Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

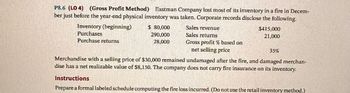

Transcribed Image Text:P8.6 (LO 4) (Gross Profit Method) Eastman Company lost most of its inventory in a fire in Decem-

ber just before the year-end physical inventory was taken. Corporate records disclose the following.

Inventory (beginning)

Purchases

Purchase returns

$ 80,000

290,000

28,000

Sales revenue

Sales returns

$415,000

21,000

Gross profit % based on

net selling price

35%

Merchandise with a selling price of $30,000 remained undamaged after the fire, and damaged merchan-

dise has a net realizable value of $8,150. The company does not carry fire insurance on its inventory.

Instructions

Prepare a formal labeled schedule computing the fire loss incurred. (Do not use the retail inventory method.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Tanke Company reported net income on the year-end financial statements of $850,200. However, errors in inventory were discovered after the reports were issued. If inventory was overstated by $21,000, how much net income did the company actually earn?arrow_forwardE9.14B (L0 4) (Gross Profit Method) Wineview Company lost most of its inventory in a fire in December just before the yearend physical inventory was taken. The corporation’s books disclosed the following. Beginning inventory $210,000 Sales $970,000 Purchases for the year 805,000 Sales returns 71,000 Purchase returns 15,000 Rate of gross margin on net sales 20% Merchandise with a selling price of $51,000 remained undamaged after the fire. Damaged merchandise with an original selling price of $25,000 had a net realizable value of $2,500. Instructions Compute the amount of the loss as a result of the fire, assuming that the company had no insurance coverage.arrow_forwardanswer in text form please (without image)arrow_forward

- P9-4B (L05) (Gross Profit Method) Higgs Company lost most of its inventory in a fire in November just before the year-end physical inventory was taken. Corporate records disclose the following. Sales Inventory (beginning) Purchases Purchase returns $186,000 667,000 $863,000 64,000 25% Sales returns Gross profit % based on net selling price 46,000 Merchandise with a selling price of $65,000 remained undamaged after the fire, and damaged merchandise has a salvage value of $26,400. The company does not carry fire insurance on its inventory. Instructions Prepare a formal labeled schedule computing the fire loss incurred. (Do not use the retail inventory method.)arrow_forwardplease answer do not imagearrow_forward1. Lams Company's accounting records indicated the following information: Inventory, January 1 P1,000,000; Purchases 5,000,000; Sales 6,400,000.A physical inventory taken on December 31, 2020, revealed actual ending inventory at cost was P1,150,000. Lams' gross profit on sales has regularly been about 25 percent in recent years. The company believes some inventory may have been stolen during the year. What is the estimated amount of missing inventory at December 31, 2020? a. P350,000 b. P200,000 c. P450,000 d. P50,000 2. The following information is available for Tyron Corp. for its most recent year: Net Sales P3,600,000; Freight-in P90,000; Ending Inventory P240,000. The gross margin is 40 percent of net sales. What is the cost of goods available for sale? a. P2,400,000 b. P2,440,000 c. P1,680,000 d. P1,920,000 3. On October 1, Dennis Company purchased P200,000 face value 12% bonds for 98 plus accrued interest and brokerage fees and…arrow_forward

- Sagararrow_forwardanswer in text form please (without image)arrow_forwardIndigo Company lost most of its inventory in a fire in December just before the year-end physical inventory was taken. The corporation's books disclosed the following. Beginning inventory Purchases for the year Purchase returns Amount of the loss $ tA $172,400 406,400 27,100 Sales revenue Sales returns Rate of gross profit on net sales Merchandise with a selling price of $21,300 remained undamaged after the fire. Damaged merchandise with an original selling price of $14,600 had a net realizable value of $5,200. Compute the amount of the loss as a result of the fire, assuming that the corporation had no insurance coverage. $621,100 174430 22,800 30 %arrow_forward

- Required information P7-6 (Algo) Analyzing and Interpreting the Effects of Inventory Errors LO7-5 [The following information applies to the questions displayed below.] The income statement for Pruitt Company summarized for a four-year period shows the following: Sales revenue Cost of goods sold Gross profit Expenses Pretax income Income tax expense (30%) Net income P7-6 Part 1 2016 2017 $2,041,000 $2,469,000 1,618,000 1,492,000 549,000 484,000 65,000 19,500 $45,500 Sales revenue Cost of goods sold Gross profit Expenses Pretax income Income tax expense (30%) Net income 851,000 496,000 355,000 106,500 $248,500 496,000 334,000 2018 $2,712,000 1,781,000 100,200 233,800 931,000 522,000 409,000 122,700 $286,300 An audit revealed that in determining these amounts, the ending inventory for 2017 was overstated by $21,000. The company uses a periodic inventory system. Answer is complete but not entirely correct. PRUITT COMPANY Income Statement For the Four-Year Period 2016 2017 $ 2,041,000…arrow_forwardPronghorn Company lost most of its inventory in a fire in December just before the year-end physical inventory was taken. Corporate records disclose the following. Inventory (beginning) Purchases. Purchase returns $81,000 295,600 27,900 Inventory fire loss $ Sales revenue Sales returns Gross profit % based on net selling price $407,900 20,700 32 % Merchandise with a selling price of $29,400 remained undamaged after the fire, and damaged merchandise has a net realizable value of $8,000. The company does not carry fire insurance on its inventory. Compute the amount of inventory fire loss. (Do not use the retail inventory method.)arrow_forwardanswer in text form please (without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning