FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

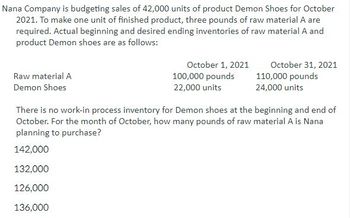

Transcribed Image Text:Nana Company is budgeting sales of 42,000 units of product Demon Shoes for October

2021. To make one unit of finished product, three pounds of raw material A are

required. Actual beginning and desired ending inventories of raw material A and

product Demon shoes are as follows:

Raw material A

Demon Shoes

October 1, 2021

100,000 pounds

22,000 units

October 31, 2021

110,000 pounds

24,000 units

There is no work-in process inventory for Demon shoes at the beginning and end of

October. For the month of October, how many pounds of raw material A is Nana

planning to purchase?

142,000

132,000

126,000

136,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 662,000 units, estimated beginning inventory is 110,000 units, and desired ending inventory is 87,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below. Material A 0.50 lb. per unit @ $0.52 per pound Material D 1.00 lb. per unit @ $2.46 per pound Material C 1.20 lb, per unit @ $1.01 per pound The dollar amount of Material t used in production during the year is O&$1571,940 Ob $1.257.552 O $2,357910 Od $1.886.320arrow_forwardPlease do not give solution in image format thankuarrow_forwardMagnolia, Inc., manufactures bedding sets. The budgeted production is for 22,100 comforters this year. Each comforter requires 7 yards of material. The estimated January 1 beginning inventory is 4,970 yards with the desired ending balance of 4,500 yards of material. If the material costs $6.50 per yard, determine the materials budget for the year.$fill in the blank 1arrow_forward

- Point, Inc. produces men's shirts. The following budgeted and actual amounts are for 2019: Cost Budget at 3,000 units Actual Amounts at 2,800 units $75,000 87,000 Direct materials Direct labor Fixed overhead Instructions Prepare a performance report for Point, Inc. for the year. Direct materials Direct labor Fixed overhead Total costs F3 + F4 Ⓡ 3 # 4 $ F5 36,000 5 % F6 Budget F7 C Manufacturing Performance Budget Report For the Year Ended December 31, 2019 6 A POINT, INC. Search F8 $75,000 7 & 78,000 34,500 0: Actual F9 60 8 * Differences F/U LG F10 9 ( F11 - 0) F12 + Prt Sc ScrLk Ins = +arrow_forwardMary's Baskets Company expects to manufacture and sell 23,000 baskets in 2019 for $6 each. There are 3,000 baskets in beginning finished goods inventory with target ending inventory of 3,000 baskets. The company keeps no work- in-process inventory. What amount of sales revenue will be reported on the 2019 budgeted income statement? O A. $120,000 B. $156,000 OC. $102,000 OD. $138,000 Calculator Nextarrow_forwardCrompton produces a product that sell at wholesale for 2.60 per unit. Budgeted production in both 2018 and 2019 was 3,000 units. There was no beginning inventory in 2018. The following data summarized the 2018 and 2019 operations: 2018, 2019 Units sold =2,500, 3,200 Units produced 3,000 3,000 Costs: Variable factory overhead per unit 0.65, 0.65 Fixed factory overhead 1,290, 1,290 Variable marketing per unit 0.80, 0.80 Fixed Selling and Administrative 650, 650 Compute variable costing operating income for the 2019.arrow_forward

- Smooth Incorporated manufactures hair brushes that sell at wholesale for $2.60 per unit. Budgeted production in both 2021 and 2022 was 4,000 units. There was no beginning inventory in 2021. The following data summarized the 2021 and 2022 operations: 2021 2022 Units sold 3,000 4,200 Units produced 4,000 4,000 Costs: Variable factory overhead per unit $ 0.55 $ 0.65 Fixed factory overhead $ 1,800 $ 1,800 Variable marketing per unit $ 0.75 $ 1.00 Fixed Selling and Administrative $ 650 $ 650 Full costing operating income for 2021 is calculated to be: (Do not round intermediate calculations. Round your final answers to whole dollar amounts.) Multiple Choice $1,450. $1,900. $1,950. $1,521. $1,569.arrow_forwardPlay-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following manufacturing costs: Direct materials $1.65 Direct labor 0.60 Variable overhead 0.80 Fixed overhead 1.90 Total unit cost $4.95 For the coming year, Play-Disc expects to make 330,000 plastic discs, and to sell 311,000 of them. Budgeted beginning inventory in units is 16,000 with unit cost of $4.95. (There are no beginning or ending inventories of work in process.) Required: Question Content Area 1. Prepare an ending finished goods inventory budget for Play-Disc for the coming year. If required, round your answers to the nearest cent. Play-DiscEnding Finished Goods Inventory BudgetFor the Coming Year Unit costs: $- Select - - Select - Overhead: - Select - - Select - Total cost per unit $fill in the blank 04d2fcfb606b005_9 Total ending inventory cost $fill in the blank 04d2fcfb606b005_10 Question Content Area 2. What…arrow_forwardCoronado Industries determines that 63000 pounds of direct materials are needed for production in July. There are 4200 pounds of direct materials on hand at July 1 and the desired ending inventory is 3600 pounds. If the cost per unit of direct materials is $3, what is the budgeted total cost of direct materials purchases? O 183600. O 190800. O 187200. O 194400.arrow_forward

- Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following manufacturing costs: Direct materials $1.65 Direct labor 0.50 Variable overhead 0.75 Fixed overhead 1.90 Total unit cost $4.80 For the coming year, Play-Disc expects to make 380,000 plastic discs, and to sell 369,000 of them. Budgeted beginning inventory in units is 20,000 with unit cost of $4.80. (There are no beginning or ending inventories of work in process.) Required: 1. Prepare an ending finished goods inventory budget for Play-Disc for the coming year. If required, round your answers to the nearest cent. Play-DiscEnding Finished Goods Inventory BudgetFor the Coming Year Unit costs: Direct materials $______ Direct labor _____ Overhead: _____ Budgeted variable overhead ______ Budgeted fixed overhead ______ Total cost per unit $______ Total ending inventory cost $_____ 2. What if sales increased to 379,000 discs? How would that…arrow_forwardMandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 625,000 units, estimated beginning inventory is 109,000 units, and desired ending inventory is 89,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A 0.50 lb. per unit @ $0.64 per poundMaterial B 1.00 lb. per unit @ $2.33 per poundMaterial C 1.20 lb. per unit @ $0.78 per poundThe dollar amount of Material B used in production during the year is a.$2,114,475 b.$1,127,720 c.$1,691,580 d.$1,409,650arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education