FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![[The following information applies to the questions displayed below.]

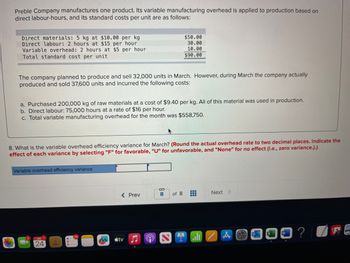

Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on

direct labour-hours, and its standard costs per unit are as follows:

Direct materials: 5 kg at $10.00 per kg

Direct labour: 2 hours at $15 per hour

Variable overhead: 2 hours at $5 per hour

Total standard cost per unit

The company planned to produce and sell 32,000 units in March. However, during March the company actually

produced and sold 37,600 units and incurred the following costs:

a. Purchased 200,000 kg of raw materials at a cost of $9.40 per kg. All of this material was used in production.

b. Direct labour: 75,000 hours at a rate of $16 per hour.

c. Total variable manufacturing overhead for the month was $558,750.

7. What is the variable overhead spending variance for March? (Do not round intermediate calculations. Round the actual overhead

rate to two decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for

no effect (i.e., zero variance.).)

Variable overhead rate variance

$50.00

30.00

10.00

$90.00

< Prev

7

8

of 8 HB

Next >](https://content.bartleby.com/qna-images/question/15c83c94-5314-4a21-9e70-4aa8e53c29f2/b26233a6-01aa-4295-81c0-5bc26cb319bd/yceirr_thumbnail.jpeg)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on

direct labour-hours, and its standard costs per unit are as follows:

Direct materials: 5 kg at $10.00 per kg

Direct labour: 2 hours at $15 per hour

Variable overhead: 2 hours at $5 per hour

Total standard cost per unit

The company planned to produce and sell 32,000 units in March. However, during March the company actually

produced and sold 37,600 units and incurred the following costs:

a. Purchased 200,000 kg of raw materials at a cost of $9.40 per kg. All of this material was used in production.

b. Direct labour: 75,000 hours at a rate of $16 per hour.

c. Total variable manufacturing overhead for the month was $558,750.

7. What is the variable overhead spending variance for March? (Do not round intermediate calculations. Round the actual overhead

rate to two decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for

no effect (i.e., zero variance.).)

Variable overhead rate variance

$50.00

30.00

10.00

$90.00

< Prev

7

8

of 8 HB

Next >

Transcribed Image Text:Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on

direct labour-hours, and its standard costs per unit are as follows:

Direct materials: 5 kg at $10.00 per kg

Direct labour: 2 hours at $15 per hour

Variable overhead: 2 hours at $5 per hour

Total standard cost per unit

The company planned to produce and sell 32,000 units in March. However, during March the company actually

produced and sold 37,600 units and incurred the following costs:

a. Purchased 200,000 kg of raw materials at a cost of $9.40 per kg. All of this material was used in production.

b. Direct labour: 75,000 hours at a rate of $16 per hour.

c. Total variable manufacturing overhead for the month was $558,750.

8. What is the variable overhead efficiency variance for March? (Round the actual overhead rate to two decimal places. Indicate the

effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.).)

Variable overhead efficiency variance

2

JAN 1

24

$50.00

30.00

10.00

$90.00

< Prev

sty

S

8 of 8

Next >

E

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 5.50 Direct labor $ 3.00 Variable manufacturing overhead $ 1.50 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 2.50 Fixed administrative expense $ 2.00 Sales commissions $ 1.00 Variable administrative expense $ 0.50 9. If 8,000 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production?arrow_forwardJT Engineering's normal capacity is 20,000 direct labor hours. If JT's variable costs are $26,400 and its fixed costs are $14,900 when the company runs at normal capacity, what is its standard manufacturing overhead rate per unit? A. $2.07 B. $0.75 C. $1.32 D. $0.48arrow_forwardA company manufactures a product with three models, each with different direct material costs and labour hour required and monthly production volume as follows: Model A Model B Model C |Units of production Labour hour required | Direct material costs 1,700 1,200 0.6 1,100 0.3 0.7 30 40 50 Labor rate is $10 per hour. The total manufacturing overhead is estimated to be $103,000 per month. Required: a) The manufacturing overhead is allocated to the three models based on labor hour. Compute the pre-determined overhead rate and the unit product cost of Model A. b) The company is considering to use the activity-based costing and gathers the following data related to the cost and activities: Expected Activity Activity Cost Pool Overhead Costs Model A Model B Model C Activity 1 $30,000 1,000 600 400 Activity 2 General Factory $17,000 1,700 200 100 $56.000 510 660 230 Total $103.000 i. Compute the activity rate for each activity. ii. Compute the unit product costs of Model A and Model B.arrow_forward

- artinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 6.50 Direct labor $ 4.00 Variable manufacturing overhead $ 1.60 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 3.50 Fixed administrative expense $ 2.20 Sales commissions $ 1.20 Variable administrative expense $ 0.45 Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 10,000 units? (Do not round intermediate calculations.)arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labour-hours, and its standard costs per unit are as follows: Direct materials: 5 kg at $10.00 per kg Direct labour: 2 hours at $15 per hour Variable overhead: 2 hours at $5 per hour Total standard cost per unit The company planned to produce and sell 32,000 units in March. However, during March the company actually produced and sold 37,600 units and incurred the following costs: a. Purchased 200,000 kg of raw materials at a cost of $9.40 per kg. All of this material was used in production. b. Direct labour: 75,000 hours at a rate of $16 per hour. c. Total variable manufacturing overhead for the month was $558,750. 5. What is the labour rate variance for March? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.). Do not round intermediate calculations.) Labour rate variancearrow_forwardCO Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 00 ZT Total standard variable cost per unit 00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising Sales salaries and commissions Shipping expenses $10.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. C. Total variable manufacturing overhead for the month was $390,600.…arrow_forward

- The Jaguar Company, which manufactures electrical switches, uses a standard costing system and carries all inventories at standard. The standard manufacturing overhead costs per switch are based on direct labor hours and are shown below: Variable MOH (5 hours @ $12 per DMfgL hour) Fixed MOH (5 hours @ $15* per DMfgL hour) Total MOH per switch *Based on a capacity of 200,000 DMfgL hours per month The following information is available for the month of October: > 46,000 switches were produced, although 40,000 switches were scheduled to be produced. > 225,000 DMfgL hours were worked at a total cost of $5,625,000. Actual variable MOH costs were $2,750,000. Actual fixed MOH costs were $3,050,000. $ 60 75 $135 1. Compute the variable MOH spending, efficiency, and flexible-budget variances, and the allocated variable MOH costs.arrow_forwardKoontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Direct materials: Standard: 1.80 feet at $2.20 per foot Actual: 1.75 feet at $2.40 per foot Direct labor: Standard: 0.90 hour at $14.00 per hour Actual: 0.95 hour at $13.40 per hour Variable overhead: Standard: 0.90 hour at $5.00 per hour Actual: 0.95 hour at $4.60 per hour Total cost per unit Excess of actual cost over standard cost per unit Required 1 Standard Cost per Unit $3.96 Required 2 12.60 Required 3 4.50 Complete this question by entering your answers in the tabs below. $ 21.06 1a. Materials price variance 1a. Materials quantity variance 1b. Labor rate variance 1b. Labor efficiency variance 1c. Variable overhead rate variance 1c. Variable overhead efficiency variance The production superintendent was pleased when he saw this report and commented: "This $0.24 excess cost is well within the 5 percent limit management has set for…arrow_forwardMartinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 6.50 Direct labor $ 4.00 Variable manufacturing overhead $ 1.60 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 3.50 Fixed administrative expense $ 2.20 Sales commissions $ 1.20 Variable administrative expense $ 0.45 15. What incremental manufacturing cost will Martinez incur if it increases production from 10,000 to 10,001 units? (Round your answer to 2 decimal places.)arrow_forward

- Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 8 pounds at $10.00 per pound Direct labor: 5 hours at $13 per hour Variable overhead: 5 hours at $8 per hour Total standard variable cost per unit $ 80.00 65.00 40.00 $ 185.00 The company also established the following cost formulas for its selling expenses: Advertising Sales salaries and commissions Shipping expenses Fixed Cost per Month $ 290,000 $ 280,000 Variable Cost per Unit Sold $ 21.00 $ 12.00 The planning budget for March was based on producing and selling 15,000 units. However, during March the company actually produced and sold 17,000 units and incurred the following costs: a. Purchased 170,000 pounds of raw materials at a cost of $8.00 per pound. All of this material was used in production. b. Direct-laborers worked 64,000 hours at a rate of $14.00 per hour. c. Total variable…arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 8 pounds at $10.00 per pound $ 80.00 Direct labor: 5 hours at $13 per hour 65.00 Variable overhead: 5 hours at $8 per hour 40.00 Total standard variable cost per unit $ 185.00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising $ 290,000 Sales salaries and commissions $ 280,000 $ 21.00 Shipping expenses $ 12.00 The planning budget for March was based on producing and selling 15,000 units. However, during March the company actually produced and sold 17,000 units and incurred the following costs: a. Purchased 170,000 pounds of raw materials at a cost of $8.00 per pound. All of this material was used in production. b. Direct-laborers worked 64,000 hours at a rate…arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $9.00 per pound Direct labor: 3 hours at $15 per hour Variable overhead: 3 hours at $6 per hour Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Advertising Sales salaries and commissions Shipping expenses Fixed Cost per Month $36.00 45.00 18.00 $99.00 $ 210,000 $ 120,000 Variable manufacturing overhead cost Variable Cost per Unit Sold $ 13.00 $ 4.00 The planning budget for March was based on producing and selling 26,000 units. However, during March the company actually produced and sold 31,000 units and incurred the following costs: a. Purchased 155,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. b. Direct-laborers worked 56,000 hours at a rate of $16.00…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education