FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

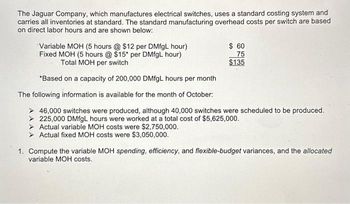

Transcribed Image Text:The Jaguar Company, which manufactures electrical switches, uses a standard costing system and

carries all inventories at standard. The standard manufacturing overhead costs per switch are based

on direct labor hours and are shown below:

Variable MOH (5 hours @ $12 per DMfgL hour)

Fixed MOH (5 hours @ $15* per DMfgL hour)

Total MOH per switch

*Based on a capacity of 200,000 DMfgL hours per month

The following information is available for the month of October:

> 46,000 switches were produced, although 40,000 switches were scheduled to be produced.

> 225,000 DMfgL hours were worked at a total cost of $5,625,000.

Actual variable MOH costs were $2,750,000.

Actual fixed MOH costs were $3,050,000.

$ 60

75

$135

1. Compute the variable MOH spending, efficiency, and flexible-budget variances, and the allocated

variable MOH costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lambeth Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Cost per Unit $ 4.90 $ 2.95 $ 1.25 $ 1.00 $ 0.40 Cost per Period $ 8,000 Variable administrative expense Fixed selling and administrative expense $ 4,000 If 3,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:arrow_forwardConsider the following production and cost data for two products, X and Y, manufactured by Company. Product X Product Y Sales price per unit $52 $40 Direct materials cost per unit $18 $8 Direct labor hours per unit 1.5 1.0 Machine hours per unit 3.0 2.0 The labor rate is $10 per hour. Variable overhead is $2 per direct labor hour. The company can hire sufficient labor for any production level. The company has 15,000 machine hours available each period. There is unlimited demand for each product. Assuming a company has achieved a reasonable level of cost accuracy, what is the most important determinant of whether cost information should be even more accurate?arrow_forwardMartinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost Per Unit $ 6.20 $ 3.70 $ 1.60 $ 4.00 $ 3.20 $2.20 $ 1.20 $ 0.45 11. If 8,000 units are produced, what is the total manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per-unit basis? Note: Round your "per unit" answer to 2 decimal places. Total manufacturing overhead cost Manufacturing overhead per unitarrow_forward

- Fleurant, Inc., manufactures and sells two products: Product W2 and Product P8. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours Product W2 400 5 2,000 Product P8 500 4 2,000 Total direct labor-hours 4,000 The direct labor rate is $37.10 per DLH. The direct materials cost per unit is $203.60 for Product W2 and $140.30 for Product P8. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Pools Activity Measures Overhead Cost Product W2 Product P8 Total Labor-related DLHs $ 218,576 2,000 2,000 4,000 Production orders orders 18,538 400 380 780 Order size MHs 202,886 3,880 3,680 7,560 $ 440,000 Which of the…arrow_forwardThe following information applies to the questions displayed below.]Antuan Company set the following standard costs per unit for its product. Direct materials (5.0 pounds @ $6.00 per pound) $ 30.00 Direct labor (1.9 hours @ $11.00 per hour) 20.90 Overhead (1.9 hours @ $18.50 per hour) 35.15 Standard cost per unit $ 86.05 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 30,000 Indirect labor 75,000 Power 30,000 Maintenance 30,000 Total variable overhead costs 165,000 Fixed overhead costs Depreciation—Building 24,000 Depreciation—Machinery 70,000 Taxes and insurance 18,000 Supervisory salaries 250,250 Total fixed overhead costs 362,250 Total overhead costs $ 527,250 The…arrow_forwardLagle Corporation has provided the following information: Cost per Cost per Unit Period Direct materials $5.25 Direct labor $3.90 $1.40 Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense $7,200 $1.80 $0.30 $6,600 Fixed selling and administrative expense If 4,500 units are sold, the variable cost per unit sold is closest to:arrow_forward

- Godiva company has two products, A and B. The company uses activity-based costing to allocate overhead costs of $100,000. Data relating to the company's activity pools for the current year are given below: Cost Pool Total cost in Total Number of Activity Measures Used Cost Pool Product A Product B Total Activity 1 $42,000 100 200 300 Activity 2 $10,000 20 5 25 Activity 3 $48,000 3,000 3,000 6,000 Compute the activity rate (allocation rate) for Activity 2: $500 $2,000 $400 $140arrow_forwardVitex, Inc. manufactures a popular consumer product and it has provided the following data excerpts from its standard cost system: Inputs (1)StandardQuantityor Hours (2)StandardPriceor Rate StandardCost(1) × (2) Direct materials 6 pounds $3 per pound $ 18.00 Direct labor 0.8 hours $15 per hour 12.00 Variable manufacturing overhead 0.8 hours $3 per hour 2.40 Total standard cost per unit $32.40 TotalStandardCost* Variances Reported Priceor Rate Quantity orEfficiency Direct materials $405,000 $6,900 F $9,000 U Direct labor $ 270,000 $14,550 U $21,000 U Variable manufacturing overhead $54,000 $1,300 F $? U *Applied to Work in Process during the period. The company’s manufacturing overhead cost is applied to production on the basis of direct labor-hours. All of the materials purchased during the period were used in production. Work in process inventories are insignificant and can be ignored. Required: How many units were produced last…arrow_forwardKesterson Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense Cost per Unit $ 6.30 $ 3.30 $ 1.25 $ 1.30 $ 0.60 Cost per Period $ 15,000 $ 4,200 If 7,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:arrow_forward

- [The following information applies to the questions displayed below.] Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 5 pounds at $8.00 per pound Direct labor: 3 hours at $15 per hour Variable overhead: 3 hours at $9 per hour Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Variable Cost per Unit Sold Advertising Sales salaries and commissions Shipping expenses Fixed Cost per Month $ 350,000 $ 400,000 $ 40.00 45.00 27.00 $112.00 The planning budget for March was based on producing and selling 21,000 units. However, during March the company actually produced and sold 26,000 units and incurred the following costs: Direct labor cost $ 27.00 $18.00 a. Purchased 160,000 pounds of raw materials at a cost of $6.50 per pound. All of this material was used in production. b.…arrow_forwardPlease provide answer in text (Without image)arrow_forwardCarlise Corp., which manufactures ceiling fans, currently has two product lines, the Indoor and the Outdoor. Carlise has to overhead of $132,720. Carlise has identified the following information about its overhead activity cost pools and the two product lines: Quantity/Amount Consumed by Indoor Line Quantity/Amount Consumed by Outdoor Line Activity Cost Pools Cost Driver Materials handling Number of moves Quality control Number of inspections Machine maintenance Number of machine hours Required: 1. Suppose Carlise used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) Indoor Model Outdoor Model Total Cost Assigned to Pool $21, 120 $71,760 4,600 inspections $39,840 29,000 machine hours 19,000 machine hours 600 moves 500 moves 5,800 inspections Overhead Assignedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education