FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

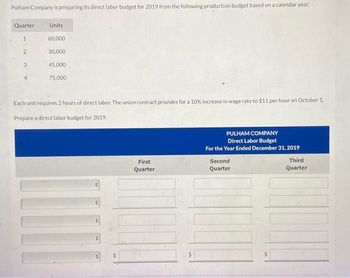

Transcribed Image Text:Pulham Company is preparing its direct labor budget for 2019 from the following production budget based on a calendar year:

Quarter Units

60,000

30,000

45,000

75,000

1

2

3

Each unit requires 2 hours of direct labor. The union contract provides for a 10% increase in wage rate to $11 per hour on October

Prepare a direct labor budget for 2019.

$

First

Quarter

PULHAM COMPANY

Direct Labor Budget

For the Year Ended December 31, 2019

Second

Quarter

Third

Quarter

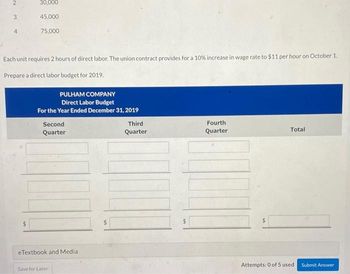

Transcribed Image Text:Pulham Company is preparing its direct labor budget for 2019 from the following production budget based on a calendar year:

Quarter Units

60,000

30,000

45,000

75,000

1

2

3

Each unit requires 2 hours of direct labor. The union contract provides for a 10% increase in wage rate to $11 per hour on October

Prepare a direct labor budget for 2019.

$

First

Quarter

PULHAM COMPANY

Direct Labor Budget

For the Year Ended December 31, 2019

Second

Quarter

Third

Quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Osprey Co. prepared a master budget for 2021 reflecting indirect material costs of $170,440 based on annual production of 153,215 widgets (the annual production is spread out equally over the twelve months). During July 2021, Osprey Co. produced 10,673 widgets incurring indirect material costs of $15,600. What was the static budget amount (in dollars) for indirect materials for July 2021?arrow_forwardRodriguez, Inc., is preparing its direct labor budget for 2020 from the following production budget based on a calendar year. Quarter Units Quarter 3 1 2 20,000 25,000 4 Units 35,000 30,000 Each unit requires 1.50 hours of direct labor. Prepare a direct labor budget for 2020. Wage rates are expected to be $16 for the first 2 quarters and $18 for quarters 3 and 4. (Round Direct labor time per unit answers to 2 decimal places, eg. 52.50.) $ $ RODRIQUEZ, INC. Direct Labor Budget 2 Quarter $ $ 3 $ $ 4 Yeararrow_forwardSheridan Company makes and sells artistic frames for pictures. The controller is responsible for preparing the master budget and has accumulated the following information for 2027. Estimated unit sales Unit selling price Direct labor hours per unit Direct labor cost per hour Beginning Materials Inventory Cost per Pound Desired Ending Inventory Direct Labor Cost per Hour Direct Labor Hours per Unit January 10,560 $60.00 $ 2.00 $ $6.00 id Media Show Transcribed Text February March April 12,320 11,440 9,680 $57.50 $57.50 $57.50 $57.50 Sheridan has a labor contract that calls for a wage increase to $7.00 per hour on April 1. New labor-saving machinery has been installed and will be fully operational by March 1. Jan 2.00 J Sheridan expects to begin the year with 15,488 frames on hand and has a policy of carrying an end-of-month inventory of 100% of the following month's sales, plus 40% of the second following month's sales. 1.50 $6.00 $6.00 $7.00 $7.00 Direct Materials per Unit Direct…arrow_forward

