FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

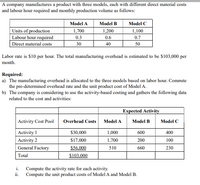

Transcribed Image Text:A company manufactures a product with three models, each with different direct material costs

and labour hour required and monthly production volume as follows:

Model A

Model B

Model C

|Units of production

Labour hour required

| Direct material costs

1,700

1,200

0.6

1,100

0.3

0.7

30

40

50

Labor rate is $10 per hour. The total manufacturing overhead is estimated to be $103,000 per

month.

Required:

a) The manufacturing overhead is allocated to the three models based on labor hour. Compute

the pre-determined overhead rate and the unit product cost of Model A.

b) The company is considering to use the activity-based costing and gathers the following data

related to the cost and activities:

Expected Activity

Activity Cost Pool

Overhead Costs

Model A

Model B

Model C

Activity 1

$30,000

1,000

600

400

Activity 2

General Factory

$17,000

1,700

200

100

$56.000

510

660

230

Total

$103.000

i.

Compute the activity rate for each activity.

ii.

Compute the unit product costs of Model A and Model B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kubin Company’s relevant range of production is 16,000 to 24,500 units. When it produces and sells 20,250 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 7.70 Direct labor $ 4.70 Variable manufacturing overhead $ 2.20 Fixed manufacturing overhead $ 5.70 Fixed selling expense $ 4.20 Fixed administrative expense $ 3.20 Sales commissions $ 1.70 Variable administrative expense $ 1.20 Required: 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 20,250 units? b. What is the total indirect manufacturing cost incurred to make 20,250 units? 2. Assume the cost object is the Manufacturing Department and that its total output is 20,250 units. a. How much total manufacturing cost is directly traceable to the Manufacturing Department? b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department? 3. Assume…arrow_forwardSpates, Incorporated, manufactures and sells two products: Product H2 and Product E0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours Product H2 200 7.0 1,400 Product E0 200 6.0 1,200 Total direct labor-hours 2,600 The company’s expected total manufacturing overhead is $271,468. If the company allocates all of its overhead based on direct labor-hours, the overhead assigned to each unit of Product H2 would be closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forwardAcme Company manufactures and sells two products, Product A and Product B. Acme's total manufacturing overhead cost is $168,000, and Acme applies overhead to jobs using three activity-based overhead rates, computed as follows: Activity Cost pool ? ? Machine hours Allocation base Number of setups Setups Machining Packaging .$15,000 Units packed O $33.60 O $31.20 O $36.60 O $37.20 Units of allocation base Product A Product B 20 setups 20 setups 1,000 hours 150 units ? 350 units Allocation rate $450 per setup $27 per MH ? If Acme decides to use a plantwide overhead rate with machine hours as the allocation base, what would be its plantwide overhead rate?arrow_forward

- P Alvarez Company makes three joint products, products A, B, and C. For each batch, the materials cost is $22,500, direct labor cost is $6,600, and manufacturing overhead is $13,900. From each batch, the company makes 4,300 pounds of A, 3,200 pounds of B, and 2,500 pounds of C. Required: a. What are the total joint costs for each batch of the products? b. Allocate the joint costs to each of the three products. c. Determine the cost per pound for product A. a. Total joint costs b. Amount of joint costs allocated to A b. Amount of joint costs allocated to B b. Amount of joint costs allocated to C c. Cost for product A per poundarrow_forwardLanders Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard cost per unit Actual costs used in production of 12,000 units Direct 1.80 feet at $3.00 per 24,000 feet purchased at a total cost of materials foot $69,900, used only 21,000 feet in production Direct 0.90 hours at $18.00 11,400 hours at $17.40 per hour labor per hour Variable 0.90 hours at $5.00 11,400 hours at a total cost of $62,600 overhead per hour Required: 1. Compute the total standard cost per unit and total actual cost per unit. How much is the difference between the actual unit costs and standard cost? 2. Compute the following variances for May: Materials quantity and price variances. а. b. Labor efficiency and rate variances. Variable overhead efficiency and rate variances. с. 3. Discuss the main reasons for the difference between the actual unit costs and standard cost you computed in (1).arrow_forwardKrypton Inc. manufactures two products, Vintex and Bromal. The company estimated it would incur $160,690 in manufacturing overhead costs during the current period. Overhead currently is applied to the products on the basis of direct labour hours. Data concerning the current period's operations appear below: Vintex Bromal Estimates Volume 4700 units 3300 units Direct labour hours per unit 2.1 hours 1.6 hours Direct labour cost per unit $33.60 $25.60 Direct material cost per unit $4.80 $12.70 The company is considering using an activity-based costing system to compute unit product costs instead of its traditional single plant-wide system based on direct labour hours. The activity based costing…arrow_forward

- Ashvinarrow_forwardShip Co. produces storage crates that require 1.2 meters of material at $.85 per meter and 0.1 direct labor hours at $15.00 per hour. Overhead is applied at the rate of $9 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card?arrow_forwardA VACUUM MANAUFACTUER HAS PREPARED THE FOLLOWING HAS THE FOLLOWING COST DATA FOR MANUFACTURING ONE OF ITS ENGINE COMPONENTS BASED ON THE ANNUAL PRODUCTION OF 50,000 UNITS DIRECT MATERIALS $75,000 DIRECT LABOR $100,000 TOTAL $175,000 IN ADDITION, VARIABLE FACTORY OVERHEAD IS APPLIED AT $7.50 PER UNIT.arrow_forward

- A company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $84,399 and the cost drivers for Product 1 is 200 and 500 for Product 2. The assembling activity pool has estimated costs of $65,366 and the cost drivers for Product 1 is 350 and 275 for Product 2. Direct labor hours for Product 1 is 323 and 371 for Product 2. What is the total manufacturing overhead rate to be used under traditional cost accounting?arrow_forwardHenry Company has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40/kg Direct Labor $ 3.00 0.40 hour $ 7.50/hour Variable Overhead $ 4.00 0.40 hour $ 10.00/hour Fixed Overhead* $ 4.80 0.40 hour $ 12.00/hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100 and $25,000, respectively.…arrow_forwardFleurant, Inc., manufactures and sells two products: Product W2 and Product P8. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours Product W2 400 5 2,000 Product P8 500 4 2,000 Total direct labor-hours 4,000 The direct labor rate is $37.10 per DLH. The direct materials cost per unit is $203.60 for Product W2 and $140.30 for Product P8. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Pools Activity Measures Overhead Cost Product W2 Product P8 Total Labor-related DLHs $ 218,576 2,000 2,000 4,000 Production orders orders 18,538 400 380 780 Order size MHs 202,886 3,880 3,680 7,560 $ 440,000 Which of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education