FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

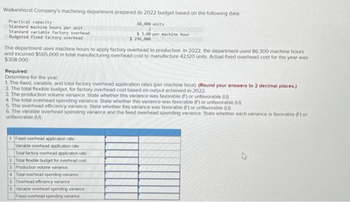

Transcribed Image Text:Walkenhorst Company's machining department prepared its 2022 budget based on the following data

Practical capacity

Standard machine hours per unit

Standard variable factory overhead

Budgeted fixed factory overhead

The department uses machine hours to apply factory overhead to production. In 2022, the department used 86,300 machine hours

and incurred $565,000 in total manufacturing overhead cost to manufacture 42,120 units. Actual fixed overhead cost for the year was

$308,000

40,000 units

$3.00 per machine hour

$ 290,000

Required:

Determine for the year

1. The fixed, variable, and total factory overhead application rates (per machine hour) (Round your answers to 2 decimal places)

2. The total flexible budget, for factory overhead cost based on output achieved in 2022.

3. The production volume variance State whether this variance was favorable (F) or unfavorable (U)

4. The total overhead spending variance. State whether this variance was favorable (F) or unfavorable (U)

5. The overhead efficiency variance. State whether this variance was favorable (F) or unfavorable (U).

6. The variable overhead spending variance and the foxed overhead spending variance. State whether each variance is favorable (F) or

unfavorable (U)

1 Fixed overhead application rate

Variable overhead application rate

Total factory overhead application rate

2. Total flexible budget for overhead cost

3 Production volume variance

4 Total overhead spending variance

5 Overhead efficiency vanance

6 Vanable overhead spending variance

Fixed overhead spending variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Define Overhead rate.

VIEW Step 2: 1. Compuation of Fixed,variable and total overhead rate

VIEW Step 3: 2. Computation of Total flexible budget

VIEW Step 4: 3. Computation of Production volume variance

VIEW Step 5: 4. Compute the total overhead variance

VIEW Step 6: 5. Computation of overhead efficiency variance

VIEW Step 7: 6. Compute the fixed and variable overhead spending variance

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Echo Amplifiers prepared the following sales budget for the first quarter of 2018: Jan. Feb. Mar. Units BOD Sales price $100 $100 Budgeted sales $80,000 $130,000 $100,000 It also has this additional information related to its expenses: Direct material per unit Direct labor per unit Variable manufacturing overhead per hour Fixed manufacturing overhead per month Sales commissions per unit Sales salaries per month Delivery expense per unit Factory utilities per month Administrative salaries per month Marketing expenses per month Insurance expense per month Depreciation expense per month Budgeted Sales in Units Variable Expenses Sales Commissions 1,300 Delivery Total Variable Expenses Fixed Expenses Sales Salaris $100 Administrative Salaries Marketing Expenses Insurance Expense Depreciation Expense 1,500 Total Fixed Expenses Total Selling and Administrative Expenses $1.50 2 Prepare a sales and administrative expense budget for each month in the quarter ending March 31, 2018. Enter all…arrow_forwardIvanhoe, Inc. produces men's shirts. The following budgeted and actual amounts are for 2022: Cost Direct materials Direct labor Fixed overhead Budget at 2,650 units $66,250 71.550 39.050 Actual Amounts at 2,950 units $76,500 78,750 38,200arrow_forwardA9arrow_forward

- Point, Inc. produces men's shirts. The following budgeted and actual amounts are for 2019: Cost Budget at 3,000 units Actual Amounts at 2,800 units $75,000 87,000 Direct materials Direct labor Fixed overhead Instructions Prepare a performance report for Point, Inc. for the year. Direct materials Direct labor Fixed overhead Total costs F3 + F4 Ⓡ 3 # 4 $ F5 36,000 5 % F6 Budget F7 C Manufacturing Performance Budget Report For the Year Ended December 31, 2019 6 A POINT, INC. Search F8 $75,000 7 & 78,000 34,500 0: Actual F9 60 8 * Differences F/U LG F10 9 ( F11 - 0) F12 + Prt Sc ScrLk Ins = +arrow_forwardPlease help me to solve this problemarrow_forwardBlue Spruce Welding rebuilds spot welders for manufacturers. The following budgeted cost data for 2022 is available for Blue Spruce. Technicians' wages and benefits Parts manager's salary and benefits Office employee's salary and benefits Other overhead (a) Total budgeted costs Compute the rate charged per hour of labor. Time Charges $202,800 Labor rate $ 39,000 7,800 $249,600 The company desires a $39 profit margin per hour of labor and a 28% profit margin on parts. It has budgeted for 7,800 hours of repair time in the coming year, and estimates that the total invoice cost of parts and materials in 2022 will be $416,000. Material Loading Charges per hour $39,300 14,780 29,120 $83,200arrow_forward

- aHRiIh mahufactures pipes and applies manufacturing overhead costs to production at a budgeted indirect-cost rate of $18 per direct labor-hour. The following data are obtained from the accounting records for June 2020: Direct materials $140,000 Direct labor (4,000 hours @ $10/hour) 40,000 Indirect labor 13,000 Plant facility rent 30,000 Depreciation on plant mach. & equip. 22,500 Sales commissions 24,000 Administrative expenses 28,000 For June 2020, manufacturing overhead is O overallocated by $6.500 Ounderallocated by $21.500 ovrcallocated by $21.500arrow_forwardSunland Company has accumulated the following budget data for the year 2022: 1. 2. 3. 4. 5. 6. Sales: 29,200 units; unit selling price $82 Cost of one unit of finished goods: direct materials, 2 kg at $5 per kilogram; direct labour, 3 hours at $13 per hour; and manufacturing overhead, $5 per direct labour hour Inventories (raw materials only): beginning, 9,900 kg; ending, 15,700 kg Raw materials cost: $5 per kilogram Selling and administrative expenses: $219,000 Income taxes: 30% of income before income taxes Prepare a schedule showing the calculation of the cost of goods sold for 2022. SUNLAND COMPANY Computation of Cost of Goods Sold For the Year Ending December 31, 2022 Cost of goods sold Manufacturing overhead Beginning inventory Direct materials Ending inventory Number of units sold Selling and administrative expenses Direct labour Cost of one unit of finished goods eTextbook and Media $ $ $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education