Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:ces

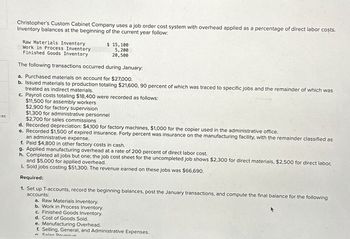

Christopher's Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs.

Inventory balances at the beginning of the current year follow:

Raw Materials Inventory

Work in Process Inventory

Finished Goods Inventory

$ 15,100

5,200

20,500

The following transactions occurred during January:

a. Purchased materials on account for $27,000.

b. Issued materials to production totaling $21,600, 90 percent of which was traced to specific jobs and the remainder of which was

treated as indirect materials.

c. Payroll costs totaling $18,400 were recorded as follows:

$11,500 for assembly workers

$2,900 for factory supervision

$1,300 for administrative personnel

$2,700 for sales commissions

d. Recorded depreciation: $4,100 for factory machines, $1,000 for the copier used in the administrative office.

e. Recorded $1,500 of expired insurance. Forty percent was insurance on the manufacturing facility, with the remainder classified as

an administrative expense.

f. Paid $4,800 in other factory costs in cash.

g. Applied manufacturing overhead at a rate of 200 percent of direct labor cost.

h. Completed all jobs but one; the job cost sheet for the uncompleted job shows $2,300 for direct materials, $2,500 for direct labor,

and $5,000 for applied overhead.

i. Sold jobs costing $51,300. The revenue earned on these jobs was $66,690.

Required:

1. Set up T-accounts, record the beginning balances, post the January transactions, and compute the final balance for the following

accounts:

a. Raw Materials Inventory.

b. Work in Process Inventory.

c. Finished Goods Inventory.

d. Cost of Goods Sold.

e. Manufacturing Overhead.

f. Selling, General, and Administrative Expenses.

Sales Devenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- OReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardOn August 1, Cairle Companys work-in-process inventory consisted of three jobs with the following costs: During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows: Before the end of August, Jobs 70, 72, 73, and 75 were completed. On August 31, Jobs 72 and 75 were sold. Cairles selling and administrative expenses for August were 1,200. Required: Prepare an income statement for Cairle Company for August.arrow_forwardOn August 1, Cairle Companys work-in-process inventory consisted of three jobs with the following costs: During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows: Before the end of August, Jobs 70, 72, 73, and 75 were completed. On August 31, Jobs 72 and 75 were sold. Required: 1. Calculate the predetermined overhead rate based on direct labor cost. 2. Calculate the ending balance for each job as of August 31. 3. Calculate the ending balance of Work in Process as of August 31. 4. Calculate the cost of goods sold for August. 5. Assuming that Cairle prices its jobs at cost plus 20 percent, calculate Cairles sales revenue for August.arrow_forward

- Terrills Transmissions uses a job order cost system. A partial list of the accounts being maintained by the company, with their balances as of November 1, follows: The following transactions were completed during November: a. Materials purchases on account during the month, 74,000. b. Materials requisitioned during the month: 1. Direct materials, 57,000. 2. Indirect materials, 11,000. c. Direct materials returned by factory to storeroom during the month, 1,100. d. Materials returned to vendors during the month prior to payment, 2,500. e. Payments to vendors during the month, 68,500. Required: 1. Prepare general journal entries for each of the transactions. 2. Post the general journal entries to T-accounts. 3. Balance the accounts and report the balances of November 30 for the following: a. Cash b. Materials c. Accounts Payablearrow_forwardLeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: During June, direct labor cost was 143,000, direct materials purchases were 346,000, and the total overhead cost was 375,800. The inventories at the end of June were: Required: 1. Prepare a cost of goods manufactured statement for June. 2. Prepare a cost of goods sold schedule for June.arrow_forwardBarnes Company uses a job order cost system. The following data summarize the operations related to production for October: a. Materials purchased on account, 315,500. b. Materials requisitioned, 290,100, of which 8,150 was for general factory use. c. Factory labor used, 489,500 of which 34,200 was indirect. d. Other costs incurred on account for factory overhead, 600,000; selling expenses, 150,000; and administrative expenses, 100,000. e. Prepaid expenses expired for factory overhead were 18,000; for selling expenses, 6,000; and for administrative expenses, 5,000. f. Depreciation of office building was 30,000; of office equipment, 7,500; and of factory equipment, 60,000. g. Factory overhead costs applied to jobs, 711,600. h. Jobs completed, 1,425,000. i. Cost of goods sold, 1,380,000. Instructions Journalize the entries to record the summarized operations.arrow_forward

- Baldwin Printing Company uses a job order cost system and applies overhead based on machine hours. A total of 150,000 machine hours have been budgeted for the year. During the year, an order for 1,000 units was completed and incurred the following: The accountant computed the inventory cost of this order to be 4.30 per unit. The annual budgeted overhead in dollars was: a. 577,500. b. 600,000. c. 645,000. d. 660,000.arrow_forwardDuring the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardA company has the following transactions during the week. Purchase of $3,000 raw materials inventory Assignment of $700 of raw materials inventory to Job 7 Payroll for 10 hours and $3,000 is assigned to Job 7 Factory depreciation of $1,750 Overhead applied at the rate of $200 per hour What is the cost assigned to Job 7 at the end of the week?arrow_forward

- On December 1, Carmel Valley Production Inc. had a work in process inventory of 1,200 units that were complete as to materials and 50% complete as to labor and overhead. December 1 costs follow: During December the following transactions occurred: a. Purchased materials costing 50,000 on account. b. Placed direct materials costing 49,000 into production. c. Incurred production wages totaling 50,500. d. Incurred overhead costs for December: e. Applied overhead to work in process at a predetermined rate of 125% of direct labor cost. f. Completed and transferred 10,000 units to finished goods. (Hint: You should first compute equivalent units and unit costs. The unit cost should include applied, not actual, factory overhead.) Carmel Valley uses the weighted average cost method. The ending inventory of work in process consisted of 1,000 units that were completed as to materials and 25% complete as to labor and overhead. Required: Prepare the journal entries to record the above December transactions.arrow_forwardMarzons records show raw materials Inventory had a beginning balance of $200 and an ending balance of $300. If the cost of materials used during the month was $900, what were the purchases made during the month?arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,