College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Give me answer

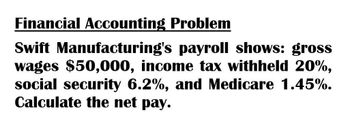

Transcribed Image Text:Financial Accounting Problem

Swift Manufacturing's payroll shows: gross

wages $50,000, income tax withheld 20%,

social security 6.2%, and Medicare 1.45%.

Calculate the net pay.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Accounting Problem Swift Manufacturing's payroll shows: gross wages $50,000, income tax withheld 20%, social security 6.2%, and Medicare 1.45%. Calculate the net pay.arrow_forwardSwift Manufacturing's payroll shows: gross wages $50,000, income tax withheld 20%, social security 6.2%, and Medicare 1.45%. Calculate the net pay.arrow_forwardFinancial accounting problemarrow_forward

- Recording Payroll and Payroll Taxes The following data are taken from Fremont Wholesale Company's May payroll Administrative salaries $47,600 Sales salaries 65,800 Custodial salaries 9,800 Total payroll $123,200 Salaries subject to 1. 45 percent Medicare tax $123,200 Salaries subject to 6.2 percent Social Security tax 103,600 Salaries subject to federal unemployment taxes 19,600 Salaries subject to state unemployment taxes 28,000 Federal income taxes withheld from all salaries 24,920 Assume that the company is subject to a two percent state unemployment tax (due to a favorable experience rating) and a 0.6 percent federal unemployment tax. Required Record the following in general journal form on May 31: a. Accrual of the monthly payroll. b. Payment of the net payroll. c. Accrual of employer's payroll taxes. ( Assume that the FICA matches the amount withheld.) d. Payment of these payroll-related liabilities. (Assume that all are settled at the same time.) Round your answers to the…arrow_forwardAssume the following data for Blossom Home Appliance Repair for the payroll quarter ended March 31. • Gross earnings $240,000.00 • Employee FICA taxes 18,360.00 • Federal income tax 48,000.00 • State income tax 4,799.00 • Number of employees this quarter: 30 Blossom is subject to the following rates: FICA 7.65% (the 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages), state unemployment 5.4% up to $7,000, and federal unemployment 0.6% up to $7,000. No employee reached the limit for FICA taxes, and all employees reached the limit for unemployment taxes in the first quarter.Prepare the journal entry to record payment of employer taxes, assuming all taxes were paid on April 15. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit…arrow_forwardRecording Payroll Taxes According to a summary of the payroll of Kirby Co., $380,500 in earnings were subject to the 7.6% FICA tax. Also, $51,368 in earnings were subject to state and federal unemployment taxes. Round your answers to the nearest cent. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 4.5%; federal unemployment, 1%. b. Illustrate the effects on the accounts and financial statements of recording the accrual of payroll taxes. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts. Balance Sheet Statement of Income Assets Liabilities + Stockholders' Equity Cash Flows Statement No effect v No effect FICA tax payable v SUTA payable v FUTA payable v Retained earnings + = + Statement of Cash Flows Income Statement No effect v Payroll tax expensearrow_forward

- The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.: Salaries: Deductions: Sales salaries S330,000 Income tax withheld S116,600 Warehouse salaries 180,000 U.S. savings bonds 14,454 Office salaries 147,000 Group insurance 11,826 $657,000 Tax rates assumed: Social security 6% State unemployment (employer only) 5.4% Medicare 1.5% Federal unemployment (employer only) 0.8% Required: 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles): a. December 30, to record the payroll. b. December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $31,000 is subject to unemployment compensation taxes. 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year,…arrow_forwardWanted answer for this general account options questionarrow_forwardThe following information about the payroll for the week ended December 30 was obtained from the records of Pharrell Co.: Salaries: Sales salaries $330,000 Warehouse salaries 184,000 Office salaries 146,000 $660,000 Deductions: Income tax withheld $117,200 Social security tax withheld 39,600 Medicare tax withheld 9,900 Retirement savings 14,520 Group insurance 11,880 $193,100 Tax rates assumed: Social security 6% Medicare 1.5% State unemployment (employer only) 5.4% Federal unemployment (employer only) 0.6% Required: 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles): A. December 30, to record the payroll. B. December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year,…arrow_forward

- Assume that social security taxes provide answer general accountingarrow_forwardAssume the following data for Blossom Home Appliance Repair for the payroll quarter ended March 31. Gross earnings Employee FICA taxes Federal income tax State income tax Number of employees this quarter: $372,000.00 28,458.00 74,400.00 7,439.00 30 Blossom is subject to the following rates: FICA 7.65% (the 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages), state unemployment 5.4% up to $7,000, and federal unemployment 0.6% up to $7,000. No employee reached the limit for FICA taxes, and all employees reached the limit for unemployment taxes in the first quarter. Prepare the journal entry to record payment of employer taxes, assuming all taxes were paid on April 15. (Credit account titles are automatically indented when amount is entered. Do not indent anually.)arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning