FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

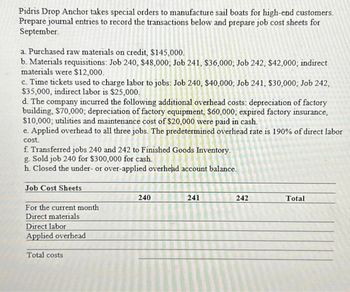

Transcribed Image Text:Pidris Drop Anchor takes special orders to manufacture sail boats for high-end customers.

Prepare journal entries to record the transactions below and prepare job cost sheets for

September.

a. Purchased raw materials on credit, $145,000.

b. Materials requisitions: Job 240, $48,000; Job 241, $36,000; Job 242, $42,000; indirect

materials were $12,000.

c. Time tickets used to charge labor to jobs: Job 240, $40,000; Job 241, $30,000; Job 242,

$35,000, indirect labor is $25,000.

d. The company incurred the following additional overhead costs: depreciation of factory

building, $70,000; depreciation of factory equipment, $60,000; expired factory insurance,

$10,000; utilities and maintenance cost of $20,000 were paid in cash.

e. Applied overhead to all three jobs. The predetermined overhead rate is 190% of direct labor

cost.

f. Transferred jobs 240 and 242 to Finished Goods Inventory.

g. Sold job 240 for $300,000 for cash.

h. Closed the under- or over-applied overhead account balance.

Job Cost Sheets

For the current month

Direct materials

Direct labor

Applied overhead

Total costs

240

241

242

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ces Christopher's Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balances at the beginning of the current year follow: Raw Materials Inventory Work in Process Inventory Finished Goods Inventory $ 15,100 5,200 20,500 The following transactions occurred during January: a. Purchased materials on account for $27,000. b. Issued materials to production totaling $21,600, 90 percent of which was traced to specific jobs and the remainder of which was treated as indirect materials. c. Payroll costs totaling $18,400 were recorded as follows: $11,500 for assembly workers $2,900 for factory supervision $1,300 for administrative personnel $2,700 for sales commissions d. Recorded depreciation: $4,100 for factory machines, $1,000 for the copier used in the administrative office. e. Recorded $1,500 of expired insurance. Forty percent was insurance on the manufacturing facility, with the remainder classified as an administrative…arrow_forwardOnline A job-order costing system at a company applied overhead to jobs using a predetermined overhead rate. During the year the company's Finished Goods inventory account was debited for $125,000 and credited for $140,500. The ending balance in the Finished Goods inventory account was $20,000. At the end of the year, manufacturing overhead was overapplied by $36,500. The balance in the Finished Goods inventory account at the beginning of the year was:arrow_forwardhelparrow_forward

- A summary of the time tickets for August follows: Description Job 321 Job 329 Job 336 Job 342 Job 346 Indirect labor a. Amount Journalize the entries for (a) the labor cost incurred and (b) the application of factory overhead to production for August. The predetermined factory overhead rate is 70% of direct labor cost. If an amount box does not require an entry, leave it blank. b. $11,000 9,200 5,000 8,300 5,700 8,000arrow_forwardEntries and Schedules for Unfinished Jobs and Completed Jobs Hildreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: Materials purchased on account, $2,130. Materials requisitioned and factory labor used: Job No. Materials Factory Labor 101 $2,710 $2,080 102 3,310 2,810 103 2,200 1,370 104 7,430 5,160 105 4,720 3,930 106 3,440 2,500 For general factory use 920 3,080 Factory overhead costs incurred on account, $5,180. Depreciation of machinery and equipment, $1,480. The factory overhead rate is $35 per machine hour. Machine hours used: Job No. Machine Hours 101 35 102 22 103 18 104 67 105 26 106 16 Total 184 Jobs completed: 101, 102, 103, and 105. Jobs were shipped and customers were billed as follows: Job 101, $7,220; Job 102, $8,270; Job 105, $12,180. Required: 1. Journalize the entries…arrow_forwarddon't give answer in image formatarrow_forward

- Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $4,860 Job 202 2,430 Job 203 1,920 Job 204 3,570 Factory supervision 1,660 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $28 per direct labor hour. The direct labor rate is $18 per hour. If required, round final answers to the nearest dollar. Question Content Area a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select - Question Content Area b. Journalize the entry to apply factory overhead to production for November. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select -arrow_forwardEntries for Direct Labor and Factory Overhead Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as fllows: Job 201 $3,650 Job 202 1,820 Job 203 1,440 Job 204 2,690 Factory supervision 1,250 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $20 per direct labor hour. The direct labor rate is $15 per hour. If required, round final answers to the nearest dollar. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payablearrow_forwardA. What are the costs of Jobs SY-400 and SY-403 at the beginning of the month and when completed? B. What is the cost of Job SY-404 at the end of the month? C. How much was under or oversupplied service overhead for the month?arrow_forward

- Entries and Schedules for Unfinished Jobs and Completed Jobs Kaymer Industries Inc. uses a job order cost system. The following data summarize the operations related to production for January, the first month of operations: Materials purchased on account, $31,150. Materials requisitioned and factory labor used: Job Materials Factory Labor 301 $3,100 $2,390 302 3,780 3,230 303 2,510 1,580 304 8,490 5,930 305 5,390 4,520 306 3,940 2,870 For general factory use 1,050 3,540 Factory overhead costs incurred on account, $5,920. Depreciation of factory machinery and equipment, $1,700. The factory overhead rate is $45 per machine hour. Machine hours used: Job Machine Hours 301 30 302 33 303 15 304 84 305 38 306 21 Total 221 Jobs completed: 301, 302, 303, and 305. Jobs were shipped and customers were billed as follows: Job 301, $8,210; Job 302, $10,190; Job 303, $13,820. Required: 1. Journalize…arrow_forwardJournalize the entry to record the factory labor costs Journalize the entry to apply factory overhead to production for November.arrow_forwardEntries for Materials Kingsford Furnishings Company manufactures designer furniture. Kingsford Furnishings uses a job order cost system. Balances on April 1 from the materials ledger are as follows: Fabric $19,900 Polyester filling 6,000 Lumber 44,600 Glue 1,900 The materials purchased during April on account are summarized from the receiving reports as follows: Fabric Polyester filling Lumber Glue Materials were requisitioned to individual jobs as follows: Polyester Filling Job 601 Job 602 Job 603 Factory overhead-indirect materials Total a. $96,300 133,900 263,900 9,100 b. Fabric $34,700 26,700 24,600 Balance, April 30 Lumber Glue $43,700 $116,900 47,500 102,400 32,300 56,900 $86,000 $123,500 $276,200 $4,500 $490,200 The glue is not a significant cost, so it is treated as indirect materials (factory overhead). a. Journalize the entry to record the purchase of materials in April. If an amount box does not require an entry, leave it blank. $4,500 Total $195,300 176,600 113,800 b.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education