- Ramos Company provides the following (partial) production budget for the next three months. Each finished unit requires 0.6 hour of direct labor at the rate of $21 per hour. The company budgets variable overhead at the rate of $25 per direct labor hour and budgets fixed overhead of $8,500 per month. Production Budget April May June Units to produce 490 620 590 1. Prepare a direct labor budget for April, May, and June.2. Prepare a factory overhead budget for April, May, and June.arrow_forwardWhitmer Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.04 direct labor-hours. The direct labor rate is $9.10 per direct labor-hour. The production budget calls for producing 4,500 units In February and 5,000 units In March. Required: Prepare the direct labor budget for February and March, assuming that the direct labor work force is fully adjusted to the total direct labor-hours needed each month. (Round "labor-hours per unit" & "labor cost per hour" answers to 2 decimal places.) 12 Required production in units Direct labor-hours per unit Total direct labor-hours needed Direct labor cost per hour Total direct labor cost February Marcharrow_forwardOcak Uçan Yağlar Sanayi A.Ş. He bought 6 automatic filling machines and paid a total of 600,000 liras for them. The depreciation life of filling machines is 5 years. In this situation a) If the ordinary depreciation method is applied, what is the depreciation amount to be allocated according to the years? 4. What will be the book value at the end of the year? b) If the rapid depreciation method is applied, what is the depreciation amount to be allocated over the years? 4. What will be the book value at the end of the year?arrow_forward

- For Gundy Company, units to be produced are 5,130 in quarter 1 and 6,100 in quarter 2. It takes 1.5 hours to make a finished unit, and the expected hourly wage rate is $15 per hour.Prepare a direct labor budget by quarters for the 6 months ending June 30, 2020. GUNDY COMPANYDirect Labor Budgetchoose the accounting period For the Six Months Ending June 30, 2020June 30, 2020For the Quarter Ending June 30, 2020 Quarter 1 2 Six Months select an opening labor budget item Beginning Materials InventoryCost Per PoundDesired Ending InventoryDirect Labor Cost Per HourDirect Labor Time (Hours) Per UnitDirect Materials Per UnitDirect Materials PurchasesTotal Cost of Direct Materials PurchasesTotal Direct Labor CostTotal Materials RequiredTotal Pounds Required for ProductionTotal Required Direct Labor HoursUnits to be Produced enter a…arrow_forwardWalt Bach Company has accumulated the following budget data for the year 2019. Sales: 40000 units, unit selling price $50. Cost of one unit of finished goods: Direct materials 2 pounds at $5 per pound, direct labor 1.5 hours at $12 per hour, and manufacturing overhead $6 per direct labor hour. Inventories (raw material only): Beginning, 10000 pounds; ending, 15000 pounds. Raw materials cost: $5 per pound. Selling and administrative expenses: $200000 Income taxes: 30% of income before income taxes. Prepare a budget income statement for 2019.arrow_forwardTora Company plans to produce 1,020 units in July. Each unit requires three hours of direct labor. The direct labor rate is $11 per hou. Prepare a direct labor budget for July TORA CO. Direct Labor Budget July Units to produce 1.020 units Direct labor hours needed Cost of direct laborarrow_forward

- 1.2 REQUIRED Use the information provided below to prepare the Direct Materials Purchases Budget for April 2019. INFORMATION The estimated sales volumes of Product Jip of Polo Manufacturers for April and May 2019 are as follows: Units April 18 000 May 15 000 The policy of Polo Manufacturers is to maintain a finished goods closing inventory each month at a level equal to 40% of the next month's budgeted sales. Each unit of Product Jip requires 2 kg of Material A and 1 kg of Material B. The costs per kg of Material A and Material B are R10 and R20 respectively. Inventories of materials are expected to be as follows: Material A Material B Opening inventory 5 000 kg 6 000 kg Closing inventory 1 000 kg 2 000 kgarrow_forwardIn Ayayai Company, direct labor is $20 per hour. The company expects to operate at 12,400 direct labor hours each month. In January 2027, direct labor totaling $255,440 is incurred in working 12,896 hours. (a) Your answer is correct. Prepare a static budget report. Product Line Direct Labor CA $ Budget 248,000 +A $ AYAYAI COMPANY Static Direct Labor Budget Report For the Month Ended January 31, 2027 Actual 255,440 +A Difference 7,440 i Unfavorablearrow_forwardZira Company reports the following production budget for the next four months. Each finished unit requires six pounds of direct materials, and the company wants to end each month with direct materials inventory equal to 40% of next month's production needs. Beginning direct materials inventory for April was 1,541 pounds. Direct materials cost $5 per pound. Prepare a direct materials budget for April, May, and June. (Round your answers to the nearest whole number.) April May June 642 670 676 Units to produce Check my work July 656arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education