FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

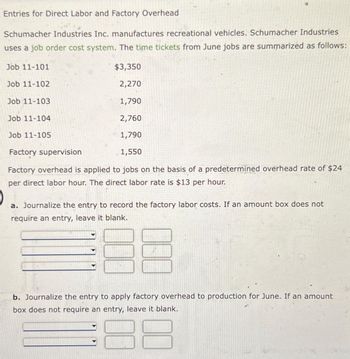

Transcribed Image Text:Entries for Direct Labor and Factory Overhead

Schumacher Industries Inc. manufactures recreational vehicles. Schumacher Industries

uses a job order cost system. The time tickets from June jobs are summarized as follows:

$3,350

2,270

1,790

2,760

1,790

Factory supervision

1,550

Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $24

per direct labor hour. The direct labor rate is $13 per hour.

Job 11-101

Job 11-102

Job 11-103

Job 11-104

Job 11-105

a. Journalize the entry to record the factory labor costs. If an amount box does not

require an entry, leave it blank.

188

b. Journalize the entry to apply factory overhead to production for June. If an amount

box does not require an entry, leave it blank.

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the entry to record the factory labor costs Journalize the entry to apply factory overhead to production for November.arrow_forwardJournalize the entriesarrow_forwardTownsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $2,270 Job 202 1,140 Job 203 900 Job 204 1,670 Factory supervision 780 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $28 per direct labor hour. The direct labor rate is $13 per hour. If required, round final answers to the nearest dollar. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payable v Feedback b. Journalize the entry to apply factory overhead to production for November. If an amount box does not require an entry, leave it blank. Work in Process Factory Overheadarrow_forward

- Entries for Costs in a Job Order Cost System Royal Technology Company uses a job order cost system. The following data summarize the operations related to production for March: a. Materials purchased on account, $770,000. b. Materials requisitioned, $680,000, of which $75,800 was for general factory use. c. Factory labor used, $756,000, of which $182,000 was indirect. d. Other costs incurred on account for factory overhead, $245,000; selling expenses, $171,500; and administrative expenses, $110,600. e. Prepaid expenses expired for factory overhead were $24,500; for selling expenses, $28,420; and for administrative expenses, $16,660. f. Depreciation of factory equipment was $49,500; of office equipment, $61,800; and of office building, $14,900. g. Factory overhead costs applied to jobs, $568,500. h. Jobs completed, $1,500,000. i. Cost of goods sold, $1,375,000. Required: Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it…arrow_forwardEntries and Schedules for Unfinished Jobs and Completed Jobs Tybee Industries Inc. uses a job order cost system. The following data summarize the operations related to production for January, the first month of operations: Materials purchased on account, $1,960. Materials requisitioned and factory labor used: Job Materials Factory Labor 301 $3,330 $2,800 302 4,060 3,780 303 2,700 1,850 304 9,120 6,940 305 5,790 5,290 306 4,230 3,360 For general factory use 1,130 4,140 Factory overhead costs incurred on account, $6,360. Depreciation of machinery and equipment, $1,990. The factory overhead rate is $75 per machine hour. Machine hours used: Job Machine Hours 301 25 302 24 303 38 304 68 305 27 306 44 Total 226 Jobs completed: 301, 302, 303, and 305. Jobs were shipped and customers were billed as follows: Job 301, $9,610; Job 302, $11,570; Job 303, $21,460. Required: 1. Journalize the entries…arrow_forwardHarper Company uses a job order cost system. Journalize the entries for materials and labor, based on the following data:Raw materials issued: Job No. 609, $850; for general use in factory, $600Labor time tickets: Job No. 609, $1,600; $400 for supervision If an amount box does not require an entry, leave it blank. fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15 fill in the blank 17 fill in the blank 18arrow_forward

- Don't give solution in image format..arrow_forwardWaterway Company uses a job order cost system. On May 1, the company has balances in Raw Materials Inventory of $15,700 and Work in Process Inventory of $4,140 and two jobs in process: Job No. 429 $2,450, and Job No. 430 $1,690. During May, the company incurred factory labor of $15,150. A summary of source documents reveals the following. Job Number 429 430 General use Show 431 Job No. 430 431 S Materials Requisition Slips $ $2.920 3.610 4,870 $11.400 Direct Material $12,360 Waterway Company applies manufacturing overhead to jobs at an overhead rate of 70% of direct labor cost. Job No. 429 is completed during the month. 960 Prove the agreement of the Work in Process Inventory control account with the job cost sheets. Beginning Work in Process Labor Time Tickets $2,160 3,360 8,030 $ $ $13.550 Job Cost Sheets 1,600 $15.150 Direct Labor Prove the agreement of the Work in Process Inventory control account with the job cost sheets. Direct Material Job Cost Sheets Direct Labor $…arrow_forwardJob Costs Using Activity-Based Costing Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted information for the year is as follows: Activity Cost Driver Amount of Driver Materials handling $88,800 Number of moves 4,000 Engineering 117,600 Number of change orders 8,000 Other overhead 174,800 Direct labor hours 46,000 Heitger worked on four jobs in July. Data are as follows: Job 13-43 Job 13-44 Job 13-45 Job 13-46 Beginning balance $23,400 $19,200 $4,700 $0 Direct materials $5,800 $9,600 $13,400 $10,100 Direct labor cost $950 $1,010 $1,590 $110 Job 13-43 Job 13-44 Job 13-45 Job 13-46 Number of moves 46 46 33 Number of change orders 35 37 17 23 Direct labor hours 950 1,010 1,590 110 By July 31, Jobs 13-43 and 13-44 were completed and sold. Jobs 13-45 and 13-46 were still in process.arrow_forward

- Entries and schedules for unfinished jobs and completed jobs Hildreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: Materials purchased on account, $147,000. Materials requisitioned and factory labor used: Job No. Materials Factory Labor 101 $ 19,320 $19,500 102 $ 23,100 28,140 103 $ 13,440 14,000 104 $ 38,200 36,500 105 $ 18,050 15,540 106 $ 18,000 18,700 For general factory use $ 9,000 20,160 Factory overhead costs incurred on account, $6,000. Depreciation of machinery and equipment, $4,100. The factory overhead rate is $40 per machine hour. Machine hours used: Job No. Machine Hours 101 154 102 160 103 126 104 238 105 160 106 174 Total 1,012 Jobs completed: 101, 102, 103, and 105. Jobs were shipped, and customers were billed as follows: Job 101, $62,900; Job…arrow_forwardTownsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $2,870 Job 202 1,430 Job 203 1,130 Job 204 2,110 Factory supervision 980 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $30 per direct labor hour. The direct labor rate is $13 per hour. If required, round final answers to the nearest dollar. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. b. Journalize the entry to apply factory overhead to production for November.arrow_forwardOak Creek Furniture Factory (OCFF), a custom furniture manufacturer, uses job order costing to track the cost of each customer order. On March 1, OCFF had two jobs in process with the following costs: Work in Process Balance on 3/1 Job 33 $ 7,500 Job 34 6,000 $ 13,500 Source documents revealed the following during March: Materials Requisitions Forms Labor Time Tickets Status of Job at Month-End Job 33 $ 3,500 $ 6,500 Completed and sold Job 34 6,000 7,800 Completed, but not sold Job 35 4,200 3,250 In process Indirect 1,300 2,140 $ 15,000 $ 19,690 The company applies overhead to products at a rate of 150 percent of direct labor cost. Required: Prepare journal entries to record the materials requisitions, labor costs, and applied overhead. Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education