FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

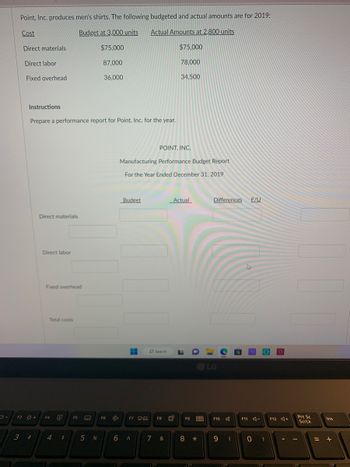

Transcribed Image Text:Point, Inc. produces men's shirts. The following budgeted and actual amounts are for 2019:

Cost

Budget at 3,000 units Actual Amounts at 2,800 units

$75,000

87,000

Direct materials

Direct labor

Fixed overhead

Instructions

Prepare a performance report for Point, Inc. for the year.

Direct materials

Direct labor

Fixed overhead

Total costs

F3 + F4 Ⓡ

3 # 4 $

F5

36,000

5 %

F6

Budget

F7 C

Manufacturing Performance Budget Report

For the Year Ended December 31, 2019

6 A

POINT, INC.

Search

F8

$75,000

7 &

78,000

34,500

0:

Actual

F9 60

8 *

Differences F/U

LG

F10

9 (

F11 -

0)

F12 +

Prt Sc

ScrLk

Ins

= +

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject : Accountingarrow_forwardPlease show calculationarrow_forwardHoward Temple, Inc., expects to sell 20,000 pool cues for $12.00 each. Direct materials costs are $2.00, direct man $4.00, and manufacturing overhead is $0.80 per pool cue. The following inventory levels apply to 2020: Beginning Inventory Ending Inventory Direct materials 24,000 units 24,000 units Work-in-Process Inventory 0 units O units Finished Goods Inventory 2,000 units 2,500 units What are the 2020 budgeted costs for direct materials, direct manufacturing labor, and manufacturing overhead. O $48,000; S96,000; $19.200 O $44,000; $88,000, $17.600 O $41.000, $82.000; $16,400 O $40,000, S80,000: $16,000 - Previousarrow_forward

- aHRiIh mahufactures pipes and applies manufacturing overhead costs to production at a budgeted indirect-cost rate of $18 per direct labor-hour. The following data are obtained from the accounting records for June 2020: Direct materials $140,000 Direct labor (4,000 hours @ $10/hour) 40,000 Indirect labor 13,000 Plant facility rent 30,000 Depreciation on plant mach. & equip. 22,500 Sales commissions 24,000 Administrative expenses 28,000 For June 2020, manufacturing overhead is O overallocated by $6.500 Ounderallocated by $21.500 ovrcallocated by $21.500arrow_forwardConsider Derek's budget information: materials to be used, $63,300; direct labor, $199,200; factory overhead, $397,400; work in process inventory on January 1, $189,300; and work in progress inventory on December 31, $194,100. What is the budgeted cost of goods manufactured for the year? a.$655,100 b.$849,200 c.$659,900 d.$194,100arrow_forwardThe production budget for Manner Company shows units to produce as follows: July, 700; August, 760; and September, 620. Each unit produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be $17.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July 700 August 760 September 620 unitsarrow_forward

- Consider Derek's budget information: materials to be used totals $63,300; direct labor totals $202,000; factory overhead totals $393,900; work in process inventory January 1, $187,200; and work in progress inventory on December 31, $193,400. What is the budgeted cost of goods manufactured for the year?arrow_forwardEsquire Clothing is a manufacturer of designer suits For June 2020, each suit is budgeted to take 3 labor-hours. The budgeted number of suits to be manufactured in June 2020 is 1,120, Esquire Clothing allocates fixed manufacturing overhead to each suit using budgeted direct manufacturing labor-hours per suit. Data pertaining to fixed manufacturing overhead costs for June 2020 are budgeted, $57,120, and actual, $63,900. In June 2020 there were 1,140 suits started and completed. There were no beginning or ending inventories of suits Requirements 1. Compute the spending variance for fixed manufacturing overhead. Comment on the results. 2. Compute the production-volume variance for June 2020. What inferences can Esquire Clothing draw from this variance? + Requirement 1. Compute the spending variance for fixed manufacturing overhead. Comment on the results Begin by computing the following amounts for the fixed manufacturing overhead Actual Costs Incurred Same Budgeted Lump Sum Regardless of…arrow_forwardD’s Company Ltd expects to have a cash balance of $45000 on March 1, 2024.Relevant monthly budget data for the months of March and April are as follows:• Collections from customers: March $85000; April $150000• Payments for direct materials: March $50000; April $75000• Direct labour: March $30000; April $45000. Wages are paid in the month they are incurred.• Manufacturing overhead: March $21000; April $25000. These costs include depreciation of$1500 per month. All other overhead costs are paid as incurred.• Selling and administrative expenses: March $15000; April $20000. These costs are exclusive ofdepreciation. They are paid as incurred.• Sales of marketable securities in March are expected to be realised $12000 in cash.D’s Company Ltd. has a line of credit at a local bank that enables it to borrow up to$25000. Thecompany wants to maintain a minimum monthly cash balance of $20000. prepare cash budgets for march n april 2024arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education