FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

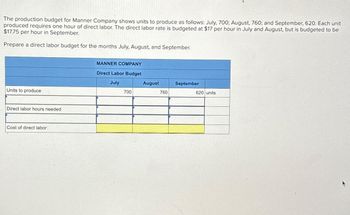

Transcribed Image Text:The production budget for Manner Company shows units to produce as follows: July, 700; August, 760; and September, 620. Each unit

produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be

$17.75 per hour in September.

Prepare a direct labor budget for the months July, August, and September.

Units to produce

Direct labor hours needed

Cost of direct labor

MANNER COMPANY

Direct Labor Budget

July

700

August

760

September

620 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Addison Company budgets production of 2,760 units during the second quarter. Information on its direct labor and its variable and fixed overhead is as follows: Direct labor Variable overhead Fixed overhead 1. Prepare a direct labor budget. 2. Prepare a factory overhead budget. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Each finished unit requires 5 direct labor hours, at a cost of $8 per hour. Budgeted at the rate of $10 per direct labor hour. Budgeted at $550,000 per quarter. Prepare a direct labor budget. Units to produce Direct labor hours needed Cost of direct labor ADDISON COMPANY Direct Labor Budget Second Quarter 2,760 unitsarrow_forwardFind the direct labor budget, and manufacturing overhead budget for the yeararrow_forwardThe direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Budgeted direct labor-hours 9,000 8,700 9,000 8,400 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $3.25 per direct labor-hour and its total fixed manufacturing overhead is $58,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $14,500 per quarter. Required: Prepare the company’s manufacturing overhead budget for the upcoming fiscal year. Compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.arrow_forward

- The production budget for Manner Company shows units to produce as follows: July, 650; August, 710; and September, 570. Each unit produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be $17.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July 650 August 710 September 570 units hsarrow_forwardYuvwell Corporation's direct labor budget for next year contained the following information: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 8,600 8,500 8,200 8,800 Budgeted direct labor-hours The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $2.75 per direct labor-hour and its total fixed manufacturing overhead is $54,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation of $13,500 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for next year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for next year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's manufacturing overhead budget for next year. Note: Round "Variable manufacturing overhead rate" answers to 2 decimal places. Variable manufacturing…arrow_forwardYuvwell Corporation's direct labor budget for next year contained the following Information: Budgeted direct labor-hours 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 8,000 8,200 8,500 7,800 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $3.25 per direct labor-hour and its total fixed manufacturing overhead is $48,000 per quarter. The only noncash Item Included in fixed manufacturing overhead is depreciation of $16,000 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for next year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for next year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's manufacturing overhead budget for next year. Note: Round "Variable manufacturing overhead rate" answers to 2 decimal places. Yuvwell Corporation…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education