Concept explainers

⦁ Prepare job cost record

Global Tire manufactures tires for all-terrain vehicles. Global uses

On September 22, Global received an order for 100 TX tires from ATV Corporation at a price of $52 each. The job, assigned number 298, was promised for October 10.

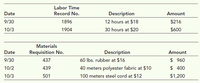

After purchasing the materials, Global began production on September 30 and incurred the following direct labor and direct materials costs in completing the order:

Global allocates manufacturing

Requirements:

1. Prepare a job cost record for Job 298.

2. Calculate the total profit and the per-unit profit for Job 298.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $23,200, direct labor $13,920, and manufacturing overhead $18,560. As of January 1, Job 49 had been completed at a cost of $104,400 and was part of finished goods inventory. There was a $17,400 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $141,520 and $183,280, respectively. The following additional events occurred during the month. 1. 2. 3. 4. Job No. 50 Purchased additional raw materials of $104,400 on account. Incurred factory labor costs of $81,200. Of this amount $18,560 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect…arrow_forwardBaggins Bed and Second Breakfast utilizes a job order costing system. They only had one job for the period. The material requisition form for the period has been provided below: Direct materials purchased $18,000 Direct materials used $17,600 In addition to the direct materials, the following amounts were incurred during production: $9,200 in direct labor and $6,500 in applied manufacturing overhead. They began the period with $4,300 in beginning balance for this job. What is the ending balance for this job?arrow_forwardEntries for Direct Labor and Factory Overhead Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $6,240 Job 202 7,000 Job 203 5,210 Job 204 6,7500 Factory supervision 4,000 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $18 per direct labor hour. The direct labor rate is $40 per hour. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payable b. Journalize the entry to apply factory overhead to production for November. If an amount box does not require an entry, leave it blank. Work in Process Factory Overheadarrow_forward

- Oak Creek Furniture Factory (OCFF), a custom furniture manufacturer, uses job order costing to track the cost of each customer order. On March 1, OCFF had two jobs in process with the following costs: Work in Process Balance on 3/1 Job 33 $ 7,500 Job 34 6,000 $ 13,500 Source documents revealed the following during March: Materials Requisitions Forms Labor Time Tickets Status of Job at Month-End Job 33 $ 3,500 $ 6,500 Completed and sold Job 34 6,000 7,800 Completed, but not sold Job 35 4,200 3,250 In process Indirect 1,300 2,140 $ 15,000 $ 19,690 The company applies overhead to products at a rate of 150 percent of direct labor cost. Required: Prepare journal entries to record the materials requisitions, labor costs, and applied overhead. Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.arrow_forwardPidris Drop Anchor takes special orders to manufacture sail boats for high-end customers. Prepare journal entries to record the transactions below and prepare job cost sheets for September. a. Purchased raw materials on credit, $145,000. b. Materials requisitions: Job 240, $48,000; Job 241, $36,000; Job 242, $42,000; indirect materials were $12,000. c. Time tickets used to charge labor to jobs: Job 240, $40,000; Job 241, $30,000; Job 242, $35,000, indirect labor is $25,000. d. The company incurred the following additional overhead costs: depreciation of factory building, $70,000; depreciation of factory equipment, $60,000; expired factory insurance, $10,000; utilities and maintenance cost of $20,000 were paid in cash. e. Applied overhead to all three jobs. The predetermined overhead rate is 190% of direct labor cost. f. Transferred jobs 240 and 242 to Finished Goods Inventory. g. Sold job 240 for $300,000 for cash. h. Closed the under- or over-applied overhead account balance. Job Cost…arrow_forwardJensen Fences uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs. The following information appears in the company's Work in Process Inventory account for the month of June: Debits to account: Balance, June 1 Direct materials Direct labor $5,000 $18,000 $12,300 Manufacturing overhead (applied to jobs as 125% of direct labor cost) $15,375 Total debits to account Credits to account: Transferred to Finished Goods Inventory account $50,675 $44,000 $6,675 Balance, June 30 Instructions a. Assuming that the direct labor charged to the jobs still in process at June 30 amounts to $1,600, compute the amount of manufacturing overhead and the amount of direct materials that have been charged to these jobs as of June 30. b. Prepare general journal entries to summarize: 1. The manufacturing costs (direct materials, direct labor, and overhead) charged to production during June. 2. The transfer of…arrow_forward

- GenX Furnishings Company manufactures designer furniture. GenX Furnishings uses a job order cost system. Balances on June 1 from the materials ledger are as follows: Fabric $ 67,910 Polyester filling 19,920 Lumber 151,860 Glue 6,750 The materials purchased during June are summarized from the receiving reports as follows: Fabric $338,580 Polyester filling 470,870 Lumber 901,370 Glue 31,670 Materials were requisitioned to individual jobs as follows: Fabric Polyester Filling Lumber Glue Total Job 601 $126,370 $161,120 $397,120 $ 684,610 Job 602 98,480 146,210 370,720 615,410 Job 603 93,880 115,240 205,800 414,920 Factory overhead-indirect materials $35,520 35,520 Total $318,730 $422,570 $973,640 $35,520 $1,750,460 The glue is not a significant cost, so it is treated as indirect materials (factory overhead). Required: a. Journalize the June 1 entry to record the purchase of materials in June.* b.…arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $25.000. direct labor $15,000, and manufacturing overhead $20,000. As of January 1, Job 49 had been completed at a cost of $112.500 and was part of finished goods inventory. There was a $18.750 balance in the Raw Materials Inventory account. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $152,500 and $197.500, respectively. The following additional events occurred during the month. 1 Purchased additional raw materials of $112.500 on account. incurred factory labor costs of $87.500. Of this amount $20,000 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect materials…arrow_forwardArcher Company produces leather jacket for individual and corporation. On September 1st 2016, three jobs are in process, with cost as follows in USD attached on picture below Questions : a. If the allocation base that the company use is direct materials, calculate the budgeted overhead rate b. Calculate the Manufacturing Overhead Cost for each job and the total of MOH allowed c. Calculate the total cost of WIP at the end of September 2016arrow_forward

- what is the interim report of a company?arrow_forwardLumos Maxima corporation manufacturers lamps and flashlights. They use a job-order cost system to accumulate their manufacturing costs, and a traditional allocation method for applying manufacturing overhead costs. The predetermined overhead rate is $16.00 per direct labor hour. During the month, White corporation worked on two different jobs. Job W-100 was completed and sold by the end of the month. Job W-200 was unfinished at the end of the period. Job W-100 Job W-200 Beginning Balance $19,400 $29,800 Direct Materials $34,200 $21,100 Direct Labor $36,000 $35,200 Actual Direct Labor Hours 8,200 6,400 What is the beginning balance of work in process at the end of the month? A. $188,500 B. $175,700 C. $220,800 D. $409,300arrow_forwardLott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $23,200, direct labor $13,920, and manufacturing overhead $18,560. As of January 1, Job 49 had been completed at a cost of $104,400 and was part of finished goods inventory. There was a $17,400 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $141,520 and $183,280, respectively. The following additional events occurred during the month. 1. 2. 3. 4. Job No. 50 Purchased additional raw materials of $104,400 on account. Incurred factory labor costs of $81,200. Of this amount $18,560 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education