materials requisitions show the following materials used for the month. Job 201 $ 48,300 Job 202 23,700 Total direct materials 72,000 Indirect materials 8,720 Total materials used $ 80,720 Time tickets show the following labor used for the month. Job 201 $ 39,300 Job 202 12,700 Total direct labor 52,000 Indirect labor 24,300 Total labor used $ 76,300 Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. Transferred Job 201 to Finished Goods Inventory. (1) Sold Job 201 for $164,060 on credit. (2) Record cost of goods sold for Job 201. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment $ 32,100 Rent on factory building (payable) 510 Factory…arrow_forwardExpedition Company worked on five jobs during May: Jobs A10, B20, C30, D40, and E50. At the end of May, the job cost sheets for these five jobs contained the following data: Beginning balance Charged to the jobs during May: Direct materials Direct labor Manufacturing overhead applied Units completed Units sold during May Job A10 $ 223 $260 $ 240 $ 267 270 0 Cost of goods sold for May Finished goods inventory at the end of May 1 Work in process inventory at the end of May. Job 820 $ 240 $ 240 $ 250 $ 280 0 0 Required: 1. What is the cost of goods sold for May? 2. What is the total value of the finished goods inventory at the end of May? 3. What is the total value of the work in process inventory at the end of May? Note: Round your intermediate calculations to 2 decimal places. Job C30 $ 226 $ 290 $ 155 $ 119 125 125 Job D40 $ 204 $ 185 $ 270 $216 0 Job E50 $ 260 Jobs A10, C30, and E50 were completed during May. Jobs B20 and D40 were incomplete at the end of May. There was no finished.…arrow_forward

- [The following information applies to the questions displayed below.]Information on Kwon Manufacturing’s activities for its first month of operations follows: Purchased $101,700 of raw materials on credit. Materials requisitions show the following materials used for the month. Job 201 $ 49,900 Job 202 25,300 Total direct materials 75,200 Indirect materials 10,320 Total materials used $ 85,520 Time tickets show the following labor used for the month. Job 201 $ 40,900 Job 202 14,300 Total direct labor 55,200 Indirect labor 25,900 Total labor used $ 81,100 Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. Transferred Job 201 to Finished Goods Inventory. (1) Sold Job 201 for $168,860 on credit. (2) Record cost of goods sold for Job 201. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment $ 33,700 Rent on factory building (payable)…arrow_forwardKelley Company shows the following costs for three jobs worked on in April Balances on March 31 Direct materials (in March) Direct labor (in March) Applied overhead (March) Costs during April Direct materials Direct labor Applied overhead Status on April 30 Additional Information Job 306 Job 387 Job 308 $31,000 22,080 11,000 $ 38,000 19,000 9,508 137,000 80,000 7 223,000 155,000 $ 101,000 105,000 7 Finished Finished (sold) (unsold) In process a. Raw Materials Inventory has a March 31 balance of $85,000. b. Raw materials purchases in April are $502,000, and total factory payroll cost in April is $374,000. c. Actual overhead costs incurred in April are Indirect materials, $51,000; Indirect labor. $24,000; factory rent, $33,000; factory utilities. $20,000; and factory equipment depreciation. $53,000. d. Predetermined overhead rate is 50% of direct labor cost e. Job 306 is sold for $610,000 cash in April. Complete this question by entering your answers in the tabs below. Requirement…arrow_forwardHelparrow_forward

- Expedition Company worked on five jobs during May: Jobs A10, B20, C30, D40, and E50. At the end of May, the job cost sheets for these five jobs contained the following data: Beginning balance Charged to the jobs during May: Direct materials Direct labor Manufacturing overhead applied Units completed Units sold during May Job A10 $ 213 $250 $ 230 $ 257 260 0 Job B20 $ 230 $ 230 $ 240 $ 270 0 0 Job C30 $ 222 $ 280 $ 150 $ 118 120 120 Job D40 $ 198 $ 180 $ 260 $212 0 0 Job E50 $255 Required: 1. What is the cost of goods sold for May? Note: Round "Unit product cost" to 2 decimal places and final answer to nearest dollar amount. 2. What is the total value of the finished goods inventory at the end of May? Note: Round "Unit product cost" to 2 decimal places and final answer to nearest dollar amount. 3. What is the total value of the work in process inventory at the end of May? $360 $290 $265 290 240 Jobs A10, C30, and E50 were completed during May. Jobs B20 and D40 were incomplete at the end…arrow_forwardJupiter Manufacturing began business on January 1. During its first year of operation, Jupiter worked on five industrial jobs and reported the following information at year-end: Direct Materials Direct Labor Allocated Mfg. Overhead Job completed Job sold Jul 10 Revenues $25,000 What was the balance in Work-in-Process OA. $2,400 OB. $1,100 OC. $2,800 OD. $2,100 Job 1 $1,000 12,000 1,500 Click to select your answer Jun 30 Job 2 $7,500 20,000 6,000 Job 3 $4,000 13,000 2,500 Sep 1 Sep 12 $39,000 Inventory at year-end? Oct 15 Not sold N/A Job 4 $3,500 12,000 7,500 Job 5 $1,700 Not sold N/A 700 400 Not Nov 1 completed N/A N/Aarrow_forwardMetropolitans Manufacturing generated the following activity for July for its current jobs. Total costs accumulated in the Work-in-Process account. Manufacturing overhead was allocated at $32 per machine hour used.1. Complete the Job Costs for each job listed below. Job 123 Job 124 Job 125 Total July 1 Balance $16,230 $12,680 $11,170 $40,080 Direct Materials Used $11,710 $18,920 $11,990 $42,620 Direct Labor Assigned to Jobs $14,520 $21,460 $7,480 $43,460 Manufacturing Overhead allocated to jobs Total Cost per Job Machine Hours used per job 410 390 70 2. Prepare the journal entry for completion of jobs 123 and 124 in July.Journal Date Description Debit Credit Open a T-account for Work-in-Process Inventory.3. Post the journal entry made in above. Compute the ending balance in the Work-in-Process Inventory account on July 31.Work-in-Process Debit Credit Double line Double line 4.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education